by Jeff Shen, Blackrock

Central banks around the world, led by the U.S. Federal Reserve, have taken a newly accommodative tilt. New blog contributor Jeff Shen reveals what big data has to say about monetary policy, and why investors may have reason for caution.

It’s summertime and the central banks are … well, easy. The Fed’s pivot to a more dovish monetary policy stance since May has been followed by a generalized move among other central banks in the same direction. Rhetoric from Fed Chairman Jerome Powell has been closely watched and markets have largely cheered the idea of lower policy rates―starting with a hoped-for cut at the end of July.

Yet there’s a big “but” to consider. The fact that this pivot has happened at a time when the economy appears to be doing well and risk assets are rallying is a source of confusion.

The Fed has indicated the main reason for its dovishness is the consistent undershooting of its 2% inflation target. This is happening while labor markets remain strong, even as the U.S. economy appears to be entering the final stages of the current expansionary cycle. This confluence of factors is stoking concern.

Does the Fed need to start an easing cycle to ensure the U.S. economy can keep humming? And even if it does make that shift, would other central banks necessarily be on the same course?

Text mining for insight

We wanted to dig deeper to understand what markets are expecting and potentially pricing in going forward.

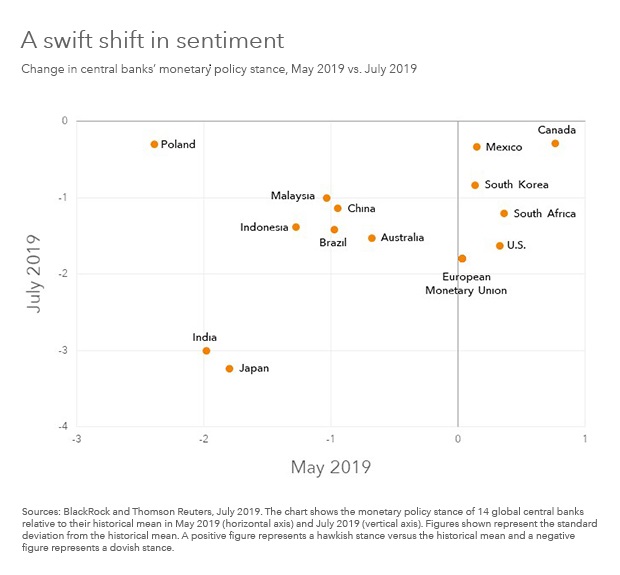

Our team, BlackRock Systematic Active Equity (SAE), processes more than 5,000 broker research reports daily to measure sell-side analyst perceptions about monetary policy. Individual central bank mentions are counted and then scored for sentiment in order to categorize them along the dovish-to-hawkish spectrum.

The data generated from this in-depth natural language processing exercise is aggregated to give us a sense of overall analyst expectations for monetary policy. The key finding: All 14 central banks in our coverage were perceived by analysts to have moved into the stimulative zone by July. Six of these (the U.S. and Europe among them) were seen as being in restrictive territory as recently as May. See the chart below.

The U.S. does seem to be playing a lead role in shifting global sentiment around central bank policies from hawkish to dovish in a short period of time. More important, our analysis found that the analyst consensus is for 12 of these central banks to ease monetary policy even further.

Reading between the lines

If we connect the dots between the macroeconomic data and the “big data” read of analyst sentiment, we arrive at one key conclusion: Market expectations for central bank easing may be too lofty.

With both the U.S. and the global economy still growing at trend levels, it is difficult to imagine that a strong and synchronized global monetary policy stimulus is in the offing. In addition, the Fed has stated its main concern is the low level of inflation ― not necessarily slowing economic growth. This implies aggressive monetary accommodation may not be as obvious or necessary as the current analyst consensus appears to assume. To the extent central banks do not deliver as anticipated on interest rates and monetary policy in general, that could leave markets ― and investors ― disappointed.

This is not to say the Fed will not cut rates at its July 30-31 session, as is widely expected. But it does imply investors may be wise to temper any hopes for broad-based and extended monetary easing as an enduring booster for stocks. The better course may be to prepare portfolios for modestly slower global growth as the cycle ages and to build in some measure of portfolio resilience.

Jeff Shen, PhD, is Co-CIO of Active Equities and Co-Head of Systematic Active Equity at BlackRock. He is the newest contributor to The Blog.

Investing involves risk, including possible loss of principal.

Stock values fluctuate in price so the value of your investment can go down depending on market conditions.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of July 2019 and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

©2019 BlackRock, Inc. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. All other marks are the property of their respective owners.

USRMH0719U-899751-1/1