by Scott Thiel, Blackrock

A dovish pivot by global central banks should extend the length of this economic cycle, supporting our upgrade to emerging market debt. Scott explains.

Central banks are shifting toward monetary easing, as they aim to cushion a global slowdown sparked by trade tensions. This policy pivot should help stretch the cycle and has depressed long-term yields, creating a supportive backdrop for income-generating assets. One such asset we favor: local-currency emerging market (EM) debt.

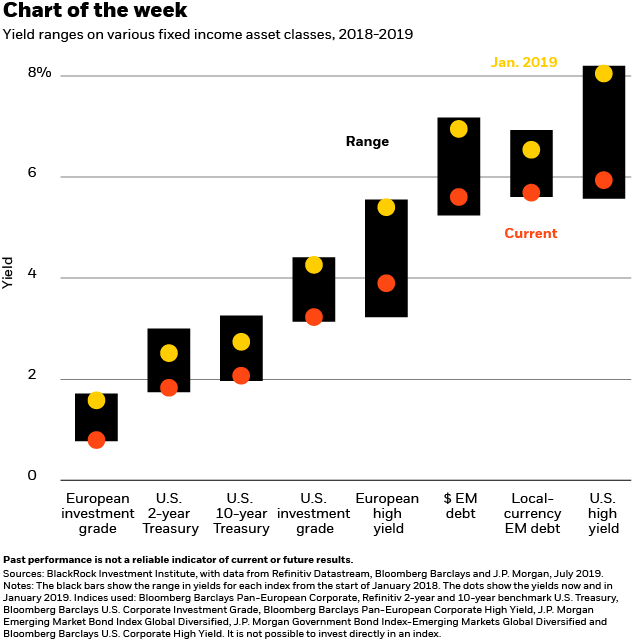

The decisively dovish turn in global monetary policy this year has helped drive bond yields to the bottom of recent ranges. See the dots in the chart above. We expect low rates to persist, with the Federal Reserve poised to deliver an insurance rate cut soon and the European Central Bank likely to provide additional stimulus by the end of October, opening the door for further global monetary easing. We see coupon income as the key driver of bond market returns in this lower-for-longer environment. Against this backdrop, we upgraded EM bonds to overweight in our 2019 midyear Global investment outlook.

The case for local-currency markets

EM debt comes in two flavors: bonds denominated in the issuer’s local currency and bonds denominated in another currency such as the U.S. dollar, so-called hard-currency debt. Global central banks’ dovish shift has spurred both types of EM debt to rally, mostly driven by declining global rates. To be sure, the U.S. Treasury rally may have gone a little too far: We see markets pricing in too much Fed easing given still decent economic fundamentals. Yield increases would dampen our expectations for further price gains in U.S. dollar EM debt. Yet we see reasons to be bullish on selected local-currency EM debt, where we believe the rally still has room to run.

Sharp appreciations in the U.S. dollar – and their potential to tighten financial conditions – have historically posed the greatest risk to EM assets. Yet we see a relatively stable dollar ahead. This reduces the risk of investing in local-currency denominated EM debt. Other positives: We expect China’s growth to be broadly stable, with policymakers ready to offset the economic drag from any trade shocks with additional fiscal stimulus – even though we do not expect a meaningful Chinese growth boost. Consumption remains resilient in many EM economies, despite a global manufacturing slowdown. And we see scope for central banks in many EMs – from India to Brazil – to lower interest rates, leading to further compression in local yields. Risks to our view include a greater-than-expected rise in U.S. Treasury yields, and tensions between the U.S. and China escalating or broadening to the Americas, Europe or other Asian economies, hurting EM manufacturing sectors.

Bottom Line

We prefer a selective approach to local-currency debt, favoring longer-term debt in Brazil, Mexico, India and Indonesia. These markets have relatively low exposure to U.S.-China trade tensions and yields that compensate for risks. More positives: high real yields, potential for monetary policy easing, strong external positions (small current account deficits and more foreign assets than liabilities) and sound institutions. We expect strategic tensions between the U.S. and China to persist, even if we see a temporary trade truce. The greater market weight of countries with high China exposure in EM equity indexes partly explains our more cautious view on EM stocks.

Scott Thiel is BlackRock’s chief fixed income strategist, and a member of the BlackRock Investment Institute. He is a regular contributor to The Blog.

Investing involves risks, including possible loss of principal.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of July 2019 and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this post is at the sole discretion of the reader. Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index.

©2019 BlackRock, Inc. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

BIIM0719U-898787