by Avi Hooper, Invesco Canada

Emerging market debt has evolved over the past few decades from a source of political and economic vulnerability to a potential positive driver of portfolio returns. The addition of new sovereign issuers (denominated in U.S. dollar and euro) has broadened the opportunity set for global investors, and corporate issuance has meaningfully contributed to its growth.

The unique fundamentals of various regions, countries and companies require more experienced analysts and will likely continue to result in dispersion of returns as demand for high-quality, higher-yielding debt rises.

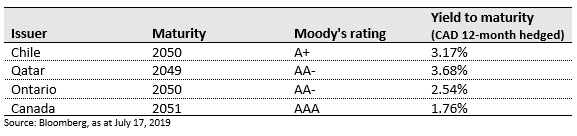

Investors holding domestic-focused, developed-market bond portfolios may want to consider ways to enhance total returns without sacrificing credit quality. Adding exposure to high-quality, emerging market sovereign debt is an effective way to add less correlated, higher returning fixed income assets.

Investing in emerging market debt doesn’t have to mean high-yield, high-volatility assets. Across our investment grade solutions, we remain focused on adding highly rated emerging market sovereign debt in U.S. dollars and euros.

The JP Morgan EMBI Global Diversified Index includes 73 different countries that have issued debt in U.S. dollars. Demand for broader emerging market exposure in portfolios is expected to rise as China’s growth supports exports from other emerging market economies. Passive index investing is supporting portfolio inflows.

The absence of other quasi-sovereign and corporate issuers from these indices offers opportunity for those whose talents lie in rigorous analysis. At Invesco Fixed Income, our analysts have boots on the ground around the world providing continuous input on Emerging Market debt opportunities consideration and inclusion in our portfolios.

This post was first published at the official blog of Invesco Canada.