by Patrick Nolan, CFA, Blackrock

While it can be tempting to flee when stocks drop suddenly, taking a gradual approach can make more sense.

The early 2019 rally in stocks was good news for investors left unnerved by 2018’s turbulent swings and late year losses. Investors rejoiced as stocks clawed their way back towards new highs, only to see another pullback as spring emerged. These spikes of volatility can be frustrating, especially when they cause your investments to lose value. Such is life investing in the later stages of a prolonged bull market.

If the up and down swings of the stock market feel bigger to you than they have in the past – it’s because they are. We hadn’t seen a 10% downturn in the S&P 500 for almost two years leading into 2018; only to watch it happen twice last year. You weren’t alone if you began to think the longest-ever bull market on record had finally run its course by the time the ball dropped in Times Square.

Despite the rising volatility, stocks remain relatively close to all-time highs, making this a great time to consider the lessons of the past eighteen months to ensure your portfolio is prepared for the future.

Market drops may be temporary

Stocks continue to fight towards new highs; but are now being met with more regular bouts of volatility that bites us back. This increased give and take of your portfolio value doesn’t need to be so rocky. There are ways to better insulate your portfolio against future market drops while still ensuring that you can participate in further rallies in case stocks quickly reverse course again.

It can be tempting either during or after these bouts of turmoil to reduce the things in your portfolio that are impacted the most – usually your stocks – for perceived safer havens like cash or short-term government bonds. Yet rapidly shifting out of stocks and ploughing dollars directly into cash is, in risk terms, like sliding down a fire pole. You can wind up doing more harm than good.

This is precisely what happened during the six-month stretch from October 2018 through March 2019. The investor who reacted and moved stocks to cash after the S&P 500 Index’s 13% loss during the 4th quarter, missed the 13% return from that index in the first quarter of 2019.

Use the stairs

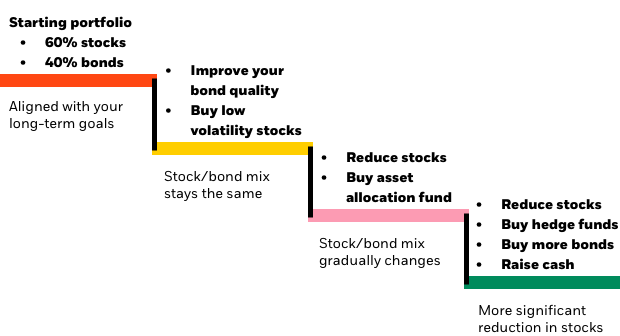

Rather than being tempted to boldly shift your portfolio allocation away from stocks each time the market falls, consider a ‘staircase’ approach that allows you to reduce your risk at a more measured pace while still allowing you to participate if stock prices double back. Here’s an example of how it might work:

Similar to when we buy insurance, we have to assess two things when looking to de-risk a portfolio:

(1) What level of protection am I seeking?

(2) How much does it cost?

The first question is pretty easy to answer – “I’m looking to lose less.” The second is more complicated because it deals with timing. If I get nervous and sell a portion of my portfolio, but the market goes higher from there, then my “cost” is the gains I missed because I wasn’t invested. These costs can be just as problematic as incurring additional losses – both may compromise your chances of reaching your investment goals.

Remember, your investment plan was built for this. If you have gone through a retirement planning exercise with an investment professional, you likely have an asset allocation that is meant to serve you for the long term, including moments of market volatility such as we are now witnessing. Making tactical adjustments like those on our staircase can help, but you need to ensure those portfolio shifts don’t take you too far away from your intended plan.

Investing in the choppy later stages of a bull market is never easy; but it is important not to overreact to market movements that could ultimately leave your portfolio out in the cold. By slowly and carefully reducing the risk in your portfolio, you can help manage against sharp falls–without giving up your ability to climb back up when the markets eventually recover. You can thoughtfully choose how much you want to protect and participate.

It’s not easy to slide up a firepole, but it is easy to walk up and down the stairs.

Patrick Nolan is the Portfolio Strategist within BlackRock’s Portfolio Solutions group. He is a regular contributor to The Blog.

*The BlackRock Portfolio Solutions team works with thousands of financial advisors each year and analyzes more than 11,000 investment models.

Investing involves risk, including possible loss of principal.

Index performance is shown for illustrative purposes only. You cannot invest directly in an index.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

This post contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial advisor before making an investment decision.

©2019 BlackRock, Inc. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

USRMH0619U-864550-1/1