by Scott Thiel, Chief Fixed Income Strategist, Blackrock

Scott explains why cyber security is a key risk for investors to monitor, especially amid rising geopolitical tensions.

Data breaches are increasingly in the news. But that’s not the only reason why one should care about cyber security. We view cyber security as a pressing issue, as it has become a flash point where countries’ economic and national security interests can overlap. This is playing out in real time in the U.S.-China trade negotiation, with market implications across the technology supply chain in particular.

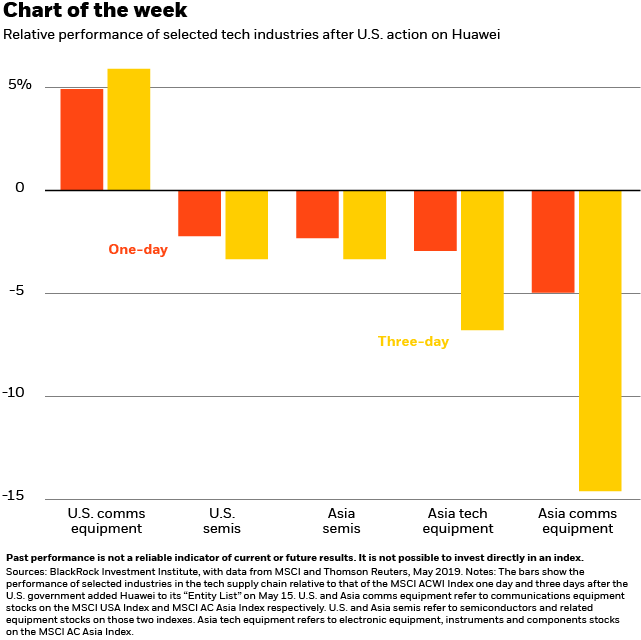

U.S.-China tech competition is heating up, amid rising trade tensions between the two nations. These two previously distinct risks are spilling into each other. The U.S. has added China’s Huawei Technologies, the world’s largest telecoms equipment maker, to its “Entity List”, a list of companies deemed a national security risk by the U.S. This designation prevents Huawei and its affiliates from buying or using U.S. technology and components without a license. In the days following the action, stocks of a slew of industries in the global telecom equipment supply chain fell, with Asian communications equipment makers leading the retreat. One exception: U.S. telecom equipment makers posted gains, as the chart shows. This performance pattern may not hold over a longer period of time, we believe. The U.S. ban could damage the global telecom supply chain over the medium term, as there are no simple substitutes for a lot of Chinese tech equipment.

Cyber risks and investment implications

Cyber-attacks are increasing in scope and intensity. Cyber actors across the world vary in sophistication and capability, ranging from well-funded government agencies and terrorist networks to criminal groups with poor resources. Their objectives span beyond stealing personal and business information to include broader geopolitical and economic aims. We view cyber-attacks as a growing risk to critical infrastructure and increasingly part of the arsenal of nation states.

Geopolitical tensions are driving an increase in the scale and sophistication of cyber-attacks—specifically those from nation states or with nation-state backing. This is the backdrop against which the U.S. has moved to restrict the use of Chinese-made equipment that it believes could potentially be used to intercept sensitive materials or disrupt American infrastructure. The seemingly abrupt U.S. action on Huawei was a long time coming, given the intensifying rivalry between the two countries: The U.S. has long complained of Chinese practices such as forced technology transfer and a lack of protections for intellectual property. China has shown its ambition to lead the development of advanced technologies including the fifth-generation cellular network (5G), yet it remains heavily dependent on the U.S. tech sector. The chips used in 5G development are dominated by U.S. semiconductor suppliers, for example. U.S semiconductor suppliers had enjoyed higher demand for their products in recent quarters as some Chinese companies built up their inventories in anticipation of a U.S. government ban; that demand now looks likely to plummet.

Bottom line

We see cyber security as an increasingly important risk for all investors to monitor, with implications that cut across sectors, from financials to utilities. This risk has become entangled with concerns about national security, economic competitiveness, and leadership in advanced technologies. We are still positive on makers of semiconductor products related to 5G development over the long term, but believe investors need to pay more attention to potential impacts of geopolitical tensions on the supply chain. And more broadly, we see potential for such tensions to drive a gradual decoupling of the U.S. and Chinese technology sectors – a reason why we believe there is a case for owning tech companies in both.

Scott Thiel is BlackRock’s chief fixed income strategist, and a member of the BlackRock Investment Institute. He is a regular contributor to The Blog.

Investing involves risks, including possible loss of principal.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of May 2019 and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this post is at the sole discretion of the reader. Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index.

©2019 BlackRock, Inc. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

BIIM0519U-853388