by Richard Bullas, Vice President, Portfolio Manager and Research Analyst, Franklin UK Equity Team, Franklin Templeton Investments

Given the large number of UK smaller companies (small caps), keeping on top of the potential opportunities has always been a challenge for investors. But as Richard Bullas explains, dwindling research coverage of the sector in recent years has made that challenge more intense while at the same time potentially offering greater scope for savvy investors to benefit. In this article, he reiterates the importance of taking a hands-on approach to small-cap investing.

We regard the UK small-cap market as one of the most sophisticated, diverse, and dynamic hunting grounds in the world.

With more than 1,250 stocks to choose from, the sheer scale of the United Kingdom’s small-cap universe (as represented by the FTSE Small Cap and FTSE AIM indices) is one of the things that we think should make it attractive to investors.1

There tends to be a greater weighting among smaller companies to newer-economy industries and sectors, and because these businesses are generally more dynamic and flexible than their larger peers, they can often grow a lot faster because they’re coming from a lower base.

The wide investment universe should create the potential for valuation anomalies, allowing savvy investors to potentially take advantage of the market’s inefficiency. As investors in this space, we try to seek out some of the under-recognised opportunities that we think are mispriced but offer superior upside potential.

The challenge for us as small-cap investors is identifying companies that appear undervalued; in other words, where we think the share price doesn’t adequately reflect the quality of the company, profit profile and longer-term growth potential.

Less Third-Party Research

Traditionally, investors across all market-cap ranges have generally relied on external research—generally from investment banks or stockbrokers—to inform their decisions.

However, for a variety of regulatory and economic reasons, over the past five years there’s been a noticeable drop in research coverage of small-cap stocks.

Over time, we’ve seen a reduction in research capacity in the stockbroking sector, and the introduction of the Markets in Financial Instruments Directive (MiFID II) last year accelerated the trend. MiFid II requires investment managers to unbundle research costs from trading fees and either pass on those costs to clients or absorb them themselves.

As a result of MiFid II, many investment managers have made substantial cuts to their research budgets. Investors are no longer willing to pay for simple company information that has already been reported and are instead demanding reports that are substantive and add value.

At the same time, stockbrokers—the traditional providers of investment research—have faced a challenging operating environment. In addition to the impact of MiFid II, falling commission fees and a lacklustre primary market (IPOs haven’t been consistent) have been additional constraints.

It has been very tough for some of these businesses to adapt and to change. As a result, consolidation has occurred, and some have gone out of business.

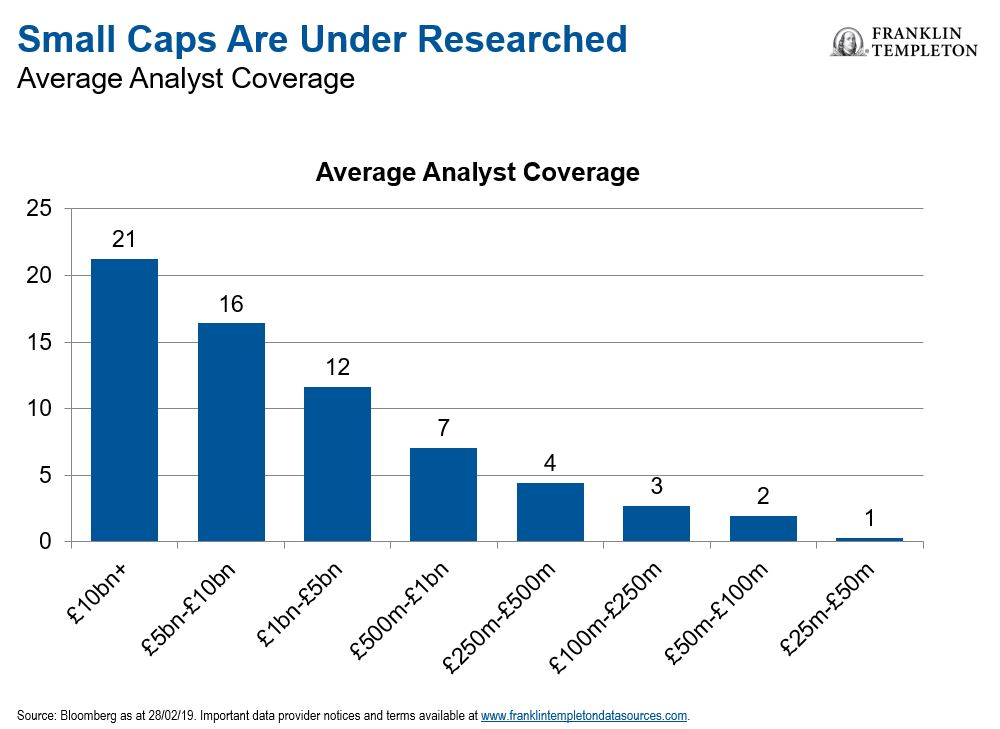

All these factors are starting to have an effect on the small-cap market. Five years ago, an average of 11 analysts covered stocks in the £500 million to £1 billion market cap range. Today, that number is seven. Similarly, the average coverage of stocks in the £250 million to £500 million range has fallen from six to four, and in the £100 million to £250 million range from five to three.2

That is an average reduction of about 36% in terms of coverage.

So as capacity has been coming out of the stockbroking sector, it means potentially more inefficient pricing and opportunities for us to seek out undervalued stocks.

The market really is becoming more under-researched, and we believe that should present an advantage to investment managers like us willing to roll up their sleeves. We do the hard work researching companies to assess the fundamentals and seek out valuation opportunities.

*****

The comments, opinions and analyses are the personal views expressed by the investment manager and are intended to be for informational purposes and general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. The information provided in this material is rendered as at publication date and may change without notice, and it is not intended as a complete analysis of every material fact regarding any country, region market or investment.

Data from third-party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information, and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user. Products, services and information may not be available in all jurisdictions and are offered by FT affiliates and/or their distributors as local laws and regulations permit. Please consult your own professional adviser for further information on availability of products and services in your jurisdiction.

Get more perspectives from Franklin Templeton delivered to your inbox. Subscribe to the Beyond Bulls & Bears blog.

1. The FTSE Small Cap Index is a small market capitalisation index consisting of the 351st and 619th largest listed companies of the London Stock Exchange. The FTSE AIM (Alternative Investment Market) All-Share Index is a capitalisation-weighted index of small and emerging companies traded on the London Stock Exchange. Indexes are unmanaged, and one cannot directly invest in them. They do not include any fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future performance.

2. Source: Bloomberg, as at 28 February, 2019.

For timely investing tidbits, follow us on Twitter @FTI_Global and on LinkedIn.

*****

What Are the Risks?

All investments involve risk, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Smaller and newer companies can be particularly sensitive to changing economic conditions. Their growth prospects are less certain than those of larger, more established companies, and they can be volatile. Actively managed strategies could experience losses if the investment manager’s judgment about markets, interest rates or the attractiveness, relative values, liquidity or potential appreciation of particular investments made for a portfolio, proves to be incorrect. There can be no guarantee that an investment manager’s investment techniques or decisions will produce the desired results.

Copyright © Franklin Templeton Investments