by Avi Lavi, AllianceBernstein

Global value stocks have continued to underperform in 2019. But there’s a big disconnect between the weak returns of cheaper stocks and their underlying earnings profile.

Investors in value stocks have continued to be disappointed this year. In the first four months of the year, the stocks in the cheapest group in the market have underperformed growth stocks by a wide margin, following the trend in recent years. Hopes of a turnaround have not materialized.

Earnings Growth Looks Resilient

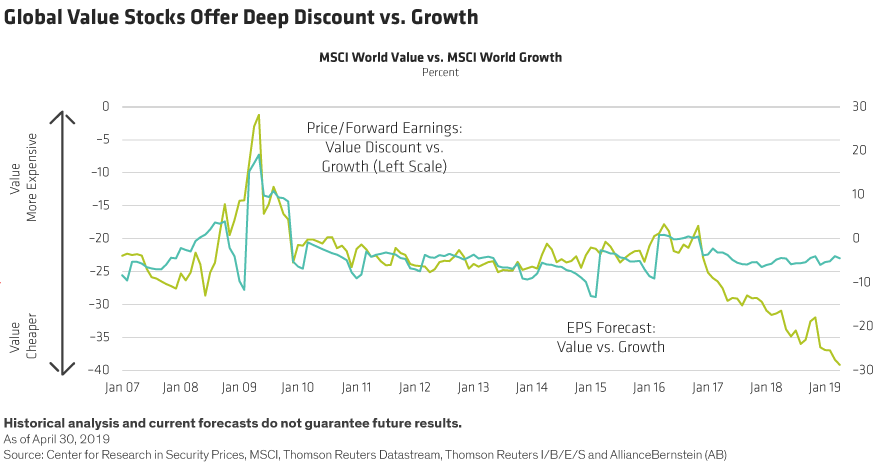

But there are some underlying signals that deserve attention. Based on price/forward earnings, the MSCI World Value Index trades at a 39% discount to the MSCI World Growth Index (Display, green line). That’s well below the long-term average discount of value to growth stocks.

Maybe value stocks are cheap for a reason? Perhaps their fundamentals have deteriorated to justify the slump? Not so. In fact, value stocks’ earnings growth expectations are very much in line with the long-term trend at 4.6% below those of growth stocks (Display, blue line). The disconnect between valuations and earnings has widened sharply since late 2016. And the trend is widespread across sectors.

What Could Prompt a Value Recovery?

So why the disconnect? We think it has more to do with the rush to growth than anything else. After the late 2018 downturn, risk appetite returned in early 2019, and investors are looking for stocks with high earnings growth. And as the macroeconomic cycle enters its later stages, growth is harder to find—and investors are willing to pay more for it. That’s not a favorable environment for value stocks that tend to have somewhat weaker earnings growth profiles.

What could trigger a value rebound? Investors are unlikely to ignore the solid earnings growth of value stocks forever, in our view. So if investors begin to pay closer attention to the profits and cash flows of these companies, we will expect value stocks to recover. And if concerns about a global slowdown give way to more optimism about the macroeconomic outlook, this will help reinforce confidence in the earnings potential for value stocks, in our view.

Another possibility is that investors continue to ignore the earnings of value companies, and value stocks remain depressed. Valuations of growth stocks might climb to bubble levels that ultimately prompt a growth downturn. In this case, we would expect value stocks to outperform growth, as in the period between 2000 and 2003 following the end of the dot-com bubble.

Interest rates could also play into the dynamics between value and growth stocks. Value stocks tend to do well during periods of rising interest rates. While current expectations are that rates will not rise this year, a resurgence of inflation could prompt higher rates and support value stocks.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.

AllianceBernstein Limited is authorised and regulated by the Financial Conduct Authority in the United Kingdom.

Source: Center for Research in Security Prices, MSCI, Thomson Reuters Datastream, Thomson Reuters I/B/E/S and AllianceBernstein (AB)

This post originally appeared at the AllianceBernstein blog

Copyright © AllianceBernstein