by Larry Adam, Chief Investment Strategist, Raymond James

As we celebrate the long Memorial Day weekend, Investment Strategy would like to take the opportunity to remember, honor and thank all of the members of our armed forces who gave their lives in service to our country. We hope everyone is able to spend quality time with loved ones and we wish you and your family a healthy and restful holiday.

Memorial Day is also the “unofficial” start to summer as the temperature heats up, school ends, and vacation season begins. In fact, the volume of miles driven in the U.S. moves up dramatically between Memorial Day and September’s Labor Day (the “unofficial” end to the summer). With more people on vacation there is a tendency for investors to lose focus on the financial markets. However, this particular summer presents numerous events, deadlines, and potential headlines that we believe investors cannot ignore as they could lead to increased volatility, both to the upside and downside. Some of these include:

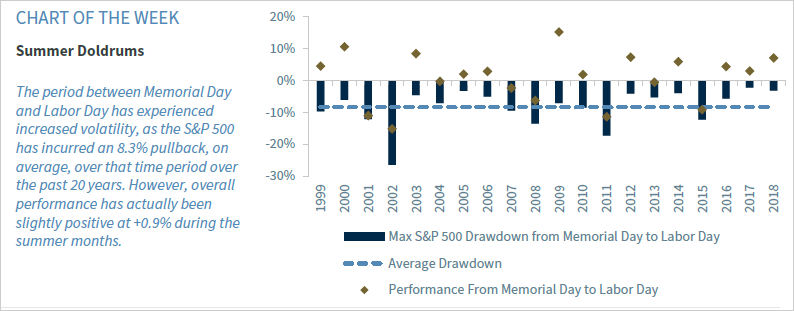

- Summer Softness | Historically, the summer months have not exhibited the strongest seasonal performance. In fact, they have suffered an average drawdown (e.g., peak to trough) of 8.3% and at least a 5% pullback ~70% of the time over the last 20 years. However, pullbacks are expected as the S&P 500 sits ~3% off its record high and the market has yet to experience a 5% pullback year-to-date (YTD). Keep in mind the S&P 500 historically experiences at least two 5% pullbacks, on average, in a given year. Most of these pullbacks represented a buying opportunity as the average return over these summer months has been +0.9%.

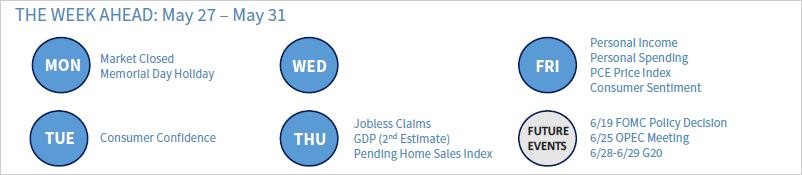

- “Deal” or “No Deal” Trade Agreement | Daily headlines and dramatic statements continue to dictate market movements. But that talk may potentially turn into concrete action in June with three key dates: June 1 (the day Chinese tariffs are implemented on $60 billion of U.S. exports); June 24 (when the U.S. could outline an additional $325 billion worth of Chinese imports to be tariffed); June 28-29 (the potential face-to-face meeting between Presidents Trump and Xi at the G-20 summit in Japan). The recent muted equity response to the trade escalation suggests to us the market is in a wait-and-see mode, with the outcome binary. A trade truce would likely send equities, especially emerging market (EM), higher whereas disappointment could lead to an additional 5% to 10% decline.

- Follow the Dot: Fed Meeting | The next Federal Open Market Committee (FOMC) meeting will be held June 18-19, which will include an interest rate decision, updated economic forecasts (including the dot plot) and the chairman’s press conference following the meeting. The previous dot plots suggested that the Federal Reserve (Fed) expects to remain on hold through year end. However, the market is currently pricing in an 81% probability of a rate cut by year end. As the Fed continues to reiterate (as evidenced through the minutes from the May FOMC meeting released this week) that it expects the moderation in inflation pressures to be ‘transitory’, the market may come under pressure if the Fed does not lower its inflation forecast or if it leaves its interest rate forecast unchanged (e.g., no rate cut). Given the ongoing debate about inflation and the direction of interest rates, the Fed’s Symposium in Jackson Hole (late August) may provide additional insight (especially if European Central Bank President Mario Draghi’s successor is in attendance).

- Earnings Downside or Déjà Vu | Similar to the first quarter, second quarter earnings are flirting with negative territory as 2Q19 S&P 500 earnings are expected to decline 0.6% year-over-year (YoY). As earnings are historically revised lower an additional 1% from now until the start of the earnings season, consensus forecasts could be in solidly negative territory when we begin 2Q19 season in early July. However, assuming the average “beat” rate, the S&P 500 should once again avoid a negative quarter. But as trade uncertainty has increased and multiple multi-national companies have expressed concerns over the tariffs, negative forward guidance or commentary from management could result in equities moving lower from current levels.

- No Shortage of Domestic and International Risks | While Congress may be on recess, the presidential race will heat up with the first Democratic primary debate on June 26-27. In addition to the festering tensions with Iran and Venezuela, the OPEC meeting on June 25-26 could prove to be a positive catalyst for oil prices if current quotas are maintained by OPEC members.

Economy

- A New York Fed study found that the 2018 tariffs imposed an annual cost of $419 for the typical household and the total annual cost of the new round of tariffs to the typical household is $831 (overall total annual cost = $1250). Similarly, an American Chamber of Commerce in China survey revealed that ~75% of U.S. companies in China are being adversely affected by the ongoing trade war between China and the U.S.

- Data released next week are not expected to move markets majorly. Advance data on inventories and foreign trade for April (May 30), along with personal income and spending figures (May 31), will help to fill in the economic picture for early 2Q19.

- Focus of the Week: The second estimate of 1Q19 GDP growth (due May 30) is expected to be relatively close to the advance estimate (3.2%), and the story shouldn’t change much (significant contributions from inventories and net exports, but slower growth in underlying domestic demand). We maintain our 1.9% GDP forecast for 2019.

U.S. Equity

- All eyes remain on U.S.-China trade relations, where the momentum has become more negative in recent weeks. Growing trade tensions as both sides jockey for position lowers the odds for much progress being made before the G-20 meeting. For this reason, we feel that equities offer an unfavorable risk vs. reward over the next month, unless the negotiations shift to the positive.

- From a global perspective, the U.S. equity market has held up better than most areas around the world (and is also exhibiting better fundamentals). On the flip side, China has been a global laggard since the re-escalation in early May (falling ~12% since then and giving up all of its YTD gains). The sharp pullback has led to oversold conditions, and we would not be surprised to see a short-term “relief” bounce. However, intermediate-term trends likely hinge on trade negotiations and whether escalation continues past June.

- In the U.S., S&P 500 companies with less revenue exposure overseas have held up much better through the volatility. For example, S&P 500 companies with over 50% of their revenues from the U.S. have pulled back -2.3% since May 3, while those with over 50% of revenues outside the U.S. have pulled back -6.1%.

- The differential in performance between companies with mostly U.S. exposure vs. those with more global exposure is clear within the Technology sector. Tech companies with over 50% of their revenues from overseas have pulled back -9.4% on average vs. -1.3% for companies with over 50% of their revenues from the U.S.

- Focus of the Week: The outlook for trade will continue to be the dominating factor for the market moving forward as the current tariffs will negatively impact global growth and corporate margins if they go into effect.

Fixed Income

- With rhetoric between the U.S. and China heating up and the potential for the trade war turning into a long-term battle (years, not weeks), investors have shifted focus to the longer-term impacts on economic growth and future Fed policy. Given this, Treasury yields on both the short and long end declined sharply this week, as the 10-Year Treasury yield declined to its lowest level (+2.30%) since November 2017.

- Similar to the U.S., sovereign yields also declined in Europe, as trade uncertainty and disappointing economic data (e.g., PMIs) pushed the 10-Year German Bund to its lowest level (-0.12%) since September 2016.

- Focus of the Week: The 3-month and 10-year treasuries have inverted again (first occurred in late March). These inversions are hard to gauge due to central bank activity applying pressure to the short-end of the curve. If the inversion holds and/or gains momentum for a sustainable period of time, it could prove to be an early indicator for the next recession. However, this will take time to develop, pushing the start of a potential recession into the early months of 2021.

International

- A number of euro area data publications will be released on May 28, providing a wide insight into the euro zone economy and potential future European Central Bank stimulus efforts. We expect these insights to show progress consistent with ~1% regional economic growth rates. Also, pay particular attention to the bank lending data as growth in the 3-4% range year-on-year suggests this key indicator is not getting worse at the margin.

- Focus of the Week: Narendra Modi emerged as the victor of India’s general election and has secured another five-year term. This removal of political uncertainty in the second largest EM economy is a long-term positive for EM equities overall.

Commodities

- Crude oil posted its largest weekly decline YTD (-7.7%) and fell to its lowest level in three months as trade uncertainty, concerns surrounding global growth, continued strength in the dollar, and an unexpectedly large build up in weekly inventories hampered the asset class. Despite the decline, crude oil will likely be supported in the near term as the unofficial start of the summer driving season (beginning over Memorial Day Weekend) brings increased demand for crude oil products.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.

Copyright © Raymond James