by Mike Gagala, Russell Investments

What if we had the DeLorean time machine from Back to the Future, and could set the dial back just 8 months?

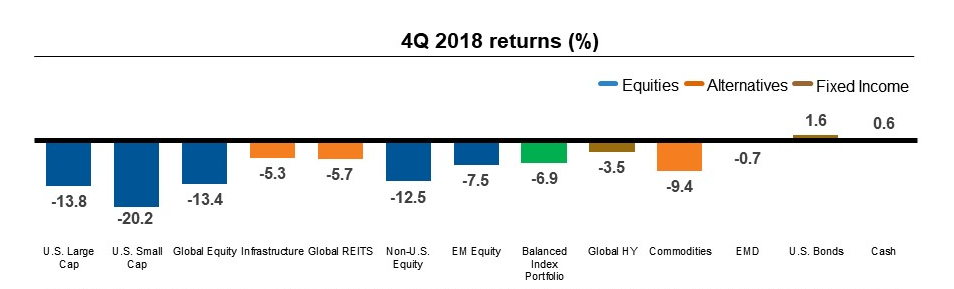

I am sitting in your office and it is October 1, 2018. Like you’ve done so many times with your local Russell Investments’ regional director, we are reviewing the Economic and Market Review. I have the document flipped open to the chart below…

Click to enlarge

Source: U.S. Small Cap: Russell 2000® Index; U.S. Large Cap: Russell 1000® Index; Global: MSCI World Net Index; Non-U.S.: MSCI EAFE Net index; Infrastructure: S&P Global Infrastructure Index; Global High Yield: Bloomberg Barclays Global High Yield Index; Global REITs: FTSE EPRA/NAREIT Developed Index; Cash: FTSE Treasury Bill 3 Month Index; EM Equity: MSCI Emerging Markets Index; U.S. Bonds: Bloomberg Barclays U.S. Aggregate Bond Index; EMD: JPM EMBI Plus Bond Index; Commodities: Bloomberg Commodity Index Total Return; Balanced Index: 5% U.S. Small Cap,15% U.S. Large Cap, 10% Global, 12% Non-U.S., 4% Infrastructure, 5% Global High Yield, 4% Global REITs, 0% Cash, 6% EM Equity, 30% U.S. Bonds, 5% EMD and 4% Commodities. Index returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment. Indexes are unmanaged and cannot be invested in directly.

…And I am pointing out that YTD, Global Equity is up +5.4%, U.S. Large Cap is up +10.5%, and U.S. Small Cap is up +11.5%. These are the market leaders through the first three quarters of 2018. We also take a quick glance at U.S. Bonds, which are down -1.6% YTD, noting the asset class is the worst performer through the first three quarters of 2018.

Now, because I was able to travel back in time to this meeting, I was able to bring something you’ve never seen before ... yes, I brought the elusive crystal ball. Holding the crystal ball in my lap, I take a long hard look at what’s about to come. Looking up at you with a renewed confidence, I calmly suggest that while the market has been great for the first three quarters of 2018, I recommend selling all of your Global Equity, U.S. Large Cap Equity, and U.S. Small Cap Equity positions, and investing the proceeds into U.S. bonds. What’s your immediate and gut reaction? I mean, after all, the market has been great for so long ... including the first three quarters of 2018.

As I’ve posed this scenario to advisors over the last couple of weeks, the answers come fast and direct: You’re crazy, followed by you’re fired!

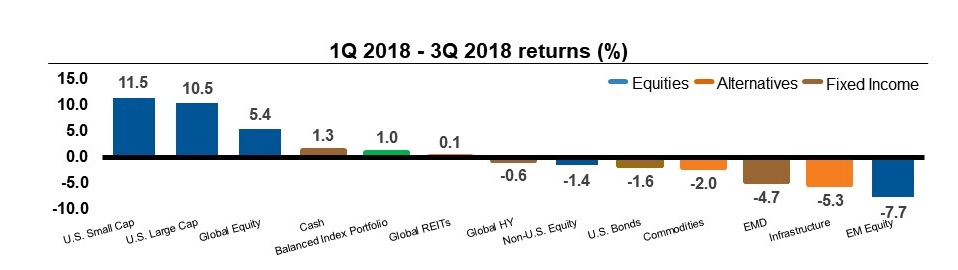

Yet, let’s look at how it actually played out in the fourth quarter of 2018:

Click to enlarge

Source: U.S. Small Cap: Russell 2000® Index; U.S. Large Cap: Russell 1000® Index; Global: MSCI World Net Index; Non-U.S.: MSCI EAFE Net index; Infrastructure: S&P Global Infrastructure Index; Global High Yield: Bloomberg Barclays Global High Yield Index; Global REITs: FTSE EPRA/NAREIT Developed Index; Cash: FTSE Treasury Bill 3 Month Index; EM Equity: MSCI Emerging Markets Index; U.S. Bonds: Bloomberg Barclays U.S. Aggregate Bond Index; EMD: JPM EMBI Plus Bond Index; Commodities: Bloomberg Commodity Index Total Return; Balanced Index: 5% U.S. Small Cap,15% U.S. Large Cap, 10% Global, 12% Non-U.S., 4% Infrastructure, 5% Global High Yield, 4% Global REITs, 0% Cash, 6% EM Equity, 30% U.S. Bonds, 5% EMD and 4% Commodities. Index returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment. Indexes are unmanaged and cannot be invested in directly.

One can easily see that the crystal ball move would have been to sell all of our equity positions and reinvest in U.S. bonds, up +1.6% (best performer of Q4 2018).

Since we don’t have access to the DeLorean time machine, and the crystal ball doesn’t actually exist, let’s think more about what actually happened as we were heading into Q4. You did not make the above recommendation to your clients, and your client’s portfolio likely remained invested in the same portfolio they had in Q3 throughout Q4. As we turned to the New Year, and your clients experienced one of the toughest Q4’s in recent history, your phone started ringing off the hook.

Investors were anxious, and ready to sell! Now was your time to shine as an advisor. As we have highlighted in our 2019 Value of an Advisor Study, your ability to help your clients avoid pulling out of markets at the wrong time and sticking to their long-term plan is one way advisors provide substantial value. This is the hard part of your job—and it is often thankless, picking up the phone, call after call, and talking your clients off the ledge. But it is invaluable to your clients. You save them from their emotions, the media hype, poor advice from others around them, and keep them focused on their long-term goals.

We don’t have a DeLorean time machine or a crystal ball to know what is coming next in the markets, so your job as your client’s advisor is to ensure they have a plan and stick to that plan to hit their financial goals. Conversations reminding clients that if their plan hasn’t changed, then your planning and investment recommendations haven’t changed either get redundant and tiresome. But they are exactly what your clients need to hear, and we are here to help you with those conversations.

Key takeaways

- Managing your client’s behavior. Perhaps the most difficult part of your job is keeping your client’s mental state and emotions balanced so they do not make catastrophic mistakes along their volatile investment journey.

- The crystal ball does not exist, and we know the best way to help a client reach their long-term investment objective is to stay invested over time. The age-old saying, time in the market, not timing the market, rings true here.

- Leverage your resources and the partnership of your Russell Investments’ regional team. We are here to share our global experience, and help guide you and your team in smooth markets as well as more volatile markets.

The bottom line

You have a partner in Russell Investments that can help you with those difficult conversations as often as needed. We are your sounding board, and are working every day to help you more efficiently deliver perspective, context and investment solutions to your clients. We are committed to helping you help your clients stay on track and reach their financial goals.

Copyright © Russell Investments