by Elga Bartsch, PhD, Blackrock

Elga suggests a few investment options that may benefit from a pick-up in European growth and any decline in geopolitical concerns.

We continue to prefer a “barbell” approach to risk taking in the late-cycle stage: quality stocks, income-generating bonds and emerging markets. And there are several investments in Europe worth highlighting.

Europe offers attractive asset valuations compared to history, especially in risk assets. Regional assets have cheapened further compared to a year ago as concerns about growth and politics increased. The exception to this are core government bonds, which we believe to be expensive compared to global peers.

As downward revisions to growth start petering out and incoming activity data begin to show signs of life, European risk assets might get a boost this year as value equities benefit. For any equity rally to have legs, investor concerns around a disorderly Brexit, global trade conflicts and Italian politics have to diminish, in our view. Given how under-owned Europe has become, even a tentative recovery might spark a relief rally.

A fear of fragmentation

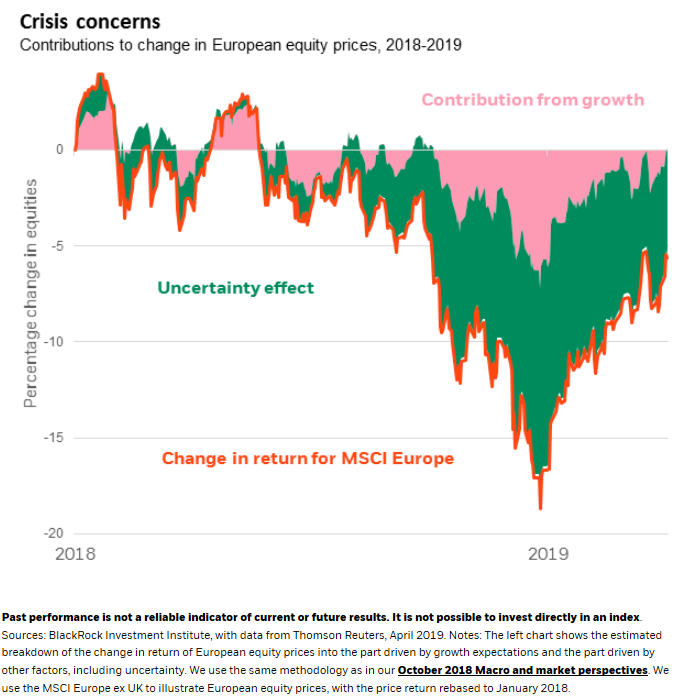

Our analysis shows that a considerable chunk of the discount in regional assets can be pinned to increased investor concerns on European fragmentation, suggesting that political risks are more adequately priced at the moment. See the Crisis concerns chart. By looking at the euro-zone equity market performance more closely and comparing it to moves in inflation-linked government bonds, we find that growth expectations played a limited role in the weak performance over the past year – while political risks played a large part.

One investment option in the fixed income space that does not require a growth comeback: long euro-zone break-even inflation rates, now at their lowest levels since 2016. We also continue to see compelling relative value in BBB-rated European corporate debt, even as we maintain a neutral view on European corporate bonds overall.

Another idea is a tactical long euro position against the US dollar. The euro has under-performed other risk assets during the 2019 market rally, in our view. The easier stance adopted by the ECB, ongoing forecast downgrades and worries over US car tariffs and political risk more broadly have weighed on the currency. We see much of this negative news as now reflected in the euro’s price. Yet the increasing use of the euro as a funding currency in carry trades could limit gains. On balance it is therefore unlikely that sustained appreciation of the currency would derail a recovery in the second half, in our view.

Elga Bartsch, PhD, Head of Economic and Markets Research for the BlackRock Investment Institute, is a regular contributor to The Blog.

Investing involves risks, including possible loss of principal.

Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. Non-investment-grade debt securities (high-yield/junk bonds) may be subject to greater market fluctuations, risk of default or loss of income and principal than higher-rated securities.

International investing involves special risks including, but not limited to currency fluctuations, illiquidity and volatility. These risks may be heightened for investments in emerging markets.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of April 2019 and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this post is at the sole discretion of the reader. Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index.

©2019 BlackRock, Inc. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

BIIM0519U-853817-1/1