In today’s episode of Market Week in Review, Research Analyst Brian Yadao and Senior Investment Strategist Paul Eitelman unpack so much economic data, it’s a wonder we could fit it into a single video.

China/U.S. trade détente? How close are we?

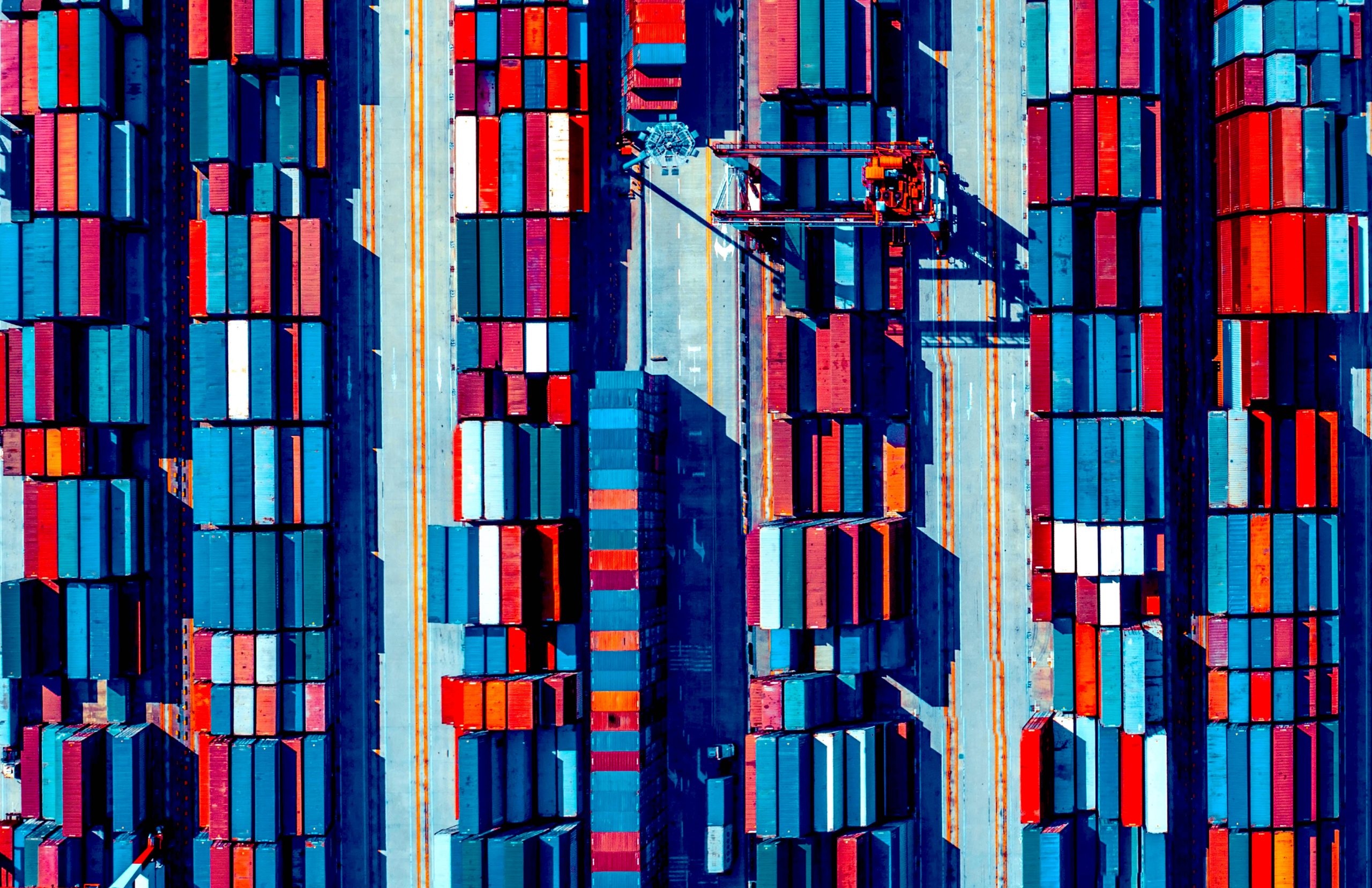

On the topic of the China/U.S. trade war, Eitelman mentioned that the U.S. delegation was in Beijing in the middle of this week, “and the negotiations were described as being productive.” Eitelman added, “I think probably the most interesting development here in the short-term reporting is that we could potentially have a trade deal announcement as early as next Friday (May 10, 2019).” Eitelman described the months-long trade dispute as a major headwind and obstacle for global financial markets. He said, “If we were to get a deal announced, I think that would be a major step forward here for the global business cycle.”

Eitelman explained that from a financial-market perspective, there seems to be a consensus building that such an announcement would pull back the tariffs that were put in place on the $200 billion of Chinese imports, but potentially leave in place the first tariff batch on the $50 billion from China as an enforcement mechanism to make sure that both the United States and China are playing by the rules of this potential deal.

Could all the tariffs be eliminated? Eitelman said, “If they’re totally removed, I think that would be seen as a positive for global financial markets. If the full set of tariffs remain, I think that would be a negative. We’re looking for sort of this middle-ground scenario as sort of the key watchpoint next week.”

Eurozone economic numbers: The good and not-so-good

The conversation shifted to the eurozone, where Yadao noted that eurozone gross domestic product (GDP) numbers came in better than expected. Eitelman’s commentary ran this way: “I think at the highest level, what we’re clear on here is the global economy, which was slowing really sharply at the end of 2018, seems to have at the very least bottomed out.” He went on to explain that many of the cyclical indicators have stabilized over the first four months of 2019, suggesting less downside risk.

Eitelman noted that eurozone first-quarter GDP numbers came in around 1.5%, a strong upswing over the end of 2018. He added, “It’s not a uniformly positive picture, though. We also pay attention to what’s happening with the bank-credit and money-supply numbers in Europe, as kind of a gauge of the underlying strength, on a more high-frequency basis. And the numbers this week were a little bit softer in that regard. So even though we saw a first-quarter pop, it’s not totally obvious that Europe is strengthening in a big way on a forward-looking perspective.”

Strong U.S. economic growth, soft inflation, and Jerome Powell, right in the middle

U.S. Federal Reserve Chairman Jerome Powell spoke earlier this week, indicating a continuation of the Fed’s holding pattern. That was followed by April’s U.S. jobs report, showing 263,000 jobs created and the lowest U.S. unemployment rate since the late 1960s. “So we’re seeing a very strong U.S. labor market,” said Eitelman. But he added some inflationary insight: “On the sort of price-pressure side, the wage-growth numbers were more modest and a bit disappointing. On the price-inflation side as well, the numbers from this Monday were also disappointing. And we’re looking at core PCE (personal consumption expenditure) inflation of just 1.55% right now. And that’s kind of considerably below the Fed’s 2% target.”

Eitelman noted that the tension between positive economic data and soft inflation numbers likely keeps the Powell and the Fed in a holding pattern, when it comes to raising or lowering interest rates. Eitelman stated that financial markets had been embedding a greater probability of a rate cut, and said, “I think as that cut gets priced out of markets, we’d be looking for interest rates to probably grind higher here over the next several months.”