by Blaine Rollins, CFA, 361 Capital

Back to macro market worries as: 1) U.S./China trade talks ramp up, 2) The U.S. Government heads for another Shutdown on Friday and 3) Global growth data points continue to point toward a slow down. Confirming the markets worries, global bond yields are in retreat with many countries looking at three year low yields. With the U.S. performing better on a relative basis, the recent U.S. dollar strength does its best to make most of us look stupid for calling for the opposite after the Fed’s change in direction away from tightening. Little on the micro front will be able to offset any news from the big three macro items above. So keep an ear adjusted to your squawk box or eyes on the front page headlines because this news will move the markets for the time being.

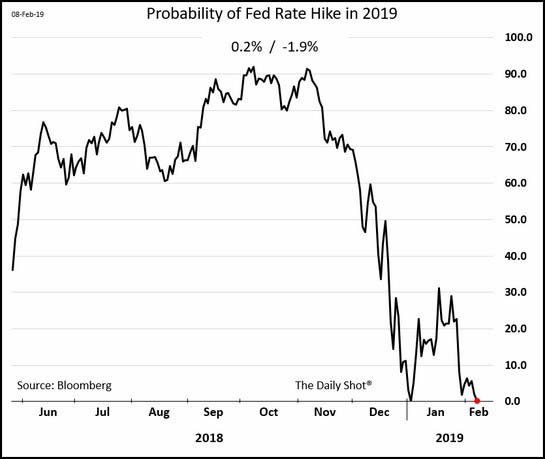

The market is now betting against a Fed rate hike for 2019…

Blame the new Fed road map or blame a global economy which is rolling over.

And global bond yields are in a full retreat…

Ten-year yields in Japan and Germany are going back to negative rates, while the U.S. heads toward 2.5%.

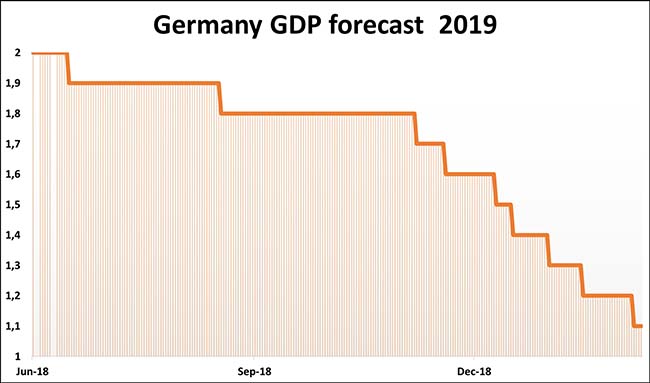

German yields suffering from the retreat in its economy…

Falling yields and a slowing economy makes for a massive headwind for Germany’s largest bank…

Which is down 29% since the S&P 500 peaked before Octoberfest (and the S&P 500 peak).

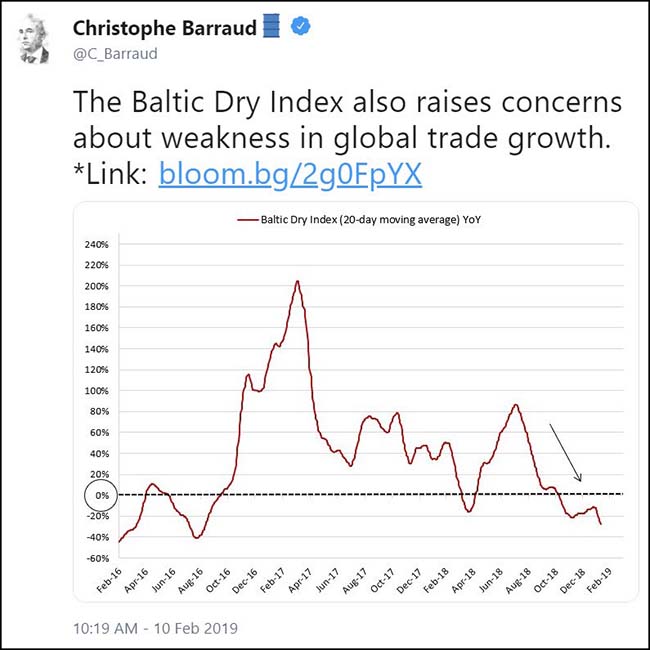

Global trade slowdown also seen in the prices for shipping…while

Doink!

@Callum_Thomas: That sound the S&P 500 makes when it hits its head on the ceiling… $SPX $SPY

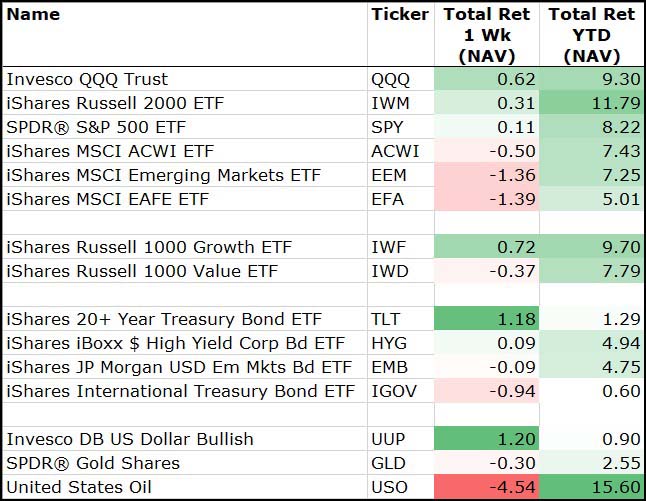

For the week, the U.S. dollar and bonds were the winners, while Oil suffered a slick slide…

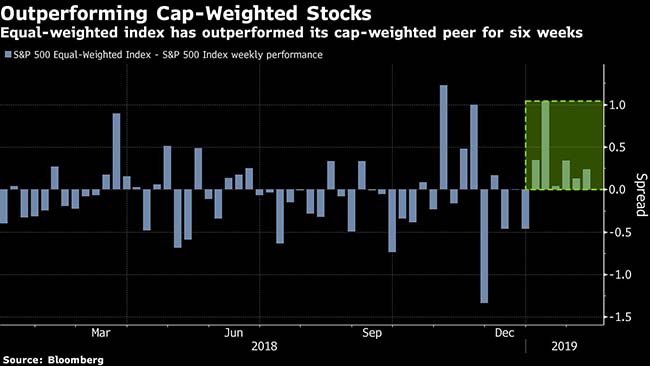

Smaller caps are on a six-week tear against the large caps…

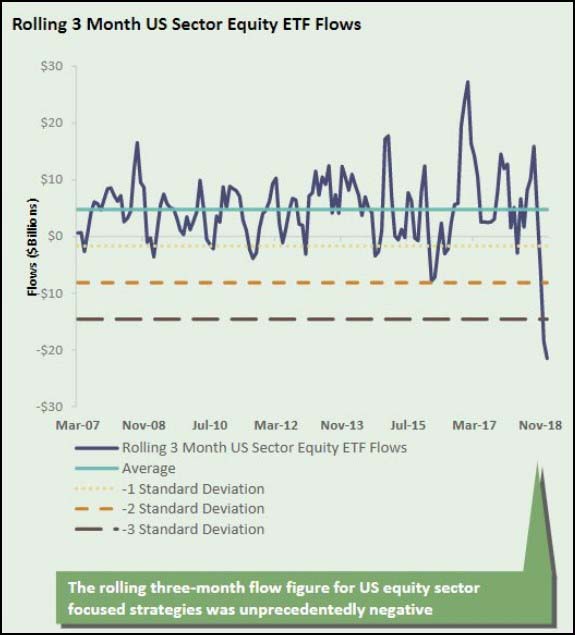

Rising breadth typically is a very good sign for the market. Interesting twist to consider about recent ETF outflows weighing on megacaps.

As stock rebounds go, this one has been big, sudden, and decidedly broad, with signs megacap titans are relaxing the stranglehold in which they’ve held the S&P 500 for two years.

While the rally took a breather last week, it remains the best annual start for U.S. equities in almost three decades, with $1.7 trillion added to share values. Notable in the surge has been the role of smaller companies — or less-gargantuan ones, anyway. An equal-weighted version of the S&P 500 that strips out market-cap biases is beating the regular gauge by 2.3 percentage points…

The lag in megacap performance is coming amid a broad exit from exchange-traded funds in the first part of the year, in which about $30 billion was pulled in the first six weeks of the year, according to EPFR data, the worst start to a year since the company started tracking exchange-traded fund flows in 2000. It may not be a coincidence. Withdrawals from index-tracking funds create a disproportionate drain on larger companies since a majority of them are cap-weighted.

And here is a chart on recent equity ETF flows…

(State Street Global Advisors)

Brazil is the best performing major geography since the S&P 500 peak…

BTG Pactual says not to fear Brazil’s strength…

Brazil is home to the only one major market across the globe where stocks are hitting all-time highs. But calling it expensive might be a mistake.

So says Carlos Sequeira, head of equity research for Latin America at BTG Pactual, one of the country’s biggest standalone investment banks. While the Ibovespa has been the first among 47 equity benchmarks tracked by Bloomberg in claiming record highs this year, at 11.6 times forecast earnings, its multiple just matched the average over the past decade.

Brazilian stocks deserve a higher multiple as efforts by new President Jair Bolsonaro to unleash market-friendly business policy will help sustain the economic recovery, according to Sequeira. The Ibovespa last year bucked a decline in global stocks, jumping 15 percent. The index has climbed another 7 percent this year and Sequeira expects it to reach 112,000 by December, an 18 percent gain from current levels.

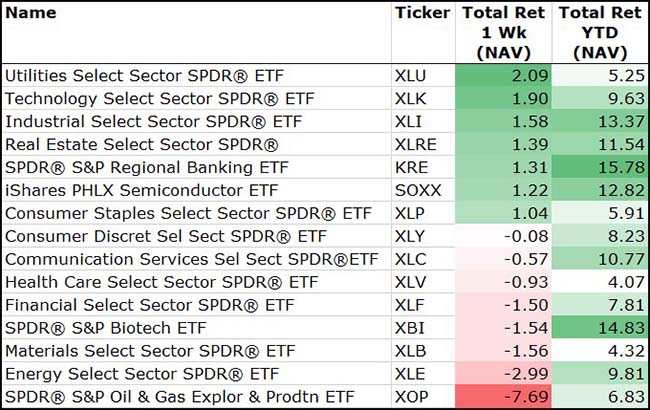

A small defensive tilt to sector performance last week…

But energy stocks could not escape the big pullback in oil and natural gas prices.

Energy stocks are the worst performing sector since the S&P 500 peak…

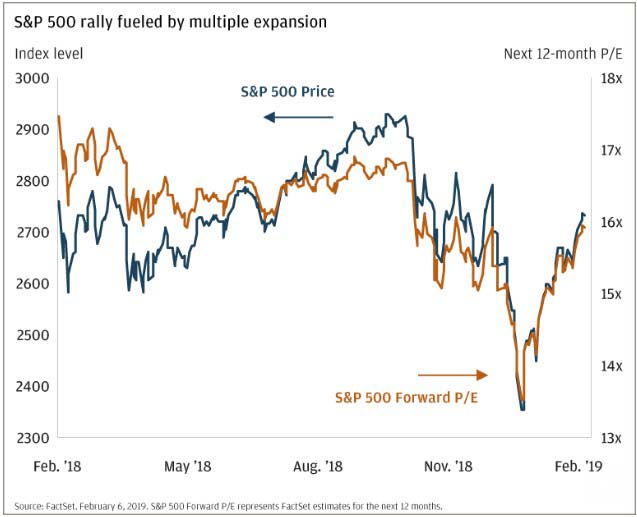

A good visual of three multiple points quickly leaving the market and then returning to the market…

(JPMorgan)

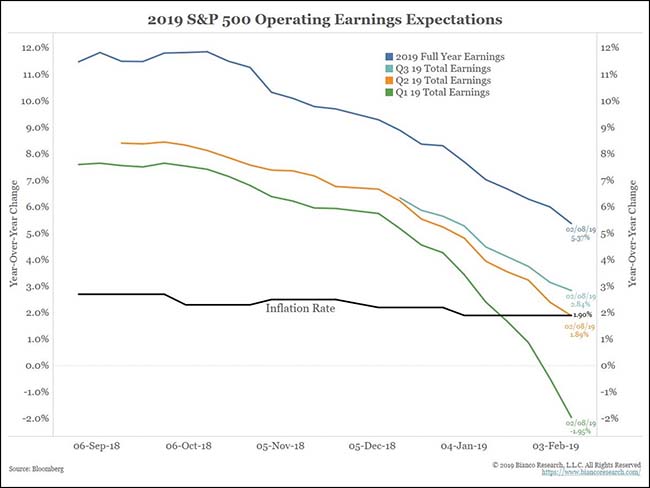

As earning season continues, so does the melting of 2019 earnings estimates…

@jessefelder: Q1 2019 earnings expectations are now negative. Q2 expectations are below the inflation rate, meaning the first half of the year is now expected to have no real growth. Full-year forecasts are now at 5.4% and have several months to continue lower

(@biancoresearch)

Fitch had some strong thoughts last week about owning illiquid bonds inside of liquid bond funds…

The rapid growth of corporate bond funds could present a threat to financial stability, according to Fitch Ratings, if a combination of investor runs and deteriorating trading conditions sends shockwaves through markets.

Concerns over the growth of corporate debt funds and the implications for “liquidity” — a gauge of how easy it is to buy and sell financial securities — have been rising since the financial crisis. Figures such as Blackstone’s Stephen Schwarzman and economist Nouriel Roubini have warned that the mismatch between how easy it is to pull money out of a fund and how hard it can be to sell the underlying bonds could exacerbate or even cause another market crunch.

Fitch warned in a report on Wednesday that as mutual funds — which allow investors to enter and exit their holdings daily — have stocked up on riskier debt, the risks associated with investors fleeing en masse have increased. Bond mutual funds typically hold some cash in reserve to handle routine redemptions, but spikes in withdrawals mean that they have to sell assets in a hurry, triggering similar forced sales across the market.

“A market stress emanating from open-ended bond funds could spread to other financial institutions and affect financial stability, given the interconnectedness among funds, banks, non-bank financial institutions and the rest of the financial market,” Fitch said.

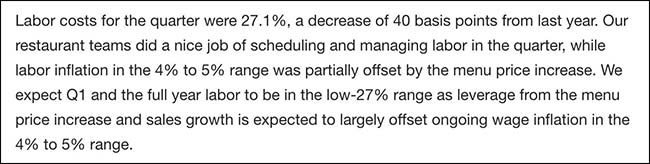

Interesting inflation item from last week’s Chipotle earnings…

@MylesUdland: Chipotle forecasting 4%-5% wage inflation in 2019 (https://yhoo.it/2Sg6Llq )

While smaller tax refunds should reflect better tax management, upcoming U.S. economic data points may see a negative hit…

The first tax-filing season under the new tax law got off to a slower start than last year and filers so far are seeing smaller average refunds, according to early Internal Revenue Service data released Friday.

With about 10% of households filing their returns, the percentage of households getting tax refunds is similar to last year, but average refund size is down 8%, to $1,865. The number of returns filed so far—16 million—is down 12% from the similar point a year ago…

The first batch of weekly data from the IRS offers a very preliminary, unrepresentative look at what’s happening to taxpayers using the new tax system, which increased the standard deduction, lowered rates, and curbed some deductions. Typically, early filers are those who expect significant refunds, while those who owe money file closer to the mid-April deadline.

(WSJ)

And U.S. auto dealers are less prepared to deal with smaller tax refund checks…

Car dealers are beginning 2019 with a heavier inventory of unsold vehicles on their lots, a situation that some analysts say will put pressure on them to cut factory output as U.S. auto sales are expected to cool this year.

There were 3.95 million vehicles on dealership lots at the end of January, a 4% increase from December and up nearly 3% from the prior-year January, according to data released Monday by WardsAuto.

While January is typically a slower month for new-vehicle sales, analysts say the rising stock levels are becoming problematic because car companies will start this year with more unsold inventory than they had three years ago when U.S. auto sales peaked at 17.55 million for the year. Industry forecasters and some auto executives predict sales this year will fall well below that figure, dropping to under 17 million vehicles for the first time since 2014.

General Motors Co. has already moved to end production at five North American factories this year in response to falling sedan sales, and aiming to get ahead of an expected U.S. car market downturn. More auto makers could be forced to follow suit as rising interest rates on new-car loans and more affordable options on the used-car lot are expected to put a damper on new-car sales this year.

(WSJ)

To receive this weekly briefing directly to your inbox, subscribe now.

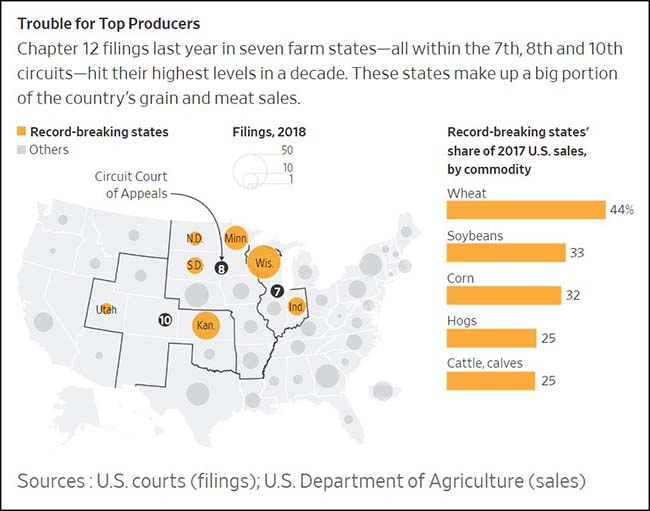

Forget about smaller economic hits. U.S. farmers are just trying to survive right now…

Throughout much of the Midwest, U.S. farmers are filing for chapter 12 bankruptcy protection at levels not seen for at least a decade, a Wall Street Journal review of federal data shows.

Bankruptcies in three regions covering major farm states last year rose to the highest level in at least 10 years. The Seventh Circuit Court of Appeals, which includes Illinois, Indiana and Wisconsin, had double the bankruptcies in 2018 compared with 2008. In the Eighth Circuit, which includes states from North Dakota to Arkansas, bankruptcies swelled 96%. The 10th Circuit, which covers Kansas and other states, last year had 59% more bankruptcies than a decade earlier.

States in those circuits accounted for nearly half of all sales of U.S. farm products in 2017, according to U.S. Department of Agriculture data…

More than half of U.S. farm households lost money farming in recent years, according to the USDA, which estimated that median farm income for U.S. farm households was negative $1,548 in 2018. Farm incomes have slid despite record productivity on American farms, because oversupply drives down commodity prices.

(WSJ)

Maine lobster fisherman feel the farmers pain as they miss selling into the Chinese New Year…

Lunar New Year is supposed to be the busiest time of the year for Tom Adams, whose company, Maine Coast, used to sell millions of pounds of lobster to China.

But the U.S.-China trade war has shut Maine Coast out of that market.

His former customers in China now buy their lobster from Canada, where dealers can sell a hard-shell version without the 25 percent import tariff. On a snowy Wednesday morning, on what should have been his busiest shipping day of the year, Adams waved at stacks of boxed lobsters waiting to be loaded on cargo trucks at his newly expanded York facility and sighed.

“Last year, all of this and more would’ve been headed to China,” he said. “But now, we’re lucky if any of them are.”

Maine lobster dealers are struggling to manage the fallout from the U.S.-China trade war. Before the tariff, China was the second biggest importer of U.S. lobster, buying $128.5 million worth of it in 2017. The U.S. was on track to double its lobster sales to China before the tariff initiated by President Trump hit in July, according to trade data. Since then, U.S. lobster exports have all but dried up.

For example, Adams lost 90 percent of his China business, which used to represent 22 percent of his sales.

California homeowners are now feeling lucky to find insurance coverage at any cost…

Home-insurance companies in the Golden State are canceling some policies, refusing to sell new ones in certain areas and applying for rate increases as they look to reduce wildfire risk.

“It’s getting harder and harder to find someone to write [insurance for] any given particular piece of property,” said Bob Anderson, co-owner of Fromarc Insurance Agency Inc. in South Lake Tahoe, Calif.

Insurers including State Farm and Allstate Corp. have filed to raise home-insurance rates in the past six months. The California FAIR Plan, the state insurer of last resort, said it would implement an average 20.3% price increase in April, with the largest increases for policies in wildfire-exposed areas.

(WSJ)

The discussion on stock repurchases and dividends continues…

Just don’t forget what happens if you push CEOs to retain too much capital.

The history of investment by corporate managers with oodles of cash on their hands isn’t encouraging. Hugh Liedtke, the late chief executive of Pennzoil, reportedly liked to quip that he believed in “the bladder theory”: Companies should pay out as much cash as possible, so managers couldn’t piss all the money away.

In the 1970s and early 1980s, giant oil companies, flush with dollars after the boom in oil prices, binged on buying department stores and developing electric typewriters. (Montgomery Ward stores and Qyx typewriters didn’t turn out to be gushers.)

(WSJ)

And because you all loved the Fyre Festival documentary…

Clearly Senator Klobuchar is durable enough to lead a charge across the Delaware River…

Now does she have what it takes to collect all those voters in the middle? Unless another moderate enters the race, I would guess we are going to hear quite a bit about the tough candidate from Minnesota.

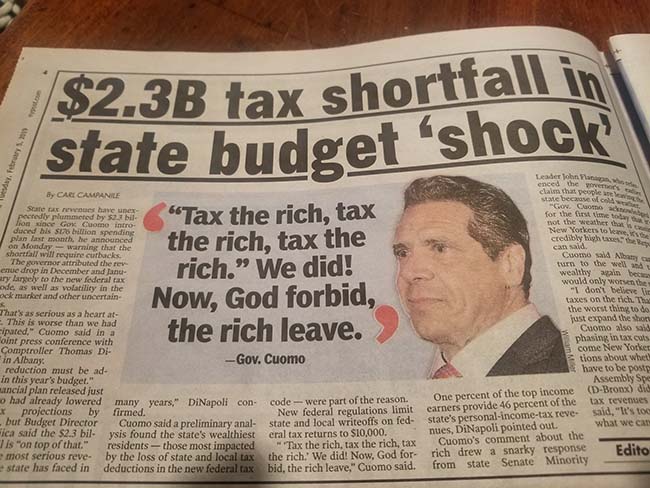

New York Post quotes Gov. Cuomo on what Howard Marks explained in his memo last week…

When pushed, the wealthy get mobile. And Florida is loving it right now…

A growing list of public officials in high-tax states are expressing alarm that big earners are bolting to low-tax states as new data suggests some home buyers are moving in response to the year-old change in the federal tax law.

New York Gov. Andrew Cuomo became the latest on Monday when he blamed a $2.3 billion state shortfall on the new federal tax law that he said is driving people to leave the state. During a news conference in Albany, Mr. Cuomo said the 2017 law capping a deduction for state and local taxes at $10,000 is the reason for the deficiency. He specifically mentioned Florida as an attractive option for New Yorkers who are unhappy with the change in the tax law

Preliminary data show a jump in Florida home purchases by buyers from high-tax states. Home values in lower-tax areas have been rising faster than those in places where limiting the ability to deduct high state and local taxes eroded some of the savings from the federal tax reduction, according to an analysis by real estate and data firm Zillow…

Nelson Gonzalez, a senior vice president at EWM Realty International in Miami, said that in the past year most of the buyers for high-end listings that he encounters are from high-tax states in the U. S.—a big change from several years ago when he mostly saw foreigners. “Ninety percent of all the deals over $10 million were tax refugees,” he said.

(WSJ)

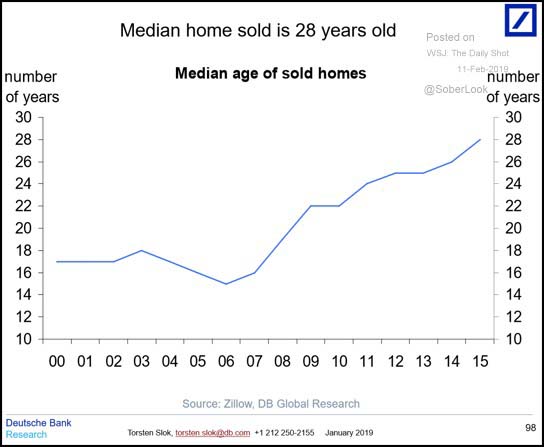

A reason to review home improvement retail and supply companies?

As houses get older, remodel and repairs will get more of the share of personal spending.

A piece on youth football that will get you thinking and talking…

Without a reversal in economic fortunes for poor communities across the country, football could one day become a sport played almost exclusively by black athletes, while still enjoyed by everyone. Black athletes—who already make up the majority of players in the most dangerous on-field positions—would continue to suffer from long-term brain damage, their life cut short by dementia and the scourge of CTE. Black boys would continue to be drawn to a sport that could make their life painful and short. Everyone else would sit back and watch.

Unfortunately, Bob Costas talked himself right out of NBC over football…

How long until Netflix offers him multiples of what he was making at the peacock?

With his 28 Emmys and eight National Sportscaster of the Year awards, Costas had become the most-respected broadcaster of his generation — a kind of Walter Cronkite for sports. He believed it was his responsibility to address uncomfortable truths, or “elephants in the room,” as he often called them.

The release of “Concussion” seemed a natural topic given the nationwide awakening about head trauma in contact sports, especially the NFL. Costas believed it was important to have viewers confront football’s existential crisis and consider their own moral dilemma as fans complicit to the sport’s carnage.

Yet he recognized such a speech posed a challenge for his bosses and NBC. The network was paying the NFL billions to air games on Sunday nights. Even more, Costas knew NBC executives were hoping to expand the network’s NFL package to Thursdays.

Costas sent the essay to his bosses for approval, something he typically did not do — and waited.

What would ensue that week — and in the years that followed — reveals for the first time how a broadcasting icon went from fronting America’s most popular sport to being excised from last year’s Super Bowl and, ultimately, ending his nearly 40-year career with NBC.

(ESPN)

(Costas attended a 2015 screening of “Concussion” and was moved by the film’s portrayal of Dr. Bennet Omalu, the neuropathologist who first posited that former NFL players had died with a brain disease caused by football. Andrew Toth/FilmMagic)

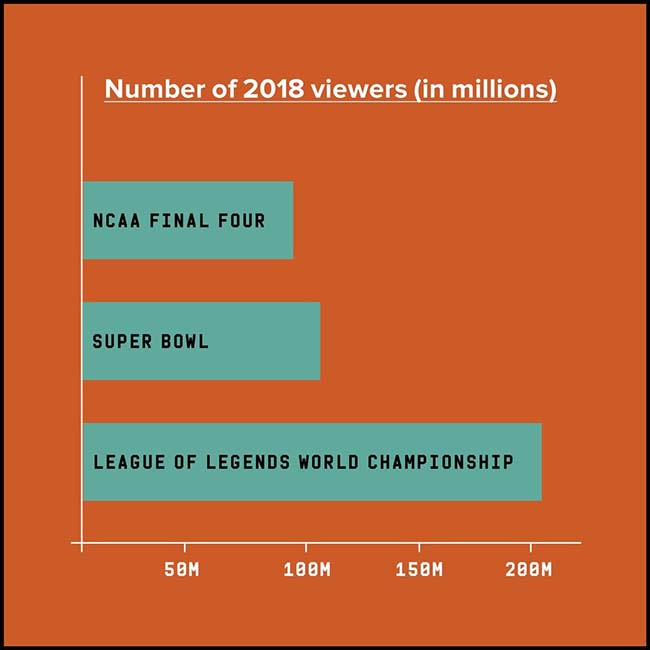

Bob Costas might want to use the time off to brush up on his Fortnite…

Over the past five years, esports have grown into an estimated $906 million industry, with recruiters, coaches, and dedicated arenas. Nearly 200 US colleges are offering around $15 million per year in scholarships for the esports elite, and university teams can earn millions more in tournament prizes. Unsurprisingly, Silicon Valley is getting in on the market: PlayVS, a startup that organizes high school esports leagues, has raised $46 million from investors like Diddy and Adidas. Game recognize game.

(Wired)

Here is another thought piece that will get you to thank the next sailor that you run into…

A little after 1:30 a.m. on June 17, 2017, Alexander Vaughan tumbled from his bunk onto the floor of his sleeping quarters on board the Navy destroyer USS Fitzgerald. The shock of cold, salty water snapped him awake. He struggled to his feet and felt a torrent rushing past his thighs.Around him, sailors were screaming. “Water on deck. Water on deck!” Vaughan fumbled for his black plastic glasses and strained to see through the darkness of the windowless compartment.

Underneath the surface of the Pacific Ocean, 12 miles off the coast of Japan, the tidy world of Berthing 2 had come undone. Cramped bunk beds that sailors called coffin racks tilted at crazy angles. Beige metal footlockers bobbed through the water. Shoes, clothes, mattresses, even an exercise bicycle careered in the murk, blocking the narrow passageways of the sleeping compartment.

In the dim light of emergency lanterns, Vaughan glimpsed men leaping from their beds. Others fought through the flotsam to reach the exit ladder next to Vaughan’s bunk on the port side of the ship. Tens of thousands of gallons of seawater were flooding into the compartment from a gash that had ripped through the Fitzgerald’s steel hull like it was wrapping paper.

As a petty officer first class, these were his sailors, and in those first foggy seconds Vaughan realized they were in danger of drowning.

If you eat out, get your reservation earlier than 6 o’clock…

This might be tricky for the East Coast crowd with the market closing at 4pm EST, but for the rest of the time zones, 5:30pm is ideal. If you worked in a restaurant, then you already know the secret.

Dining at 5:30 has several advantages — the restaurant’s staff being at their freshest might be the greatest one. Most restaurants begin their dinner service around 5pm, which means by 5:30, your server has maybe helped a handful of tables. They are warmed-up, but not yet exhausted. This means they have time to answer every single one of your questions about a menu because they aren’t trying to manage 18 different tables at various stages of their meal at the same time. Not-yet-exhausted servers means they likely will not forget anything like a refill of mayo for your fries or the two extra forks you want so you can all split the linguini you ordered, even though everyone at the table is technically on the keto diet.

The same goes for the kitchen staff. They aren’t 90 orders deep into the night, meaning they aren’t running behind. Your food will more often than not, come out quickly, and exactly as your ordered it. There is nothing worse than sitting down to dinner at 7, starving, and then having to wait an hour for your meal to finally hit the table because the kitchen is so slammed. Eating at 5:30 also guarantees that the kitchen is not out of any ingredient yet, which means you can get a double order of the squid special that you’ve been eyeing and no one will tell you those dreaded words, “Sorry, we no longer have that.”

Finally, the iPhone edition of SEVEN + YOLO…