by Jeffrey Saut, Chief Investment Strategist, Raymond James

"Time is Archimedes’ Lever in Investing - Archimedes is often quoted as saying, 'Give me a lever long enough and I can move the earth.' In investing, that lever is time. The length of time investments will be held, the period of time over which investment results will be measured and judged, is the single most powerful factor in any investment program.

If time is short, the highest investments – the ones an investor naturally most wants to own – will be undesirable, and the wise investor will avoid them. But, if the time period for investing is abundantly long, the wise investor can commit without great anxiety to investments that appear in the short-run to be very risky. Given enough time, investments that might otherwise seem unattractive may become highly desirable.

Time transforms investments from least attractive to most attractive – and vice versa – because, while the average expected rate of return is not at all affected by time, the range or distribution of actual return around the expected average is very greatly affected by time. The longer the time period over which investments are held, the closer the actual returns in a portfolio will come to the expected average.

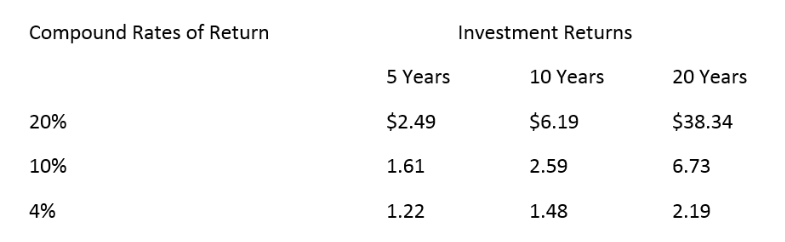

The following table shows the compounding effect on $1.00 invested at different compound rates compounded over different periods of time. It’s well worth careful study – particularly to see how powerful is time. That’s why time is the “Archimedes lever” of investment management."

. . . Investment Policy, Winning the Loser's Game, by Charles D. Ellis

Chart 1

Source: "Winning the Loser's Game," by Charles D. Ellis

According to Wikipedia, "Charles 'Charley' D. Ellis (born October 22, 1937) is an American investment consultant. In 1972, Ellis founded Greenwich Associates, an international strategy consulting firm focused on financial institutions. Ellis was appointed twice to the faculty of the Harvard Business School in 1970 and 1974 and to the Yale School of Management in 1986.

At both Harvard and Yale, he taught advanced courses on investment management. Ellis served as a successor trustee of Yale University from 1997 to 2008, where he chaired the university’s investment committee for nine years alongside Chief Investment Officer David Swensen. He received the Yale Medal in 2009 for his service to the University.

Ellis served as chair of the board of the Institute of Chartered Financial Analysts and is one of only twelve people recognized by the CFA Institute for lifetime contributions to the investment profession." We recalled his piece on “Time” while reflecting on a comment from Ron Baron, of Baron Capital fame, who told me his average holding period for a stock is 10 years!

When asked what he considered man’s greatest discovery, Albert Einstein replied, without hesitation, “Compound interest!” Yet, compound interest is ignored in this bull market. For instance, the baby boomer bulls say that compounding dividends doesn’t matter anymore.

Nobody wants to pay double taxes on them. And, that old bear growl about the markets being vulnerable when the yield on the S&P 500 drops below 3% hasn’t been valid for years. So, who cares if the current yield on the S&P 500 is only marginally above 2%?

Well, we happen to think dividends are very important. Indeed, historically, a major percentage of the return on stocks has come from dividends. How much? Of the 10.4% compounded annual return generated by stocks in the S&P 500 since 1926, nearly half has come from dividends.

There are a number of equity incomes funds that I own that have not only provided decent capital gains, but good dividend income as well. For some of those names please contact our Mutual Fund Research Department.

As for the state of the current stock market, so far we have been wrong in that after identifying the December lows, we have been looking for a pullback from the 2600 -2620 level basis the S&P 500 (SPX/2664.76). We did say that if a resolution to either the China trade tiff, or the government shutdown, were resolved that “call” might not be correct.

This week we should get more clarity on which way this market wants to move as the FOMC will announce its latest views on monetary policy Wednesday, followed by a Jerome Powell Press conference. It is worth mentioning that the S&P 500 has rallied close to its downtrend line and it will be interesting to see if it can break out above it. Our question remains whether there is just not much “internal energy” in the stock market to power stocks higher from these levels.

The call for this week: I am in NYC for the week seeing portfolio managers, doing media, conducting presentations for our financial advisors and their clients, and marinating some olives with Arthur Cashin and the Friends of Fermentation.

Since my schedule is pretty full, there may not be any more letters this week. That might be just as well since the near-term direction of the stock market is likely not going to be known until after the FOMC press conference. This morning the preopening S&P Futures are down a large 12 points at 5:00 a.m. as China’s industrial production sinks, President Trump doubts a border deal can be achieved, and fears of a global economic slowdown swirl.

*****