Global risk and risk control assets continue along the roller-coaster tracks as investors attempt to interpret the various economic and geopolitical tea leaves. This week, anxiety has run high under the pall of a fragile trade truce between the US and China, and in light of a growing consensus around a “when, not if” recession watch.

Below, we examine some of the key drivers behind recent market volatility and provide our take:

- “He Said, Xi Said” and Surgical Strikes: A Saturday evening meeting in Argentina at the G-20 between China’s President Xi and US President Trump – where an agreement was struck that postponed a significant tariff increase on Chinese imports to the US – resulted in marked optimism. In stark contrast, however, on Tuesday investors began to fear that the deal may be simply kicking a large can down the road as meaningful progress on longer term issues, such as intellectual property protections and technology transfer requirements, would remain extremely difficult.

Thursday, the mood faded to overt pessimism as the US launched a geopolitical surgical strike against China with the arrest of the CFO of Huawei on charges of violating US sanctions against Iran. Huawei is the largest telecommunications equipment company in the world and a key to China’s ambition to dominate the next-generation 5G wireless network. This arrest complicates an already highly complex situation. We remain cautiously optimistic that an eventual trade deal will be struck, but we are concerned about the tight timetable in light of growing tensions. As we have noted before, there is a lot at stake on both sides – particularly for China, which is experiencing a slowdown in growth. Hindering trade means hindering growth at a time when Chinese authorities are struggling to address a significant debt overhang. Pulling pages from the old playbook — monetary and fiscal stimulus — may not be sufficient and could be offset by an export-led slowdown.

- A Fading Growth Outlook: There are more forecasters now looking at a global economic slowdown and a recessionary outlook for the US economy in 2020. With growth expectations fading, some prognosticators are waving a red flag, and investors have seen this movie before. Recessions are tough for earnings and tough for markets.

We agree that growth is slowing. That should be relatively obvious as the US economy moves away from tax stimulus-led growth. That said, we continue to see economic data point to steady growth in the US — manufacturing and service activity remains solid and well into expansion territory, employment gains are holding steady, and consumer activity is robust. Overseas, we see stability in some of the European data that had been weakening over the past few months. Even in China, and despite trade tensions, manufacturing activity remains in expansion mode, albeit barely, while service activity is solidly so. While 2017 was the year of synchronized global growth, 2018 has proven to be one of divergence, with strong US growth decoupling from the rest of the world. Looking forward, we expect 2019 to be a year of re-coupling, where we will see synchronous growth across the US, developed ex-US, and emerging market regions converge at lower but more sustainable levels. We do not expect a recession.

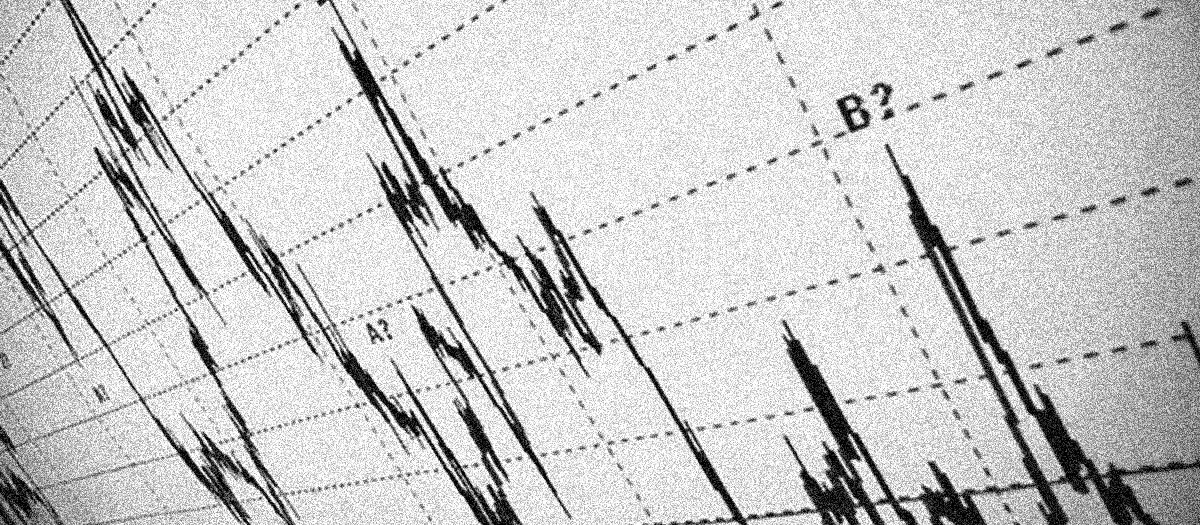

- Yield Curve Follies: Much has been made by the narrowing of the yield curve, with longer-term rates falling more than short-term rates, and many market observers are wringing their hands over the signal this may be sending. The spread between 3- and 5-year Treasuries inverted for the first time in over 10 years, and the well-watched spread between 2- and 10-year Treasuries is extremely thin at only 13 basis points, or 0.13%. History would suggest that inverted yield curves are associated with recessions, and data supports this conclusion. The bond market is sending some clear signals here about lower future growth and inflation expectations. We think the Fed will take notice, supporting our view that the Fed is closer to the end of this rate-hike cycle and will not risk engineering a yield curve inversion.

- Not Such Great Expectations: Consistent with a fading growth outlook, and mindful of the market volatility and related tightening of financial conditions, investors have reduced their collective expectations related to the Fed. On the heels of the relatively dovish statements made recently by Fed Chairman Powell, Fed funds futures have priced in a much lower and slower policy path. In fact, while the December rate hike was consensus only weeks ago, the current probability stands at only 76%. Between the flat shape of the yield curve and reduced market expectations, the Fed is in a tough spot. The change in market view likely relates to a more benign inflation outlook: Both core inflation, as well as inflation expectations, may have already peaked in this cycle, and CPI looks to have peaked in the summer at 2.4%, with the November print coming in at only 2.1%. Inflation expectations, heavily influenced by the fall in energy prices, have fallen below 2% on a 10-year basis. The subdued state of inflation will provide the Fed with ample cover to delay the next rate hike. Our view is that Powell and company should take advantage of this in word, deed or both during the upcoming meeting Dec. 18-19. Either a “dovish hike,” where a 25 basis point increase in Fed funds is accompanied by a statement suggesting a pause, or no hike at all would be welcome news to the market.

- Volatility is… Volatile: We have been warning for some time that investors had become complacent in an environment of extraordinarily low risk asset market volatility. With positive global economic momentum and accommodative global central banks, even normal market drawdowns were few and far between. What we have experienced in 2018 and most acutely since October is, unfortunately, more normal than not. This is a key driver supporting our asset allocation policy and investment philosophy. We believe that assets serve a purpose, and the reason to hold risk assets (aka volatile assets) like global equity is to fund longer-term goals and/or achieve long-term real return targets. We accept volatility as the cost of doing business, and we anticipate over time that we will be compensated for taking the extra risk.

In our favor, we have 100-plus years of data that supports what is known as the “equity risk premium.” It is a risk premium precisely because there is risk associated with the return. This risk diminishes over time as holding periods are appropriately longer term, but risk is higher and more unpredictable over the short term. Adding insult to injury is the fact that the market can oftentimes act in counterintuitive ways — for example, why should stocks be flat for the year in the US when earnings growth has been more than 25% and the economy is growing at a healthy pace? The most important actions we can take during periods of volatility are to ensure that our asset allocation appropriately aligns to our goals; to affirm that our risk assets are sized correctly with respect to the timing of those goals; and, in the event that cash outflows are required from portfolios, to confirm that we have an intentionally sized reserve of high quality bonds and cash. This will allow us to ride through such periods without selling risk assets at inopportune times.

© 2018, Northern Trust Corporation. All Rights Reserved.