by Jennifer DeLong, AllianceBernstein

Retirement reality for many Americans may not be as grim as forecasters predict. Could it be better? Yes. But many retirees in our new survey see a glass that’s more than half full.

As John Lennon noted, “Life is what happens to you while you’re busy making other plans.” That’s why our latest survey of defined contribution (DC) trends and issues not only included current plan participants, but retirees as well. We wanted to show a composite portrait of retirement’s realities painted by the people who are doing it—not just planning for it.

Most of our retired respondents were in the 65–75 age bracket, although 17% were younger. We asked them to think back to 10 years before they retired and tell us at what age they assumed or hoped they would retire. The average expectation was that they’d retire at age 65, but their actual retirement age was closer to 62—three years earlier. One interesting finding was that 16% expected to retire before age 60, and yet a far larger percentage—39%—actually did retire before that milestone.

It’s possible that some respondents retired earlier due to the recession that followed the global financial crisis. But employment, including part-time jobs, has been steadily on the rise for the past five years, and much of the labor market has been quite tight for a few years at least. These conditions might have convinced many retirees to reenter the work force. But very few of our retirees are even working part time. In fact, 93% are fully retired.

Where’s the Income Coming From?

The median income for our retired respondents is roughly $60,000. More than 60% of them receive a pension, and it’s likely that most or all of them are currently receiving Social Security as well. In describing their current investment portfolio, more than half (53%) say it’s a balance between growth and preservation or a tilt toward moderate growth. Only 11% solidly favor preservation, and 20% aren’t sure how to describe their portfolio. When asked how much of their current spending comes from their workplace retirement savings plan, three-fourths of our retirees say it’s 25% or less—and many of them say they currently don’t access those savings at all.

There could be a variety of reasons for such low usage of plan savings: Participants could be keeping their withdrawal amounts to a level that’s in line with their longevity expectations. They might also be delaying the use of those funds until age 70½, when the IRS requires the start of minimum withdrawals from tax-deferred retirement accounts. Regardless of when or to what extent retirees are accessing their workplace savings, a strong majority seem to be reasonably satisfied (or better) with their retirement realities.

For Quite a Few, Retirement’s Not So Bad After All…

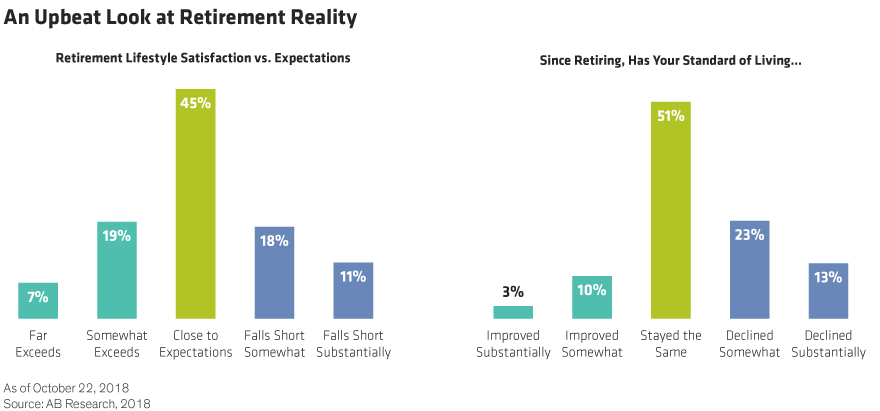

In fact, over 70% of our surveyed retirees say their current lifestyle is either in line with or better than their expectations (Display 1, left). And this upbeat assessment remained relatively consistent across several different questions. When we asked retirees if their standard of living had gone up, down or stayed the same, nearly two-thirds (64%) say it has at least stayed the same if not improved (Display 1, right).

How do retirees feel about their personal finances in retirement? Most have a satisfactory opinion of their finances. Half say that after paying their bills each month, there’s still enough left over for things like restaurants and leisure activities. And nearly a quarter more (23%) say they’re very comfortable and have enough money to do just about all the things they enjoy.

…but Too Many Are Still Not Doing Well

Before we paint too rosy a picture, it’s important to note that the percentage of participants feeling upbeat about retirement is close to the percentage of those saying they’re receiving a pension. That pensioned proportion of the retired population will likely decline at least a bit with each passing year.

One-third of retirees report dissatisfaction with their life or finances in retirement, a number that is equally likely to rise each year. We’re seeing an increased crunch on finances for retirees in many respects, including a striking rise in personal bankruptcies for older Americans. So it certainly isn’t time for American workers or the retirement industry to sit back and relax. There is an increasing need to help workers save wisely, early and continuously. But perhaps the current portrait of retirees might act as a bit of a confidence booster—an additional incentive to save beyond the more ubiquitous dire warnings.

What Would You Do Differently?

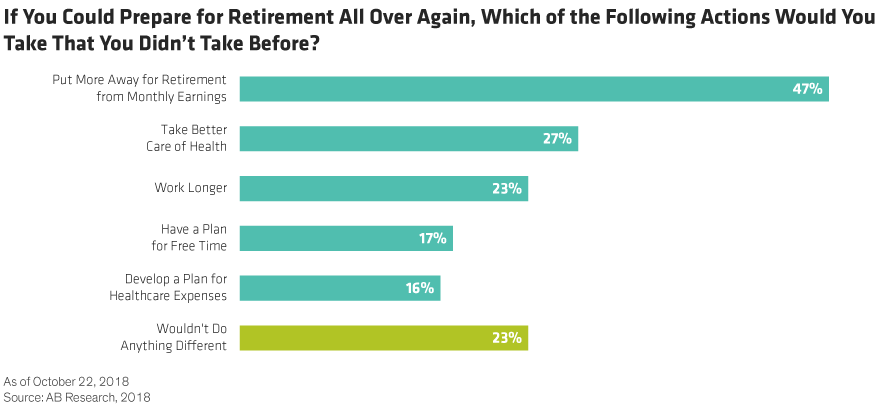

Interestingly, nearly one-fourth of our retirees say that if they could prepare for retirement all over again, they wouldn’t do anything differently. But among the rest, there were many things they might have done better. First and foremost, they’d have increased their retirement plan contributions. But equally important, they view health as a key retirement challenge—whether it’s taking better care of their health or developing a better plan for healthcare expenses (Display 2).

So our retirees report good news and bad…but a lot more good news than might have been expected. What’s in store for the future? Pensions aren’t going to make a resurgence, Social Security continues to be under attack, and it’s unlikely that many more American workers will somehow start being more dutiful about saving for retirement—despite our retired respondents’ words of advice to save more.

DC plan sponsors can help, and they are ready: the latest DC trends survey from Callan Institute notes that the number-one priority for DC plan sponsors in 2018 is increasing their participants’ retirement readiness. Now would be a good time for plan sponsors and their consultants and advisors to revisit effective tools such as automatic enrollment, the initial savings rate and automatic escalation of savings rates.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

This post originally appeared at the AllianceBernstein blog

Copyright © AllianceBernstein