by Ben Inker, GMO LLC

Executive Summary

In the first three months of 2018, volatility rose and correlations between stocks and bonds shifted. In other words, last quarter looked a lot more like the average conditions investors have experienced over the last 150 years than the very low volatility and strongly negative stock/bond correlations of more recent memory. The change, albeit only over a short period, should have investors evaluating whether the “easy” environment that we’ve seen through this bull market will continue. If it does, the returns we “deserve” to earn as investors should be low. If not, we can hope for a bumpier but more profitable future in the long run. Which path will the future take? My money is on the latter. As Hyman Minsky put it, “Stability breeds instability.”

For the last eight years, investing has seemed to be a pretty easy activity to most observers.1 While markets have generally been on a smooth and upward trend over the last eight to nine years, it hasn’t been the easiest time for value investors, as it has more often than not been the more expensive securities and markets that have led the way higher. While this has made things painful on a relative basis for value investors (including a number of GMO products), it doesn’t change the fact that financial markets have been both a smooth and profitable ride in general. It is that point that I am referring to in saying that investing has seemed “easy.” I am not suggesting that it has been a particularly easy period for active managers to beat the market.

Not only have markets given strong returns, but the apparent riskiness of both individual assets and overall portfolios has been low. It has not simply been the lack of giant, horrifying market dislocations that gives the impression of low risk, but the combination of very low general market volatility and an extremely friendly correlation structure such that stocks and bonds have been wonderfully diversifying. For most investors, this has been a happy combination. For those investors targeting a given level of volatility, whether through risk parity or otherwise, it has been a license to lever up their exposures significantly, to generally good results.

Last quarter, investing started to seem a little harder. Not only were returns to most assets mildly negative, but volatility rose and correlations shifted. That’s a good thing, probably a necessary thing if investors are to achieve their long-term goals. On the other hand, we’ve only started the transition from easy to hard, and that path is, almost by definition, not a pleasant one. Investing is often a case of “be careful what you wish for.” “Easy” is fun in the shorter term, and the shorter term can go on for a surprising amount of time, but it winds up being self-defeating. “Hard” is, well, hard, and it’s hard to like things that are hard.

Personally, I’m hoping for a return to hard. Not only should it lead to better long-term returns to investors, but it is also a good deal more interesting. Maybe last quarter was a blip and we are going to go back to “easy” for a while longer. If determining when easy turns to hard were easy, well, hard wouldn’t be as hard. But portfolios built for “easy” are poorly designed for “hard.” If conditions prevailing in the first part of this year persist, asset valuations will very likely have to fall, and the process could become disorderly if levered positions have to be unwound reasonably quickly.

1 While markets have generally been on a smooth and upward trend over the last eight to nine years, it hasn’t been the easiest time for value investors, as it has more often than not been the more expensive securities and markets that have led the way higher. While this has made things painful on a relative basis for value investors (including a number of GMO products), it doesn’t change the fact that financial markets have been both a smooth and profitable ride in general. It is that point that I am referring to in saying that investing has seemed “easy.” I am not suggesting that it has been a particularly easy period for active managers to beat the market.

So, what is investing again?

A decent working definition of investing is deploying capital to perform an economic function for which some rational counterparty is willing to compensate you. That may seem like a pointlessly broad definition, but in reality, keeping it in mind can really help you determine whether an activity is actually “investing” in the first place, as well as how much you should expect to make from an investing activity.

The investing world is not perfectly efficient, and a counterparty might have different goals and incentives than you predict, but even still I think it’s a surprisingly helpful framework. Some ways of using this framework are discussed in the paper “Back to Basics”2 from a few years ago, but I’d like to relate it to “easy” and “hard” in recent market conditions.

Equities should give a risk premium over bonds and cash in the long run due to a combination of what they mean for the issuer and what they mean for the buyer. For the issuer, equity is the lowest-risk capital he or she can raise. It never needs to be paid back, has no contractually required payments, and can never drive a company into bankruptcy. In return for this low risk, rational issuers should be willing to pay a higher long-term cost than they would for “riskier” capital. For the purchaser, the same features that are positive for issuers make equity riskier than other ways of providing capital to a company.

But it is not the idiosyncratic risk of an investment gone wrong that explains why stock investors should demand a decently sized risk premium. It is the correlated risk. Given the cyclical nature of the economy and the fact that corporate profits are the most volatile major constituent of GDP, most equities will tend to do badly at the same time. But even that doesn’t justify an equity risk premium anything like as big as we have seen historically. It is the fact that equity losses will occur at just the time that is most painful for the entities that own them. And that is the key. A portfolio does not exist in isolation.

For almost all investing entities – whether an individual saving for retirement, a corporate or public pension fund, an endowment or foundation, or a sovereign wealth fund – the most crucial risk is the risk of losing money in the portfolio at the same time that cash flow from other activities is drying up. Losing money in your portfolio stinks. Losing your job stinks more. Losing money in your portfolio at the same time you lose your job is even worse, and that correlation is what makes “risk assets” risky. While an endowment or sovereign wealth fund can’t lose its job in the same way an individual can, talk to a development officer or tax collector about what happened to cash inflows during the financial crisis, and you’ll find that the impact is analogous.

So where do “easy” and “hard” come in? Let’s imagine I told you that economic downturns were avoidable and governments could act in ways that all but guaranteed that they would be brief and minor events. What would that do to the risk premium you’d require from risk assets? If you were a company needing capital, what would that do to your choice of what kind of capital to raise? For the buyer, believing that downturns would be infrequent and shallow would make you demand less of a risk premium to buy equity.

For the issuer, despite that smaller risk premium, you’d still generally prefer a higher debt to equity ratio than you would otherwise.3 Exactly how this plays out depends on how sharp the reduction in the equity risk premium is against the risk of bankruptcy, but for simplicity’s sake, let’s imagine you were looking to raise the capital you needed as cheaply as possible subject to having no more than a 5% risk of bankruptcy over a decade. If you decrease the probability and severity of economic downturns, you decrease the probability of bankruptcy, so your desired capital structure winds up with more debt and less equity as long as the required risk premium for equity is positive.

2 Ben Inker, “Back to Basics: Six Questions to Consider Before Investing,” October 2010. This white paper is available at www.gmo.com.

3 Exactly how this plays out depends on how sharp the reduction in the equity risk premium is against the risk of bankruptcy, but for simplicity’s sake, let’s imagine you were looking to raise the capital you needed as cheaply as possible subject to having no more than a 5% risk of bankruptcy over a decade. If you decrease the probability and severity of economic downturns, you decrease the probability of bankruptcy, so your desired capital structure winds up with more debt and less equity as long as the required risk premium for equity is positive.

Actually, this framing helps explain what is otherwise an odd feature of recent corporate behavior. At a time when the cost of equity is low both relative to history and the current return on capital, why have companies been issuing debt and buying back stock instead of issuing stock to raise capital? If corporations believe that downturns will be uncommon and mild, they will rationally respond by shifting their capital structure away from expensive but safe capital (equity) into cheaper and riskier capital (debt).

Arguably, the height of this behavior has not been the last few years, but rather the years leading up to the financial crisis. Back then, the “Great Moderation” had many investors convinced that economic downturns simply didn’t happen anymore. This led to the most extreme mispricing of risk that we’ve ever been able to see in financial market history. While previous bubbles brought individual assets to price levels far more extreme than what was seen in the run-up to the financial crisis, the general risk/reward trade-off was farther from “normal” than anything we have ever seen. Exhibit 1 shows a return/volatility scatterplot from our asset class forecasts as of June 2007, along with a regression line showing the general relationship.

The slope of the line should be positive – riskier assets should be priced to deliver higher returns. But the Great Moderation changed investor perceptions of risk such that the slope went strongly negative.4 While we believe our forecasts were a reasonable representation of the “true” risk/reward trade-off available to investors at the time, it is not the case that investors believed that they were paying for the privilege of taking risk. Our forecasts assume a reversion to historically normal levels of profitability for equities and default rates for credit. But if you truly believed that economic downturns were a thing of the past, you would have increased your expectations of what “normal” profitability would look like and decreased your expectations of what normal default rates would be.

The financial crisis obviously came as a horrible shock to that mindset, but the rapid recovery in corporate cash flow in the aftermath and the consequent lower levels of distress than previous cycles experienced have served to assuage investors’ economic concerns. The passage of time has also dimmed the memories of the pain of the crisis, such that most investors seem to believe they would stay the course through another such crisis, whether or not they held their nerve last time.

But there is another feature of markets since the crisis that has exacerbated the impact on financial markets. Not only have fears of economic downturns receded again in the minds of investors, but it has seemed easier than ever to protect portfolios even should something bad occur. Risky assets are risky because of when they will lose you money.5 The most straightforward demonstration of this is thinking about a short position in stocks. It is at least as “risky” on a stand-alone basis as a long position in stocks, and yet it has shown strongly negative returns over time. The risk on a stand-alone basis is, however, irrelevant for thinking about expected returns. A short position in stocks is guaranteed to make money when a long position loses money. It is therefore strongly risk-reducing in a portfolio and portfolio + cash flow context, and as such it is perfectly rational for the holder of a short position to put up with a negative expected return.

There is an asset, however, that is likely to cushion the blow at that exact time – high quality bonds. Two important things tend to happen in depressions that are helpful to bonds. First, inflation tends to undershoot expectations as demand disappoints. And second, central banks generally ease monetary policy, lowering rates in real terms to stimulate the economy. Both of these accrue to the benefit of high quality bonds, and owners will receive a windfall from their bond holdings in a depression, which can mitigate losses suffered elsewhere in the portfolio.

4 While we believe our forecasts were a reasonable representation of the “true” risk/reward trade-off available to investors at the time, it is not the case that investors believed that they were paying for the privilege of taking risk. Our forecasts assume a reversion to historically normal levels of profitability for equities and default rates for credit. But if you truly believed that economic downturns were a thing of the past, you would have increased your expectations of what “normal” profitability would look like and decreased your expectations of what normal default rates would be.

5 The most straightforward demonstration of this is thinking about a short position in stocks. It is at least as “risky” on

a stand-alone basis as a long position in stocks, and yet it has shown strongly negative returns over time. The risk on a stand-alone basis is, however, irrelevant for thinking about expected returns. A short position in stocks is guaranteed to make money when a long position loses money. It is therefore strongly risk-reducing in a portfolio and portfolio + cash flow context, and as such it is perfectly rational for the holder of a short position to put up with a negative expected return.

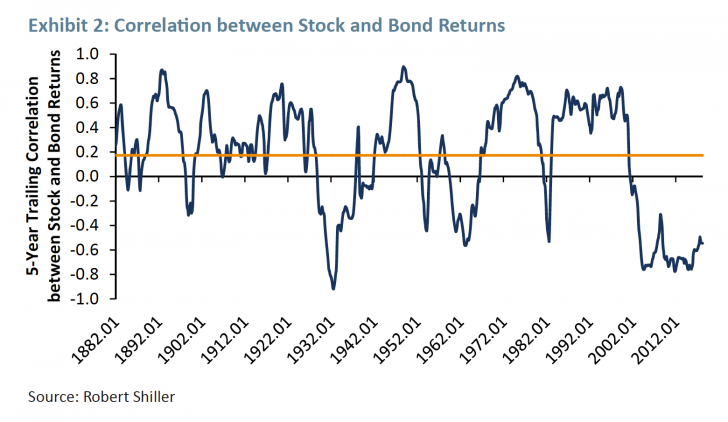

The fact that bonds also tend to give a better return than cash helps explain why bonds are a mainstay of all but the most aggressive portfolios, and, to an extent, helps explain the appeal of risk parity strategies. High quality bonds did their job in the financial crisis. But what is more surprising is how astonishingly well they have done their job since then. Despite the fact that stock markets and bond markets have simultaneously rerated since 2009 – that is to say their valuations have risen substantially – the correlation between stock returns and bond returns has been more negative than at any time in history other than the Great Depression. We can see that clearly in Exhibit 2.

Through most of the last 150 years, the correlation between stock and bond returns on a monthly basis has been positive, averaging a little under 0.2. This is a low enough figure to mean that they usefully diversify each other, but not in a hugely impressive way. The last decade, however, has seen a profound shift in this relationship, with the correlation dropping to -0.64, with the last five years a still stunningly low -0.55 despite the fact that no bad economic events have actually occurred. This is actually a monumental shift. With a correlation of 0.2, adding bonds to a stock portfolio increases the volatility of a portfolio relative to using cash for your low-risk asset. At -0.55, adding bonds to your portfolio sharply reduces overall portfolio volatility, as can be seen in Exhibit 3.

Over the last five years (and the five years prior), adding bonds to a stock portfolio decreased volatility materially, and leveraging up your bonds decreased volatility still further. Historically, adding an 80% levered bond position to a 60% stock position would have increased overall volatility from 9% to 11%.6 As with Exhibit 3, this assumes the volatility of stocks to be 15% and bonds 6%, in line with long-term history.

For the last decade, that 80% bond position would have decreased risk from 9% to 7.6%. This has helped traditional portfolios have lower risk than investors might have expected and has been even more beneficial to those in risk parity or volatility targeting strategies.

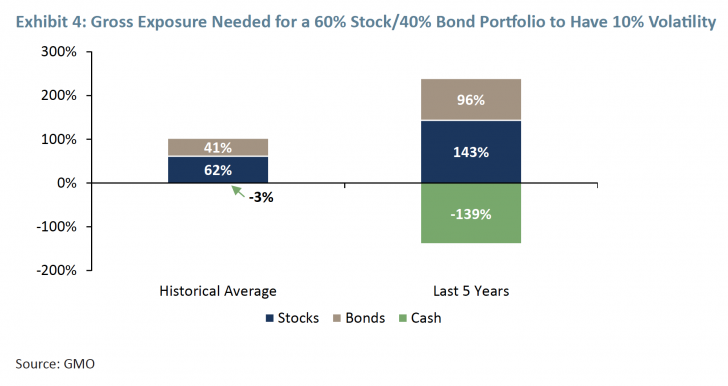

The impact on a volatility targeting strategy has been particularly startling, because those portfolios are naturally impacted by both correlations and trailing volatility. Historically, if you wanted a 60%/40% blend of stocks and bonds to have 10% volatility, you needed to lever the portfolio by 3%, giving you a portfolio of 62% stocks/41% bonds/-3% cash. Exhibit 4 shows what the portfolio would look like given the conditions of the last five years.

The leverage has gone from a 3% “why bother” level to a stunning 139%. If the last five years are a reasonable representation of the future, 143%/96%/-139% is the new 60%/40%. If you could expect the same risk premia over cash today as historically normal levels, this would mean the expected return of the portfolio has gone from 3.1% above cash to 7.3% above cash! While this would indeed be lovely, that’s simply too much of a free lunch to believe. If the risk of portfolios has truly dropped in the way that the leverage suggests, you don’t deserve to get paid anything like 7.3%.

If risk is going to revert to the longer-term averages, the leveraged portfolio winds up having a volatility of over 20%, so maybe you do “deserve” your 7.3%, but with such a high volatility you will wind up compounding at a much lower rate anyway.7 Volatility drag is the term for this effect. Basically, for two portfolios with the same expected arithmetic average return, the one with higher volatility will have a lower expected compound return and lower expected ending wealth. The drag is approximately one half of the variance of the portfolio. In this particular case, with a portfolio standard deviation of 23.5%, the volatility drag would be 2.8%, and your lovely 7.3% expected return over cash will wind up compounding at 4.5% over cash.

6 As with Exhibit 3, this assumes the volatility of stocks to be 15% and bonds 6%, in line with long-term history.

7 Volatility drag is the term for this effect. Basically, for two portfolios with the same expected arithmetic average return, the one with higher volatility will have a lower expected compound return and lower expected ending wealth. The drag is approximately one half of the variance of the portfolio. In this particular case, with a portfolio standard deviation of 23.5%, the volatility drag would be 2.8%, and your lovely 7.3% expected return over cash will wind up compounding at 4.5% over cash.

Free lunches shouldn’t persist in investing. They require counterparties to not only be irrational, but to also have a continual inflow of cash to replenish the economic losses that flow from their poor decisions. Low volatility and favorable correlations should not stably coexist with large ex-ante risk premia. But that statement does not specify which state of the world we are in. Has risk fallen sustainably and risk premia fallen along with it? If so, you will need to lever up to try to earn the kinds of returns that unlevered portfolios used to deliver. Or has the recent “easy” environment been a temporary one that is bound to reverse?

My money is on the latter (literally, as well as figuratively). Even if the natural volatility of the economy has fallen over time and even if policy response is better than it was 80 years ago, neither markets nor economies are all that well-behaved. Stability breeds instability, as Hyman Minsky pointed out 40 years ago. Statistically, we should expect to get periods of relative calm in any natural (or randomly generated) system, and those periods end. But beyond that, the calm itself encourages behaviors that eventually lead to highly volatile outcomes. The very existence of risk parity and volatility targeting strategies creates fragility in the markets in the form of feedback loops. At first, a period of calm will lead to increased leverage, which creates net buying to support markets. But a rise in volatility or shift in correlations can lead to deleveraging and selling pressure just when markets are already shaky.

Beyond Purgatory and Hell

I’ve spent a lot of time over the past few years discussing the scenarios of Hell and Purgatory. Those two scenarios differ in the equilibrium level of cash rates, but assume that risk premia are largely unaffected. Equities have a lower required return in Hell because the alternative of holding cash or bonds has a lower return than it used to, but we still assume a 4-4.5% equity risk premium over cash and a 1-1.5% term premium for bonds over cash. The low volatility and negative correlation scenario is a different shift – a decrease in required risk premia due to the fact that diversified investment portfolios are less risky to investors. As with the Hell scenario, the “low-risk” scenario makes for a rosier short-term outlook.

Today’s valuations of US stocks and bonds can be decently explained by a combination of Hell, low volatility, and negative correlations. If inflation stays low AND cash rates remain low AND cooperative markets allow portfolio engineering to reduce the risk of stock/bond portfolios, you can make today’s valuation levels make sense. On our data, US stocks look priced to deliver something around 3-3.5% real if they stay at today’s levels forever. That’s perhaps a 3% risk premium over cash, assuming market estimates for cash rates are correct. Bonds are priced to deliver perhaps 0-0.5% above cash. Those are smaller risk premia than we have seen historically, too small in our minds if future correlations are positive again and true economic risk is in line with historical volatilities instead of recent ones. But those smaller risk premia may well be perfectly reasonable in a low-risk, negative correlation world.

And that brings us back to the first quarter of 2018.8 The plus side of the fact that this quarter I have once again failed to get my quarterly written promptly is that we have data beyond the end of March. Neither volatility nor correlations have meaningfully changed from the first quarter figures if we update them through the end of April, so the shift indicated is as true for the first third of 2018 as it was for the first quarter.

It’s not that portfolios did all that badly in the quarter. A 60% stock/40% bond portfolio lost about 1.2% in the first three months of the year.9 Specifically, MSCI ACWI fell 1.1% in the quarter and the Barclays US Aggregate Bond fell 1.2%.

Most risk parity portfolios seem to have performed similarly or perhaps a little worse. But the more striking thing about the quarter was that volatility rose and correlations shifted. It’s an extremely short period, I know, but in the quarter, the annualized volatility for the S&P 500 was 19% and the correlation between stocks and bonds was between -0.2 to +0.1 depending on whether you were looking at 1-day, 5-day, or 20-day returns.

8 The plus side of the fact that this quarter I have once again failed to get my quarterly written promptly is that we have data beyond the end of March. Neither volatility nor correlations have meaningfully changed from the first quarter figures if we update them through the end of April, so the shift indicated is as true for the first third of 2018 as it was for the first quarter.

9 Specifically, MSCI ACWI fell 1.1% in the quarter and the Barclays US Aggregate Bond fell 1.2%.

That is in contrast with the last 5 years, where the volatility of the S&P 500 was under 8% and the correlation between stocks and bonds has been -0.55. In other words, after years of very low volatility and strongly negative correlations, last quarter looked a lot more like the average conditions investors have experienced over the last 150 years. In that world, historically normal risk premia make a lot of sense, and all of our collective investment goals rely on those risk premia remaining similar to historical levels. The trouble is that markets today, particularly US markets, aren’t priced for that world, so if current conditions persist, I believe valuations are likely to fall.

But I still think that’s the preferable outcome. We can either have an easy world, and get paid little for investing, or a hard world where we get paid more. Easy may be more fun in the short run, but give me harder and more profitable any day of the week.

*****

Ben Inker. Mr. Inker is head of GMO’s Asset Allocation team and a member of the GMO Board of Directors. He joined GMO in 1992 following the completion of his B.A. in Economics from Yale University. In his years at GMO, Mr. Inker has served as an analyst for the Quantitative Equity and Asset Allocation teams, as a portfolio manager of several equity and asset allocation portfolios, as co-head of International Quantitative Equities, and as CIO of Quantitative Developed Equities. He is a CFA charterholder.

Copyright © GMO LLC