by Blaine Rollins, CFA, 361 Capital

The market seems to care little about the Government shutdown, Congressional ineptitude or POTUS Twitter. As long as the synchronized global economy remains in a positive trend, earnings come in as expected, and inflation remains in a lock box, the appetite for riskier assets will continue. The economic data this week was more mixed than in the past with Housing and the Philly Fed weaker (due to the weather?) and also the University of Michigan confidence data on the weaker side (disgust with Washington?). The most important data point may have been Jobless Claims which hit 220,000 and fell to a 45-year low. There is an incredible appetite for labor. The biggest news last week came from Apple which announced it was going to pay $38 billion in taxes to bring back baskets full of cash from overseas. While we don’t know the full number yet, it will likely be a number over $200 billion. The market quickly determined that some of this will make its way back to the stock which sent its shares jumping along with the rest of the market. Good times! Safe assets like Bonds, Utilities, REITs and the U.S. dollar continue to trade like death which should be expected in this environment. So, keep the sound off on your news channels and ignore what happens in Congress or the Oval Office. The money will be made by watching the data and earnings.

To receive this weekly briefing directly to your inbox, subscribe now.

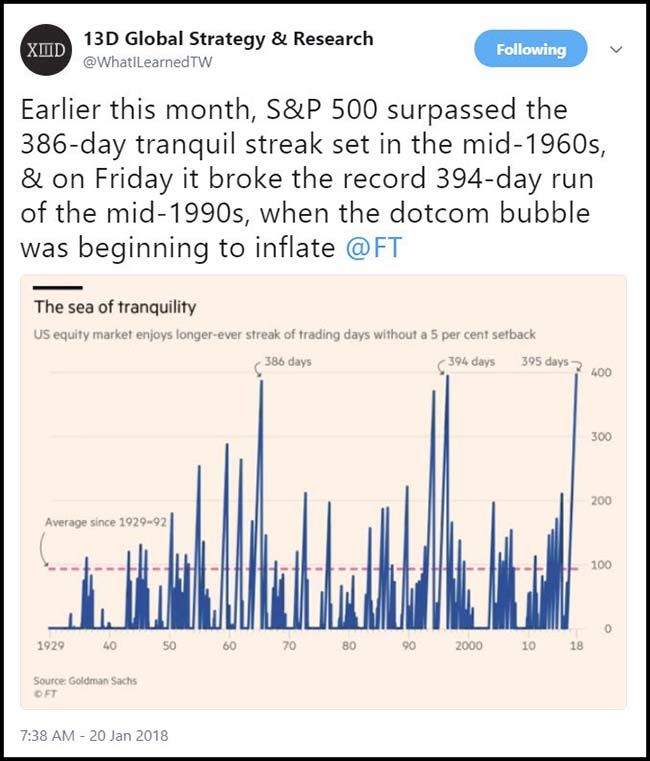

Congrats, the S&P 500 broke the tranquility record on Friday…

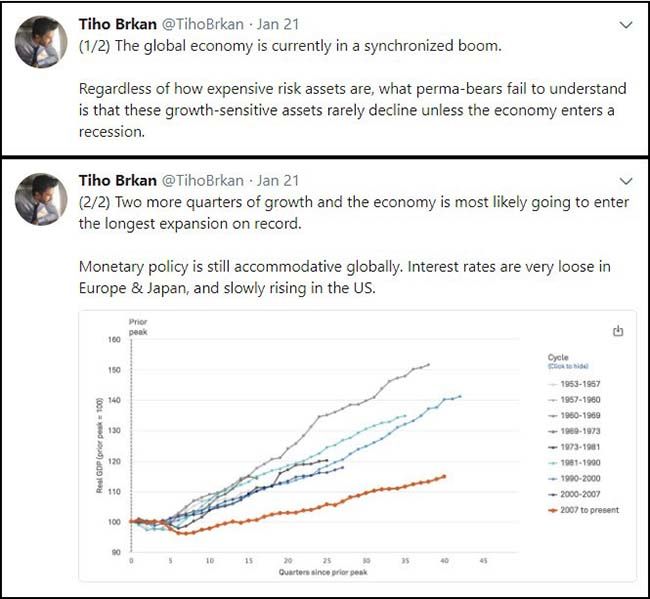

Next big record on the horizon is the duration of this economic recovery…

But given the lackluster size of the recovery, maybe we should consider the potential for this one to approach the returns of previous ones in GDP bounce rather than in just time.

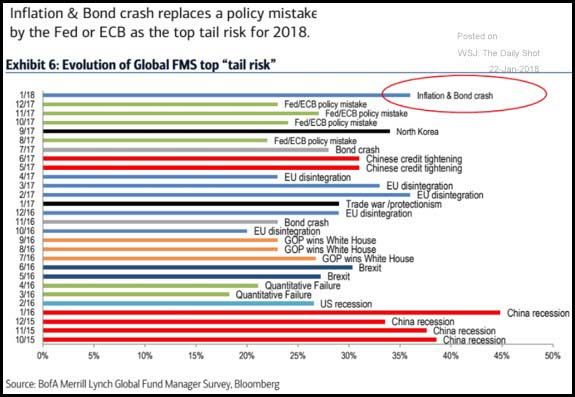

Investors have lined up their top risk as one involving inflation and a crash in Fixed Income assets…

Definitely seems like an obvious fear given the strong economy, recent bond market weakness and D.C.’s reluctance to spend less than they earn.

(WSJ/Daily Shot)

So far I have found earnings a bit lackluster…

But a large part of the blame is toward financial companies who are not getting the juice out of higher interest rates that we had hoped. Consumer and industrial numbers are looking better.

To date, 11% of the companies in the S&P 500 have reported actual results for Q4 2017. In terms of earnings, fewer companies are reporting actual EPS above estimates (68%) compared to the five-year average. In aggregate, companies are reporting earnings that are 53.0% below the estimates, which is well below the five-year average. In terms of sales, more companies (85%) are reporting actual sales above estimates compared to the five-year average. In aggregate, companies are reporting sales that are 0.9% above estimates, which is also above the five-year average.

(Factset)

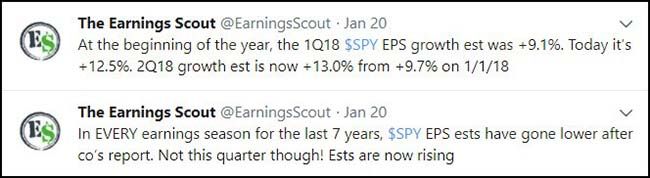

But guidance going forward is looking very good…

Now we just have to figure out how much of the confidence is due to the changes in the corporate tax and repatriation opportunity and how much is core volume, pricing and margin improvement.

The entire market thanks Apple last week for taking our attention away from Washington…

Apple Inc. announced a $38 billion tax windfall for the U.S. government this week, but the biggest beneficiary of the company’s response to tax-system changes will likely be its shareholders.

The tech giant’s plan to bring back to the U.S. most of its $252.3 billion in overseas cash holdings is expected to lead to a large increase in share buybacks and dividends, say analysts, tax experts and investors. Of broader benefit to investors, the change in tax law should boost Apple’s bottom line by cutting its effective tax rate. It also could prompt the company to ramp up acquisitions and research-and-development spending to reduce its iPhone dependency, an abiding concern of some shareholders.

Apple on Wednesday announced the planned $38 billion tax payment, the fruit of the U.S. tax overhaul adopted last month. The new law levies a one-time tax on overseas profits held in cash and other liquid assets—but at a much-reduced 15.5% rate. Apple, which for years has kept its foreign profits offshore to avoid paying the previous higher rate, said it will now bring most of that cash home.

Apple finance chief Luca Maestri last year said repatriating overseas cash would give it more flexibility to return money to shareholders, but the company hasn’t offered more detail since.

(WSJ)

Over 20% of the S&P 500 will report this week. Pencils sharpened?

(@eWhispers)

Last week saw the markets led by the foreign markets as the U.S. dollar continues to make new 3-year lows…

(Priced 1/19/18)

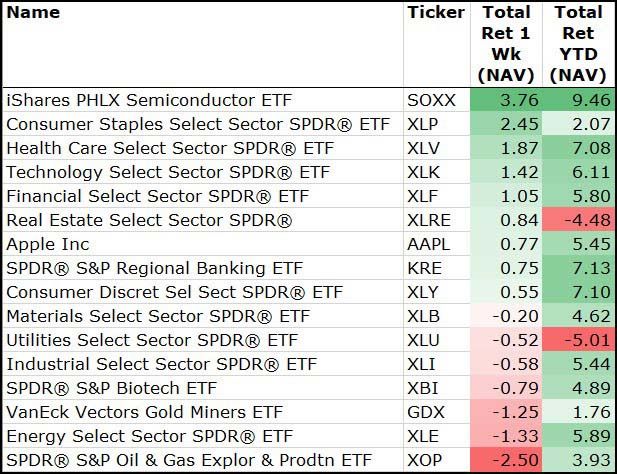

Among sectors, the Semiconductors put down the hammer to retake their top position in the markets…

Staples, Healthcare and Tech followed while Energy pulled up weak as oil gains slowed.

(Priced 1/19/18)

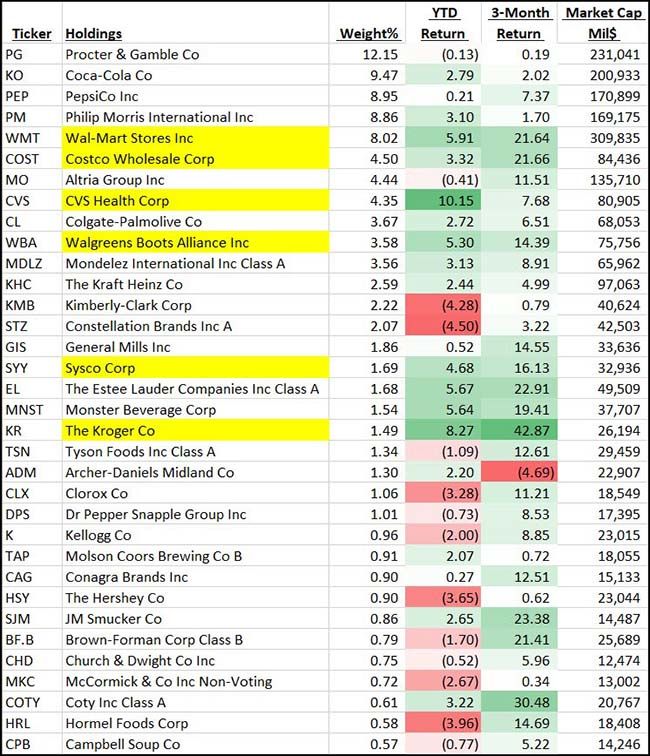

It has been surprising to see the defensive staples make such a big move the last three months…

But when you dig down into the performance, it is Retail stocks which are driving the performance…

One quarter of the Consumer Staples ETF (XLP) is Retail which has carried the Sector for the YTD and 3 months. Definitely doesn’t hurt that so many corporations are raising the minimum wages and sending $1,000 checks to all of their employees. Much of this extra cash will get spent at the highlighted names.

Speaking of staples, GE continues to eat Tide Pods…

A potential cash crunch at the firm has left many wondering if an equity offering is close at hand.

(@TraderBlain)

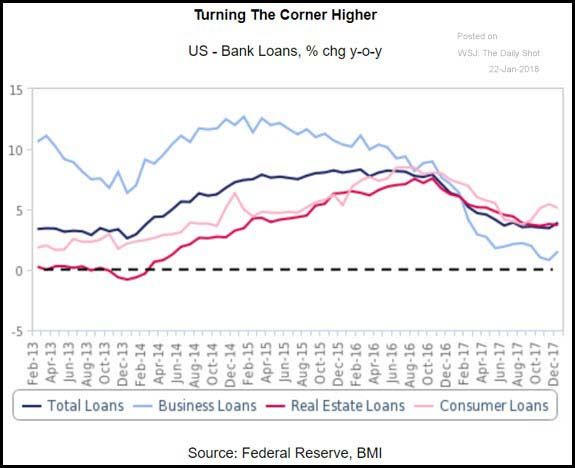

New loan data shows the economy is finally borrowing in aggregate…

(WSJ/Daily Shot)

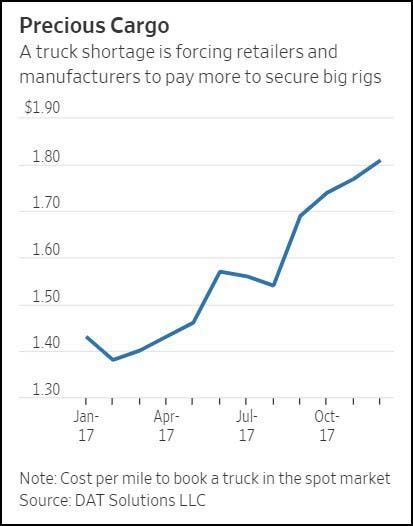

And truck space is also in high demand…

With the economy humming, retailers and manufacturers are looking to hire thousands more trucks to haul clothing, construction equipment and other goods. Trucking companies can choose which loads to take on. In December, the most recent month for which data is available, carriers charged an average 22% more than they did a year ago in the spot market, where shippers can hire trucks on short notice, according to DAT Solutions LLC.

(WSJ)

The Port of L.A. just broke its record for cargo shipped…

The Port of Los Angeles moved more cargo in 2017 than in any time in the Port’s 110-year history, racking up 9,343,192 Twenty-Foot Equivalent Units (TEUs), a 5.5 percent increase over 2016’s record-breaking year. It’s the most cargo moved annually by a Western Hemisphere port.

“We are powering Los Angeles’ economy to new heights every year, because we know that lasting prosperity means investing boldly in jobs, opportunity, and growth,” said Los Angeles Mayor Eric Garcetti. “The success of our Port tells the story of a city whose moment has arrived — and we will continue pushing forward as we expand our role in the global economy.”

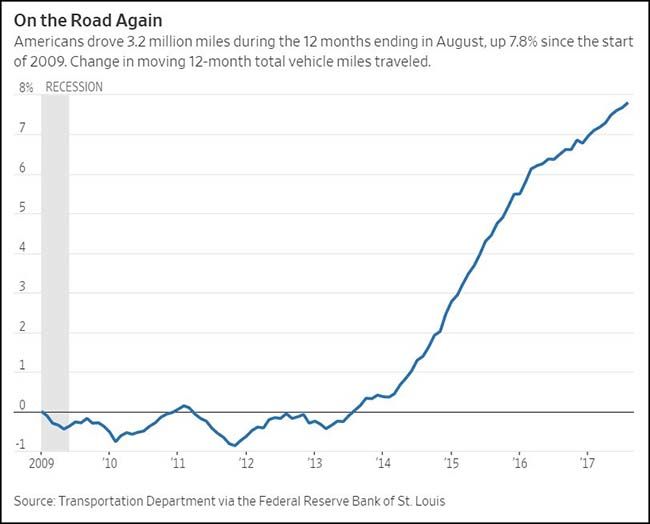

The economy is even causing miles driven to soar. Sorry about your commute…

(WSJ)

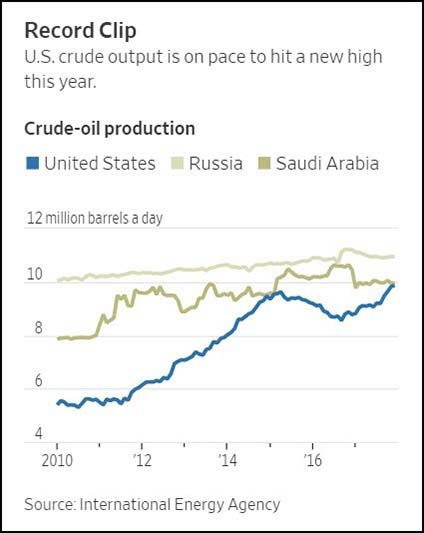

Don’t forget oil is still a big grease in the economy and U.S. production is now going to pass Saudi Arabia…

U.S. oil production is expected this year to surpass Saudi Arabia’s output, upending a global pecking order that has been a basis for U.S.-Middle Eastern policy for decades.

Crude output in the U.S. will likely climb above 10 million barrels a day in 2018, which would top the high set in 1970, the International Energy Agency said Friday.

The IEA, a Paris-based organization that advises governments and companies, raised its outlook for U.S. crude supply this year by 260,000 barrels a day, to a record 10.4 million barrels a day, largely a result of the recent rally in crude prices.

Saudi Arabia produces just under 10 million barrels a day, under an agreement with the Organization of the Petroleum Exporting Countries. The kingdom said it has the capacity to produce 12 million barrels a day. But it has never pumped more than 10.5 million daily and has pledged to limit output this year.

(WSJ)

|

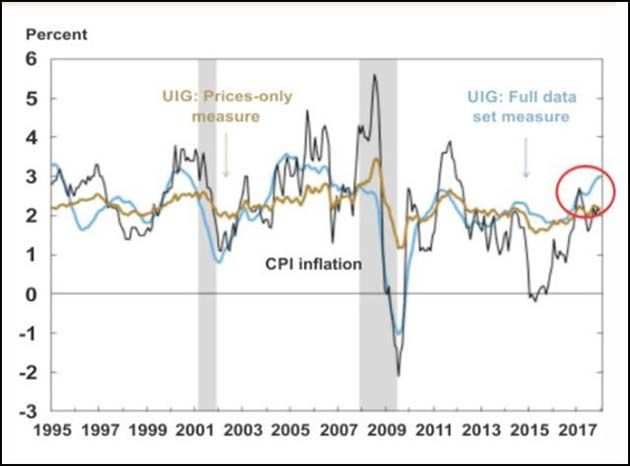

All these economic pressures are trying to leak through to the inflation data…

@WhatILearnedTW: New York Fed’s Underlying Inflation Gauge signaling that the inflation bounce since last autumn’s hurricanes is anything but transitory

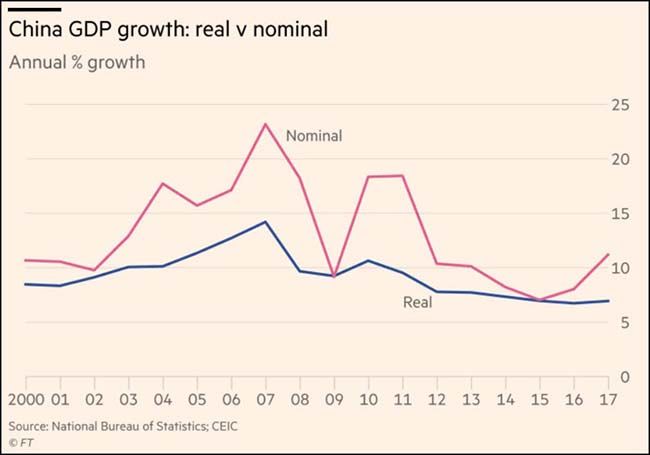

One big cause for this global growth party getting started is of course China which has turned the corner…

China’s economy grew at 6.9 per cent in 2017, the fastest pace in two years, despite policymakers making headway towards curbing financial risk from excessive debt. The country’s 6.8 per cent growth for the fourth quarter locked in China’s first yearly gross domestic product acceleration since 2010. The annual figure overshot the government’s original full-year target of “around 6.5 per cent” and outpaced growth of 6.7 per cent in 2016. In purchasing-power parity terms, growth in 2017 alone equalled the size of Canada’s entire economy, according to ANZ Bank. Net exports contributed 0.6 percentage points to overall growth, the highest contribution since 2008, as a buoyant global economy boosted trade.

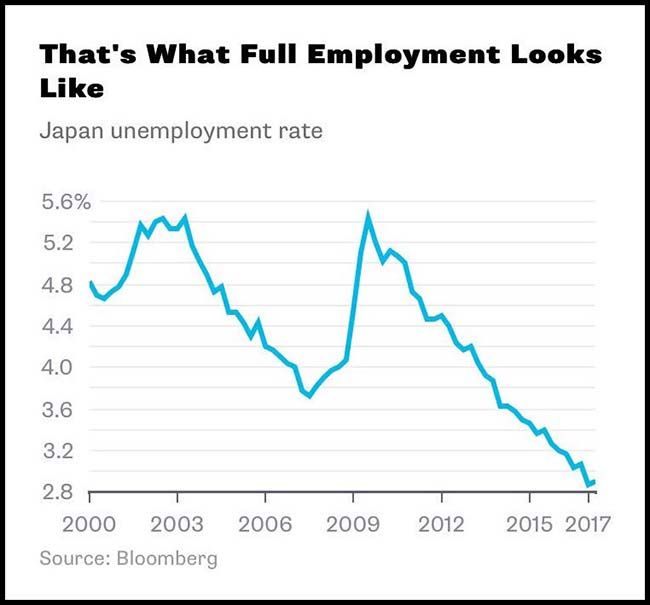

And when will Japan begin to import workers?

I have a fourteen year old that would love to spend much more time in the country.

(@PlanMaestro)

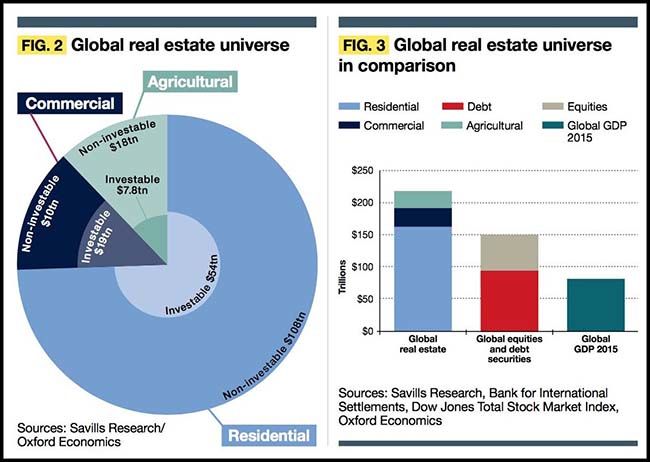

A great chart of just how big the global real estate markets are…

The investable markets are currently as big as the global stock market.

(@TihoBrkan)

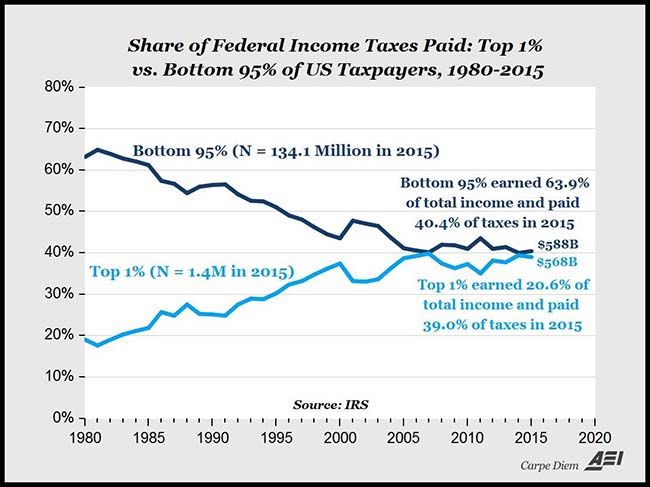

Another data series hot off the presses is the share of U.S. taxes paid by the 1%. Wow.

(@Mark_J_Perry)

The World Economic Forum starts this week. This picture is great!

The best reporting of the weekend…

This is one opioid story that you will not be able to forget.

(NYTimes)

NBC had better break the bank to sign John Malkovich for the Super Bowl because the teaser was just as good as Sunday’s game…

(WSJ/DailyShot)

Finally, this is still the easiest bet of 2018…

The average male candidate might have an easier time playing against Brady and Belichick in the Super Bowl than run for office in November.

Zwiener is part of a grassroots movement that could change America. Call it payback, call it a revolution, call it the Pink Wave, inspired by marchers in their magenta hats, and the activism that followed. There is an unprecedented surge of first-time female candidates, overwhelmingly Democratic, running for offices big and small, from the U.S. Senate and state legislatures to local school boards. At least 79 women are exploring runs for governor in 2018, potentially doubling a record for female candidates set in 1994, according to the Center for American Women and Politics at Rutgers University. The number of Democratic women likely challenging incumbents in the U.S. House of Representatives is up nearly 350% from 41 women in 2016. Roughly 900 women contacted Emily’s List, which recruits and trains pro-choice Democratic women, about running for office from 2015 to 2016; since President Trump’s election, more than 26,000 women have reached out about launching a campaign. The group had to knock down a wall in its Washington office to make room for more staff.

It’s not just candidates. Experienced female political operatives are striking out on their own, creating new organizations independent from the party apparatus to raise money, marshal volunteers and assist candidates with everything from fundraising to figuring out how to balance child care with campaigns.

It’s too early to tell how the movement will change Washington. But outside the Beltway, a transformation has already begun. In dozens of interviews with TIME, progressive women described undergoing a metamorphosis. In 2016, they were ordinary voters. In 2017, they became activists, spurred by the bitter defeat of the first major female presidential candidate at the hands of a self-described pussy grabber. Now, in 2018, these doctors and mothers and teachers and executives are jumping into the arena and bringing new energy to a Democratic Party sorely in need of fresh faces. About four times as many Democratic women are running for House seats as Republican women, according to the Center for American Women and Politics; in the Senate, the ratio is 2 to 1.

(Time)