by Doug Drabik, Fixed Income, Raymond James

This year investors assumed there would be a lot of excitement and activity. After all, the President campaigned and won on promises and hopes that “the old” would make way for “the new”. At least it felt like the peoples’ wishes were to buck the old establishment and move to more desirable people-friendly platforms. There was an expectation of increased spending on things like infrastructure coupled with perhaps less revenue as all income classes were going to get a tax break. The residual affect would increase the budget deficit and heighten the risk of inflation. This was reasonable given the current below desired level of inflation, the benefits of government spending and the advantages of putting more disposable income in the hands of the people.

Congressional roadblocks have obstructed nearly every potential development. So how has this impacted investors? What comes to mind is the old cliché that investors are driven by fear or greed. Low interest rates have continued uninterrupted and disallowed greed as a driver in the bond market; however, fear has governed in this current market, to the extent that fixed income investors are frozen like deer in headlights. The anticipated bond market excitement has turned into a dud.

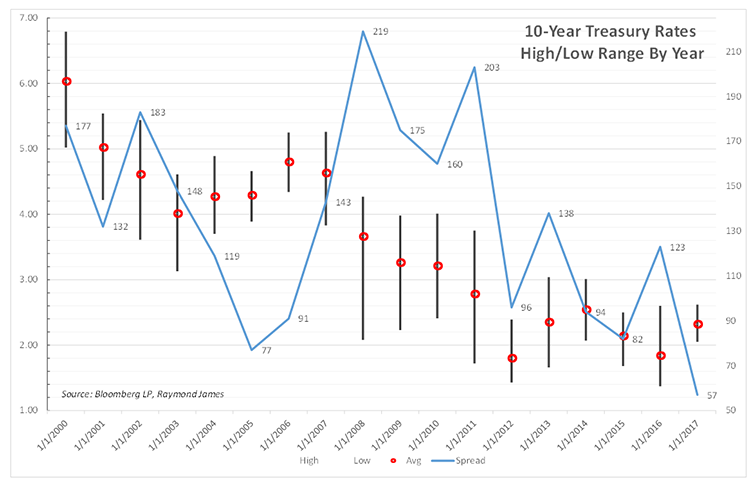

Observe the following graph. Since the turn of the century, interest rates haven’t been particularly volatile. The 10-year Treasury bond has averaged a range of 134 basis points (the blue line) from any year’s high to its low. In the last four years, the 10-year volatility has decreased 33% from its century average. This year there is only a 57bp range from the rate high and low (2.62% on 3/13 vs 2.05% on 9/7). (Each black line represents the 10-year range of rates for that given year).

The rate environment has dictated much activity, perhaps driven by fear of rising interest rates or driven by greed, which causes some investors to shift to assets with higher returns and more risk. In a more optimal approach, long-term reasoning drives the activity. It is a bonus when conditions elevate income, but regardless of interest rate levels, bonds for many investors serve a much higher purpose. Bonds are intended to first, protect wealth and second, provide very predictable income with a very defined end date when the face value is returned. Do not be the deer in headlights. The market shouldn’t dictate your overall strategy. Your overall strategy should be long-term in planning and naturally accommodate any short term occurrences.

*****

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Copyright © Raymond James