by Blaine Rollins, CFA, 361 Capital

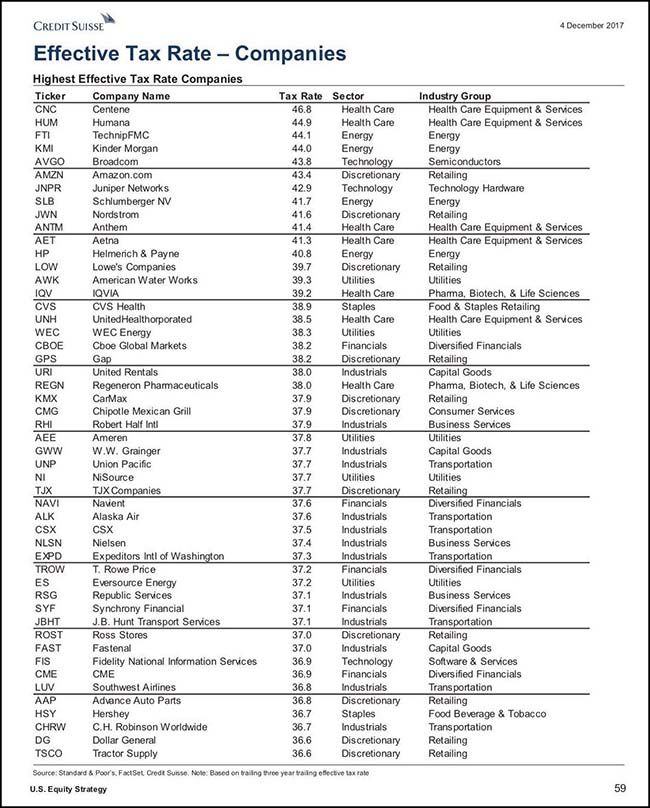

With Tax Reform looking close to passing last week, the investing world quickly grabbed its tax trade crib notes and got busy rotating. I was surprised that the Fiscal Hawks capitulated so quickly, but it appeared that the urgency to get anything done in 2017 trumped throwing an extra trillion of debt onto the kids and grandkids. The tax plan should boost U.S. GDP growth in the future (Goldman Sachs thinks it adds +0.3% in 2018 and 2019). It will also allow companies with overseas cash ($2.6 trillion in the Russell 1000) to bring it back to the U.S. at a 14% tax rate. While the tech names have the most cash sitting overseas, the market could care less about those stocks right now because they already have low U.S. corporate tax rates. What the market wants to own now are the companies with the highest 2017 tax rates who will benefit the most from the move toward 20% corporate tax rates (a good list below). So buckle up and hold on tight because with portfolio managers now very overweight technology stocks, this rotation could get bumpy.

To receive this weekly briefing directly to your inbox, subscribe now.

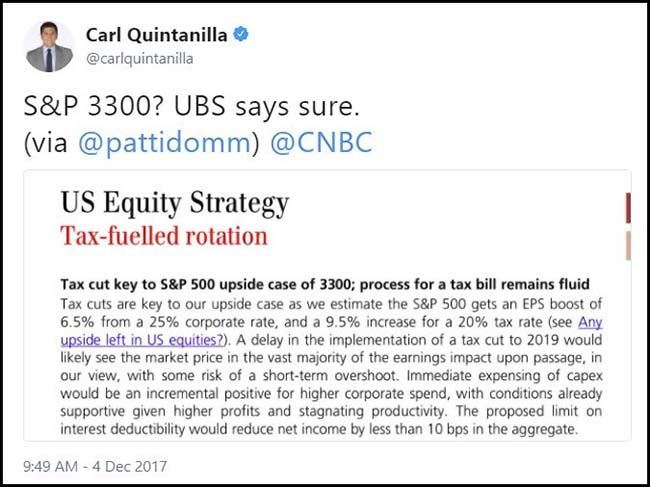

With Tax Reform on track toward a signature, expect all firms to add certainty to their upside market outlooks for 2018…

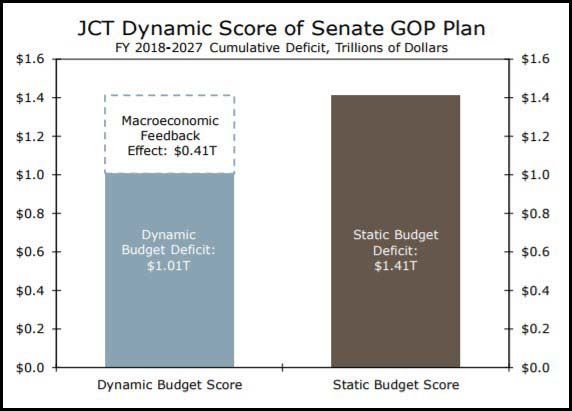

Senator Corker was the only Republican Senator to carry the Fiscal Responsibility flag and vote against the Tax Bill…

Who is going to tell the kids?

(Wells Fargo Securities)

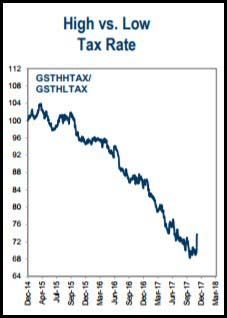

High Tax Rate stocks have been beat all year…

But no longer. Time for them to finally shine. Last week was a good start.

(Goldman Sachs)

If you need a list of names, sectors or themes, CSFB does some good tax work. This could be a good hunting list…

@carlquintanilla: Credit Suisse has a list of tax-bill “winners”: (via @pattidomm) @CNBC #TCJA

Liz Ann Sonders dove into the rotation noting the reversals since Thanksgiving…

(Schwab)

The last week’s rotation was also reflected heavily in the full November month-ending stats…

(@JackDamn)

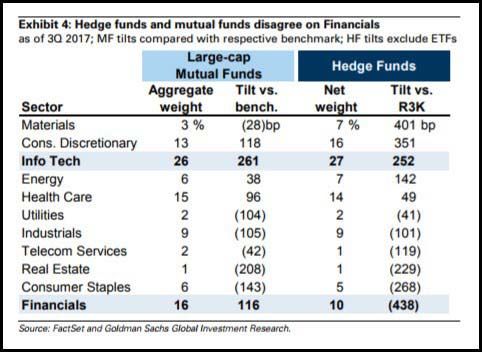

Why is the underperformance in technology stocks so painful?

Because Mutual Funds and Hedge Funds are VERY overweight them. So, there is no incremental buyer in this decline.

(Goldman Sachs)

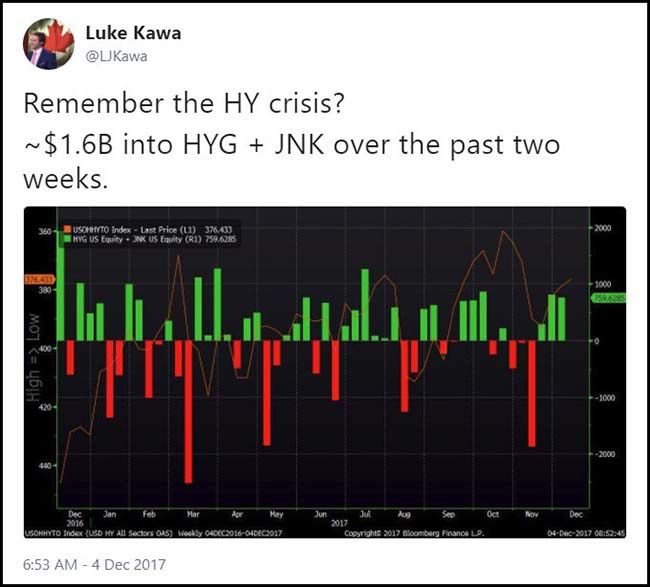

If you are wondering if this rotation will lead to a wider decline, look at the credit markets…

The massive outflows out of junk bond funds and ETFs have reversed back into inflows which is a positive.

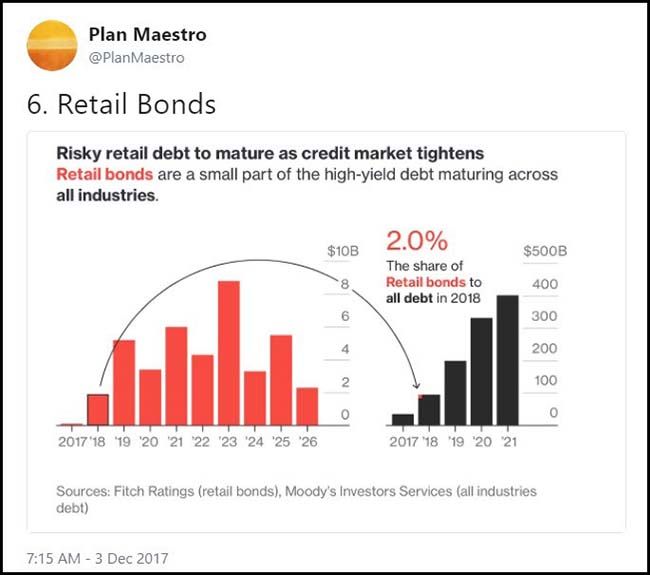

And while the market worried in November over the decimation of Retail debt…

It only amounts to 2% of the asset class which is maturing in 2018 so just not that significant.

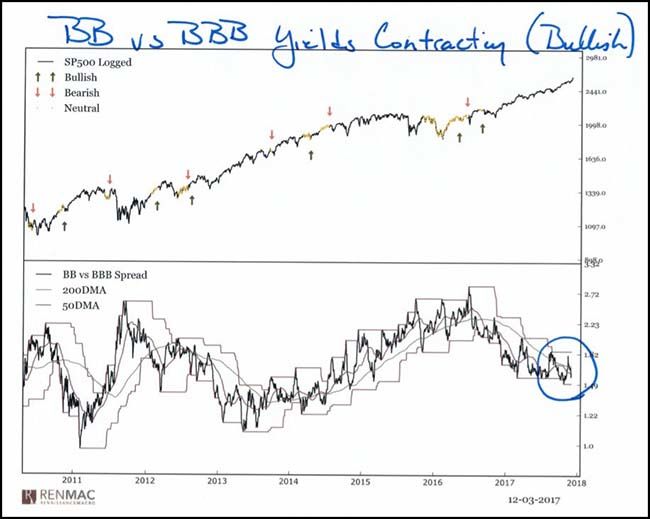

Looking more broadly at BB vs. BBB bond yields shows that the market is again approaching its lows…

(Renaissance Macro)

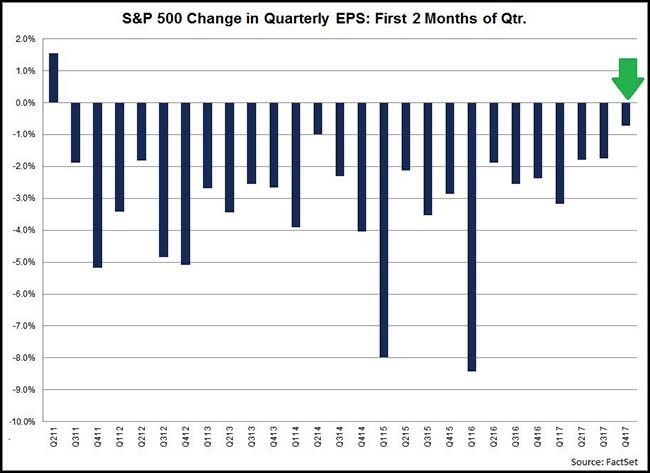

From looking at credit to looking at earnings shows that estimate changes for this quarter are in very good shape…

During the past year (four quarters), the average decline in the bottom-up EPS estimate during the first two months of a quarter has been 2.3%. For the past five years (20 quarters), the average decline in the bottom-up EPS estimate during the first two months of a quarter has been 3.3%. In the past 10 years (40 quarters), the average decline in the bottom-up EPS estimate during the first two months of a quarter has been 4.3%.

Thus, the decline in the bottom-up EPS estimate recorded during the first two months of the fourth quarter was smaller than the one-year, five-year, and 10-year averages. In fact, the fourth quarter of 2017 marked the smallest decline in the bottom-up EPS estimate for the first two months of a quarter since Q2 2011 (+1.5%).

(Factset)

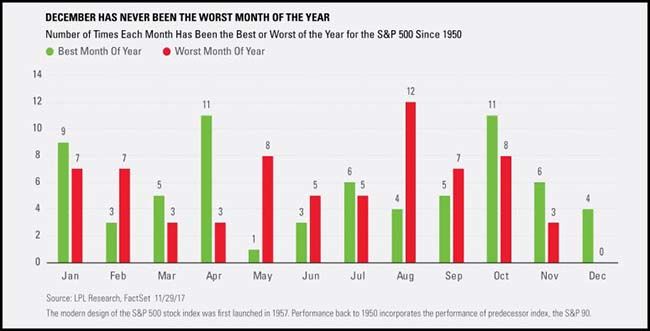

So let’s take the market into December and hope that it follows its historical trend…

“While we all know that December is historically a bullish month, what also stands out is that this month has never once been the worst month of the year for the S&P 500. Considering March 2017 is the current worst month of the year, as it closed down 0.04%, this could bode well for the bulls in December.” (Ryan Detrick, LPL Financial)

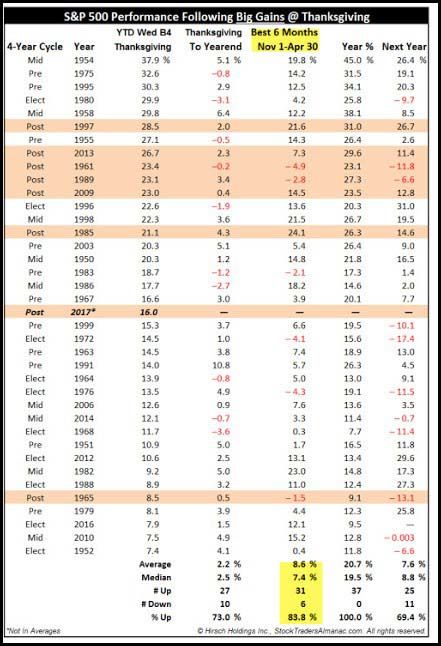

And if you need more stock market encouragement…

Historically, strength in the market into Thanksgiving leads to even more strength.

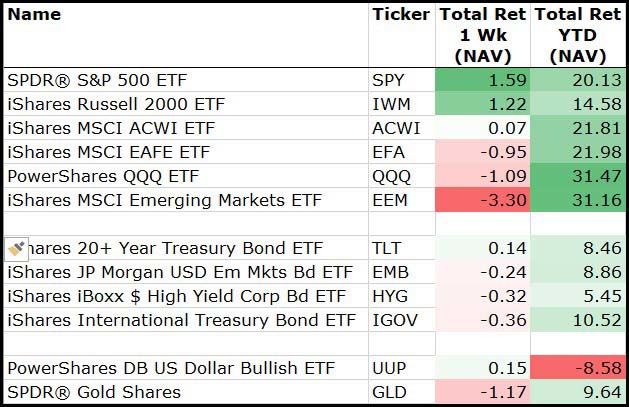

For the week, the broadest indexes moved to new highs…

But the Nasdaq and Emerging Market stocks were left far behind.

(12/1/17)

Looking more closely at Emerging Market stocks shows another pullback to the 50-day moving average…

It has held here eight times before. Will this be the ninth?

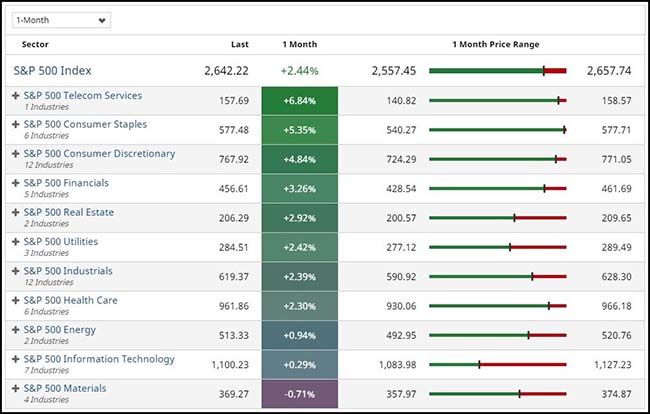

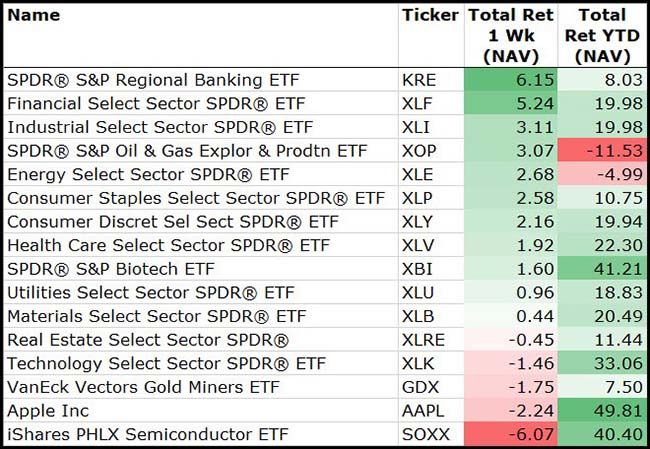

Broad dispersion across the U.S. sector indexes as Tax Reform beneficiaries gain…

(12/1/17)

One of the biggest rockets last week were Transportation stocks which caught fans across Airlines, Railroads & Truckers…

(@johnscharts)

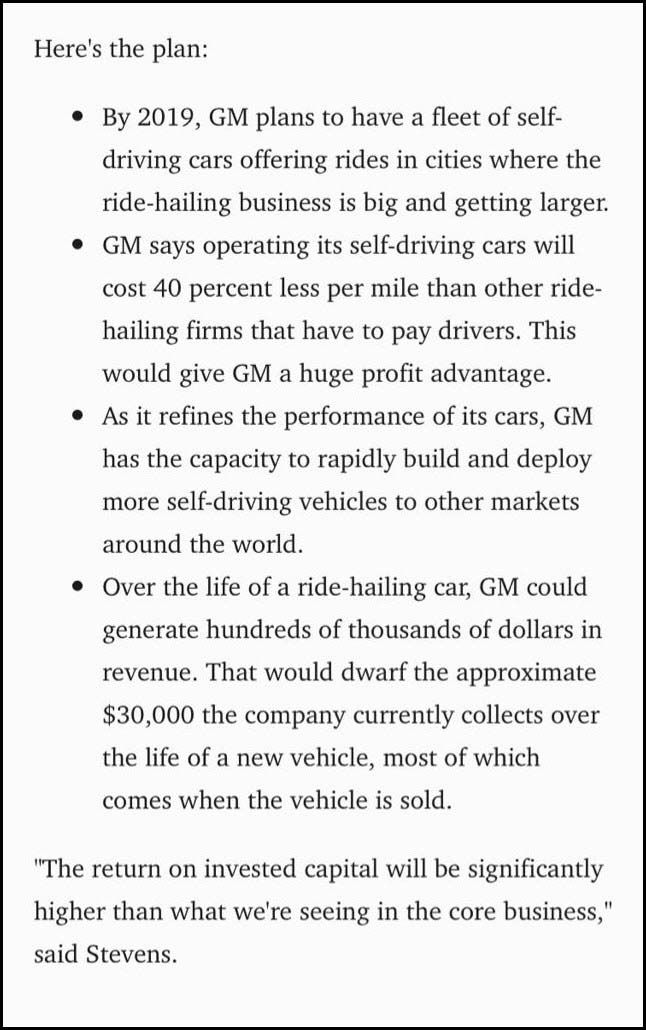

GM is going to launch a new business of self-driving, shared cars in 2019…

(@PlanMaestro)

So if you have clients that own downtown parking lots, the window for converting them into another use will be closing….

(@vitaliyk)

Hopefully GM, Tesla, Volkswagen and the others will move very quickly on self-driving…

The World Health Organization says that 1.25m people die annually from road traffic accidents (2.2% of all deaths).

…the technology think-tank RethinkX, who predict that “we are on the cusp of one of the fastest . . . most consequential disruptions of transportation in history”. They forecast that 95 per cent of US passenger miles will be made by autonomous, electric, on-demand vehicle fleets within 10 years of receiving widespread regulatory approval as we move towards a “transport-as-a-service” model. By 2030, the number of passenger vehicles on American roads will drop from 247m to 44m, destroying millions of driving jobs and the oil industry.

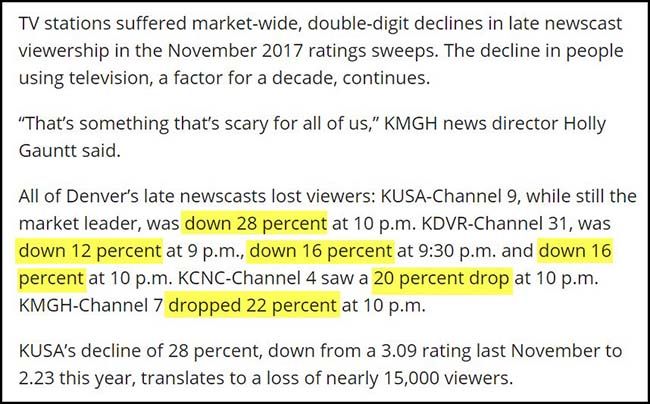

Streaming video is absolutely crushing the Denver late night news market…

Copyright © 361 Capital