by Jeffrey Saut, Chief Investment Strategist, Raymond James

“If you put a gun to my head, I really wouldn’t be short a Dow stock!”

The source of that firm declaration is an old friend of ours, a crack (read; very rich) money manager and someone who passionately embraces anonymity (never quoted, never wrong). We put a gun to his head, he refused to short any of the Dow 30 stocks, but lucky for him, neither gun nor we were loaded.

What makes our friend’s unequivocal statement noteworthy is that he has the most profound distrust of this great bull market, calls it “ridiculous, absurdly overvalued,” thinks we’re in the process of putting a top in it, warns that “we’re living on borrowed time.” And yet he see the possibility of the Dow Jones Industrials getting as high as 9000 later this year, as more and more money flows into fewer and fewer stocks, all of which happen to be in the Dow.

He expects a correction at some point during the year – the third quarter seems as good a time as any for it – and a violent one. But his plan is to buy the break in anticipation that the final, climactic advance will carry through the end of the year, maybe into 1998.

If Dow Jones should decide to sanction a derivatives index on the D-J Industrials – on which we have no word and less knowledge – then our friend thinks the Industrials are a “moon shot.” But that would also signal to him “the top tick” in the market, comparable to the beginning of the end of Japan’s big bull market in 1989, when trading in the Nikkei 225 futures began in the spring and options in the fall. The market, of course, peaked in December.

For all his demonstrated prowess and astuteness as an investor, we should caution that he’s a trader by heart, and his ability to turn on a dime is one of the big reasons he has so many dollars. Still, we feel his speculations are worth passing along. First, because he has been so successful and for so many years, but also because he’s an unlikely and sophisticated example of that increasingly familiar phenomenon in the market: the fully invested bear.

. . . Up & Down Wall Street, by Alan Abelson, Barron’s (May 5, 1997)

Alan Abelson’s prose is just as appropriate today as when it was first scribed in 1997 for there are currently a bunch of fully invested bears. We recalled the quip from our departed friend Alan Abelson when we read a quote from what we believe to be a fully invested bear, namely Carl Icahn, who cautioned last week about the “euphoric state” of the stock market.

Shortly thereafter the good folks at Credit Suisse came out with a report warning of an equity market meltdown in 2018. Meanwhile, the portfolio managers (PMs) we talk to at such organizations are indeed “fully invested!”

So, we are now in the ebullient month of December and as often stated, “It is tough to put stocks away to the downside in December. It can happen, but it’s pretty rare.” In fact, there were only two years that saw negative returns for the S&P 500 (SPX/2642.22) in December. They were 1936 and 1955, but even then the declines were small.

To be sure, over the last 100 years the average December gain has been 1.55% with a “win rate” of 74% of the time (Chart 1). Moreover, ten of the S&P’s macro sectors have experienced positive returns in December. As Bespoke Investment Group notes, “Surprisingly, it has been the high yielding dividend paying sectors that have seen the largest gains with Real Estate, Telecom Services, and Utilities all posting gains of more than 2%.”

Worth mention is that last December ALL the macro sectors rallied! Parsing a list of some of the historically best performing stocks in the S&P 500 during the month of December we find the following names from the Raymond James research universe. Each stock screens well on our models and carries a favorable rating from our fundamental analysts: Broadcom (AVGO/$271.56/Strong Buy), Oracle (ORCL/$49.61/Outperform), Valero (VLO/$84.17/Outperform), Red Hat (RHT/$125.26/Outperform), Nvidia (NVDA/$197.68/Outperform), and Mohawk (MHK/$284.82/Strong Buy).

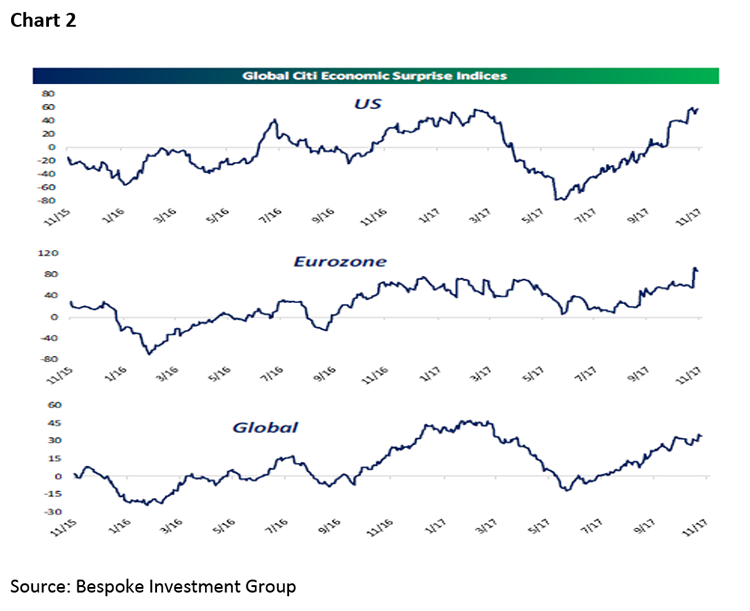

Moving on, earnings momentum continues and the economy continues to improve, which is what typically happens in the second leg of a secular bull market. Last week the Richmond Fed’s economic report showed that the manufacturing index hit its highest level ever. Then too, the US Citi Economic Surprise Index has accelerated to its strongest reading since 2013; and, it is not just the U.S., but a worldwide synchronized economic recovery (Chart 2).

Crude oil as well is suggesting the economy is stronger than a garlic milkshake. Ditto the economically sensitive D-J Transportation (TRAN/10186.63) that tagged new all-time highs last week, as did the D-J Industrial Average (INDU/24231.59), thus registering yet another Dow Theory “buy signal.” This week we get another slew of economic reports with arguably the two most important being Tuesday’s ISM report and Friday’s employment report. Consensus estimates have the ISM falling from 60.1 to 59.0 in November, while participants expect Friday’s Nonfarm Payroll estimate to print around 200,000 versus the previous 261,000 (Chart 3).

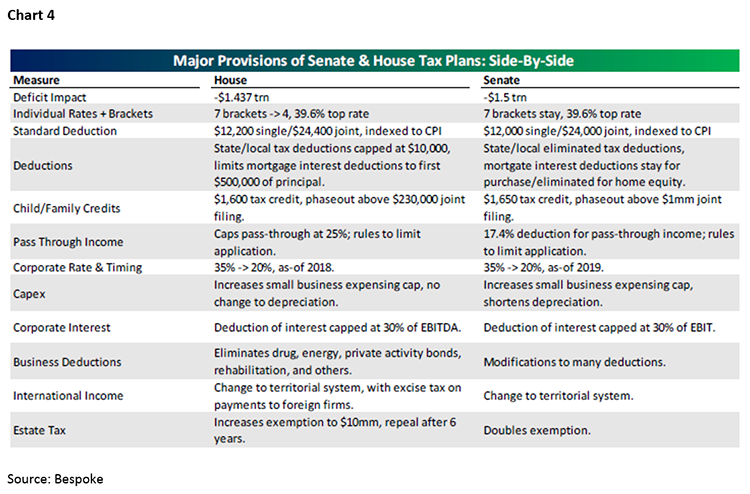

Turning to last week’s tax bill, while nobody knows what the final draft will look like, the Senate and House versions are not totally different (Chart 4). However, if our understanding is correct, we think it is a mistake to delay the corporate tax cuts (from 35% to 20%) for a year. The reason is pretty selfish in that we believe much of the rally has been powered by the sense that a reduction in the corporate tax rate could add as much as $10 to S&P’s bottom up, operating earnings estimate of ~$144 in 2018. If that happens it would go a long way in answering concerns about valuation levels for the S&P 500.

The call for this week: The equity markets withstood two negative selling bouts last week. The first was Tuesday’s FAANG Feint and the second was the Flynn Fiasco on Friday, which took the senior index down over 300-points before it closed off a mere 40-points. That caused the Dow to pull off its longest monthly winning streak since 2007. As the prescient Jason Goepfert of SentimenTrader fame writes:

Can’t get enough of the Dow. The Dow Industrials enjoyed the best weekly gain in nearly a year. Even with Friday’s scare, it rallied nearly 3%, the most since last December. It also closed at a new all-time high, raising worries about a blow-off move this week. Similar moves since 1900 don’t support that worry, with gains in the Dow almost every time over the next 2-4 weeks. Nothing but positive surprises. Economic surprises over the past three months have been consistently positive. The Citigroup Economic Surprise Index is nearing a maximum level since climbing above zero in September, which has led to good returns for stocks over the next several months. Among the most popular ETFs, bonds did okay, commodities were questionable, and energy and health care did well. Industrials get the spotlight. Nearly half of Industrial stocks in the S&P 500 hit a 52-week high late [last] week, for mostly the same reasons the Dow had such a good week.

Additional information is available on request. This document may not be reprinted without permission.

Raymond James & Associates may make a market in stocks mentioned in this report and may have managed/co-managed a public/follow-on offering of these shares or otherwise provided investment banking services to companies mentioned in this report in the past three years.

RJ&A or its officers, employees, or affiliates may 1) currently own shares, options, rights or warrants and/or 2) execute transactions in the securities mentioned in this report that may or may not be consistent with this report’s conclusions.

The opinions offered by Mr. Saut should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your Raymond James Financial Advisor.

All expressions of opinion reflect the judgment of the Equity Research Department of Raymond James & Associates at this time and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. Other Raymond James departments may have information that is not available to the Equity Research Department about companies mentioned. We may, from time to time, have a position in the securities mentioned and may execute transactions that may not be consistent with this presentation’s conclusions. We may perform investment banking or other services for, or solicit investment banking business from, any company mentioned. Investments mentioned are subject to availability and market conditions. All yields represent past performance and may not be indicative of future results. Raymond James & Associates, Raymond James Financial Services and Raymond James Ltd. are wholly-owned subsidiaries of Raymond James Financial.

International securities involve additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets.

Investors should consider the investment objectives, risks, and charges and expenses of mutual funds carefully before investing. The prospectus contains this and other information about mutual funds. The prospectus is available from your financial advisor and should be read carefully before investing.

Copyright © Raymond James