by Ryan Detrick, LPL Research

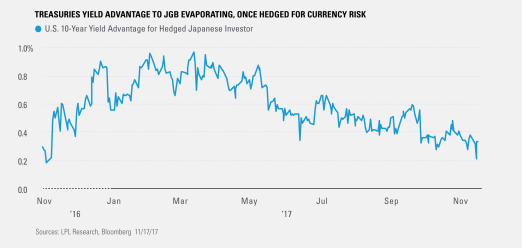

When investors buy securities denominated in foreign currency, they frequently hedge their currency exposure to mitigate the risk of exchange rate fluctuations eating into their returns. For Japanese investors, the cost of hedging is becoming increasingly expensive; so much so that once it’s taken into account, the yield advantage of the U.S. 10-year Treasury relative to the 10-year Japanese Government Bond (JGB) is heading towards 0%.

Japan has been a relatively steady source of demand for Treasuries lately. This is mainly due to the roughly 0% yield on 10-year JGB, which is caused by Japan’s ongoing monetary stimulus. However, that wasn’t the case in the latter half of last year. In June 2016, Treasury yields hit all-time lows, and increasing hedging costs made investing in Treasury bonds unappetizing for Japanese investors. Subsequently, Japan became a net seller of Treasuries over the final five months of 2016. That selling pressure helped push rates higher in the United States.

After rates moved higher in late 2016, Japan was once again a net buyer of long-term Treasuries in five of the first eight months of 2017, based on currently available data from the U.S. Treasury. This has helped to keep a lid on rates. Many factors influence long-term Treasury yields including: economic growth and inflation expectations, central bank accommodation levels, and investor flows; but the waning of one important source of demand could bias rates higher in the short term, similar to Japan’s impact during the second half of 2016.

IMPORTANT DISCLOSURES

The economic forecasts set forth in the presentation may not develop as predicted.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

Stock investing involves risk including loss of principal.

Investing in foreign and emerging markets securities involves special additional risks. These risks include, but are not limited to, currency risk, political risk, and risk associated with varying accounting standards. Investing in emerging markets may accentuate these risks.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor

Member FINRA/SIPC

Tracking # 1-669399 (Exp. 11/18)

Copyright © LPL Research