by Kate Moore, Chief Equity Strategist, Blackrock

Equity valuations may look rich compared with history, but we do not believe this is something to be feared. Kate explains.

Many investors are skeptical about equity valuations after an eight-year rally. Investor trepidation is understandable. The cyclically adjusted price-to-earnings (P/E) ratio for U.S. stocks was at its highest level since March 2002 as of end-July according to Thomson Reuters data, a level last associated with a major market correction.

Equity valuations may look rich compared with history, but we do not believe this is something to be feared, as we write in our new Global equity outlook Goldilocks and the valuation bears. We see starting valuations as an indicator of future returns only in the long run. Drivers such as earnings growth and momentum power markets in the near to medium term, in our view.

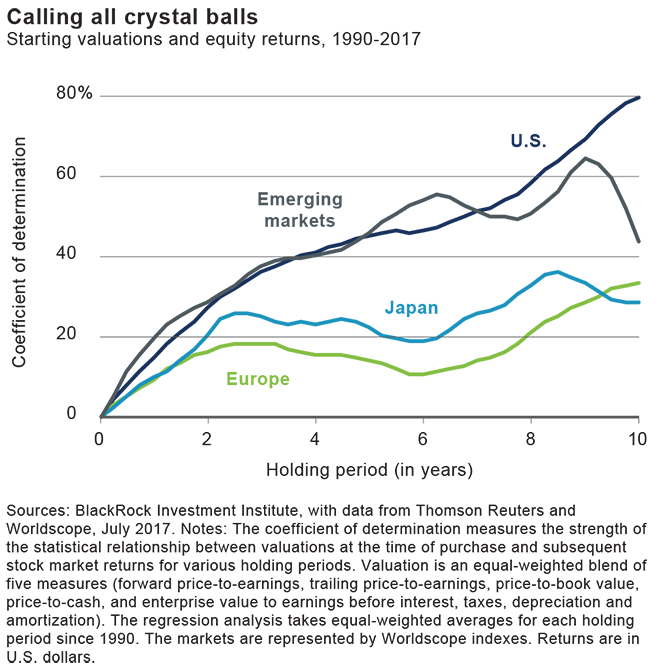

We analyzed almost three decades of equity market history in the U.S., Europe and Japan, and roughly two decades in emerging markets. We composed a blend of five key valuation metrics—including forward price-to-earnings ratios and price-to-book value—and examined how strong the relationship was between starting valuations—or valuations at the time of purchase—and the variability of subsequent U.S. dollar returns over time.

We found that starting valuations have historically been a poor indicator of future equity returns in the short run. Sentiment-driven changes in market multiples tend to trump fundamentals for holding periods of five years or less. Cheap stocks can remain cheap for years, and often need a catalyst for re-rating. Similarly, highly priced stocks can ride waves of momentum to become even more expensive, before eventually settling to more reasonable multiples.

Starting valuations are a more reliable compass in the long term, we found. They have shown a strong relationship with U.S. equity performance over 10-year periods, our analysis shows. See the chart below.

Emerging markets equities tell a similar story, albeit with a weaker relationship. But the connection between starting valuations and subsequent returns appears limited in Europe and Japan. The chart illustrates the results in U.S. dollar terms, but the results were similar in local-currency terms, we found. Only Europe showed a slightly stronger relationship in local currency.

What could cause lofty valuations to crash back down to earth in the near term? The end of ultra-easy monetary policy globally is an oft-cited culprit. The argument: Easy money boosted asset prices on the way up, so valuations and markets should deflate when central banks remove accommodation.

We believe these concerns are overstated. Tighter monetary policy by itself creates a headwind to asset prices, but the net effect on asset prices and valuations could remain positive if it is offset by resilient growth. And we believe the current economic expansion has legs. In addition, we expect central banks to remove monetary accommodation very slowly and predictably

The relationship between equities and interest rates is clear—at least in theory. Lower rates boost the value of future earnings when discounted into today’s dollars, supporting higher valuation multiples. And lower rates are exactly what we expect. We see interest rates rising only gradually in this cycle—and to lower peaks than in the past. Structural factors such as aging populations, stagnant productivity growth and plentiful global savings are among the reasons.

This is why we do not expect equity valuation multiples to revert to historical means. In the U.S. and Europe today, a high starting point for valuations does create a headwind for future returns, we believe. Yet structurally lower interest rates point to sustainably higher valuation multiples than in the past. This suggests today’s valuations are not as stretched as they may appear.

In the near term, we see a global recovery in corporate earnings underpinning equity markets. And we see earnings and dividend growth offsetting a modest return drag from multiple contraction over the medium term, making equities attractive relative to other asset classes. Read more in our Global equity outlook.

Kate Moore is BlackRock’s chief equity strategist, and a member of the BlackRock Investment Institute. She is a regular contributor to The Blog.

Investing involves risks, including possible loss of principal.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of August 2017 and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

©2017 BlackRock, Inc. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.