by Hamish Preston, Senior Associate, Index Investment Strategy, S&P Dow Jones Indices

Among the many themes to have emerged in U.S. markets during the first six months of 2017, low volatility in equities and changes in the global interest rate environment—some realized and some anticipated—were particularly important drivers. In a similar vein to our summary on Europe, here are some thoughts on these trends.

The potential rewards from market timing were extremely low.

When the market swings wildly from one day to another, the rewards available from successful market timing can be significant. But when volatility is low and the market grinds upward, it is difficult to beat a strategy that remains fully invested and minimizes trading costs. In the first half of 2017, equity markets across the world were characterized by low volatility, both in realized terms and in implied measures such as VIX®.

The trend for lower volatility was exemplified by the U.S., where the standard deviation of daily price movements in the S&P 500® was a measly 0.44% between January and June 2017. In fact, only 1963 and 1964 saw lower numbers at the end of June in a record stretching back to 1929 (see Exhibit 1).

Low correlations between S&P 500 constituents go a long way in explaining the near historic lows in daily volatility over the first half of this year. In any case, the relatively tight range of daily returns of the S&P 500 over the first six months of 2017 meant that market timing strategies would have found it even more difficult than usual to deliver excess returns.

Central bankers’ speeches weighed on dividend strategies.

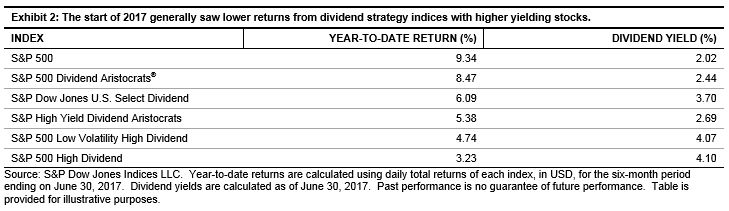

The U.S. Federal Reserve’s decisions to increase interest rates and speeches from Mark Carney and Mario Draghi that suggested the possibility of sooner-than-expected rate increases at the Bank of England and the European Central Bank, respectively, appeared to weigh on the performance of dividend strategies. None of our U.S. dividend strategy indices managed to beat the S&P 500’s 9.3% year-to-date total return for the period ending on the June 30, 2017, and the S&P 500 High Dividend Index underperformed by 6.11%.

As Exhibit 2 shows, dividends seemed to explain much of this relative performance. Year-to-date returns of strategies with higher yielding stocks performed worse than their lower yielding counterparts, although the S&P Dow Jones U.S. Select Dividend Index proved to be the slight exception.

Copyright © S&P Dow Jones Indices