Doesn’t Anyone Want to Own Stocks Anymore?

by Ryan Detrick, LPL Research

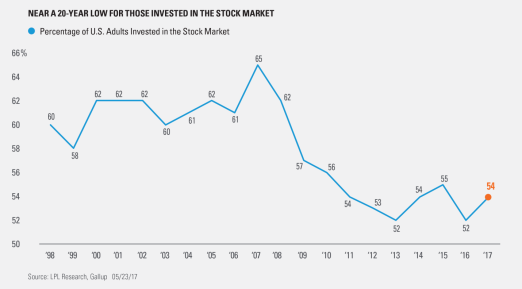

A recent Gallup poll showed that the percentage of U.S. adults invested in the stock market is near a 20-year low. With the S&P 500 Index at new all-time highs, this lack of participation in stocks is quite surprising.

The poll asked respondents if they were invested in an individual equity, stock mutual fund, or a self-directed 401(k) or IRA. This same poll, which reflected that up to 65% of adults were invested in the U.S. stock market in 2007, just ahead of the financial crisis, indicates that participation has dropped 11% over the past 10 years.

Per Ryan Detrick, Senior Market Strategist, “The big question is: Do you need Mom and Pop investors to come back full force into equities before the bull market can end? From a contrarian point of view that makes sense, but it isn’t quite so simple. We’d continue to focus on the improving fundamentals, strong technicals, and modest valuations (when you factor in low inflation and historically low interest rates) as a reason to expect higher equity prices. Still, this survey shows we are a long way away from seeing Uber drivers giving stock tips or your Aunt talking about the next hot tech IPO at Thanksgiving dinner.”

*****