by Benjamin Streed, CFA, Raymond James

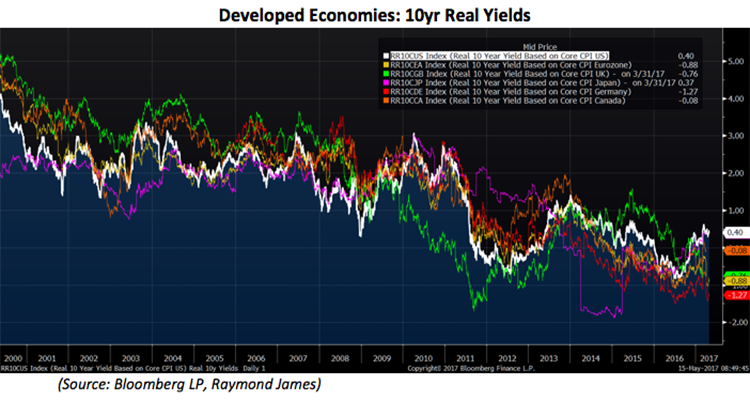

Something very interesting is happening in the US bond markets, but you have to dig deep to notice it. When discussing yields one must be careful to differentiate between nominal, or stated yield, and the real yield which takes into account the negative effect of inflation on investment returns. Put simply, the nominal rate less inflation equals an investor’s real yield. Obviously, high nominal yields are wonderful but when paired with high inflation you end up with a low real yield, not ideal by any stretch of the imagination. In the United States, 10 year real yields have been falling for decades since they topped out in the 1980s, falling from over 8% to zero (or even negative) in recent years as inflation remains muted. Interestingly, low real yields are not unique to the US. Globally, there is a clear trend for developed economies, one pointing toward subdued real yields.

If these real yields seem low, it’s because they are. Developed countries around the world currently have real 10yr rates ranging from negative 1.27% in Germany up to as much as 0.40% here in the United States. Canada is in the middle of the pack at zero percent while the Eurozone as a whole is well below zero. To rephrase this point for emphasis, at ~40 basis points the US has the highest real rate of interest in the developed world. Investors in the current market environment do not demand much above the core rate of inflation to own longer-dated US Treasuries.

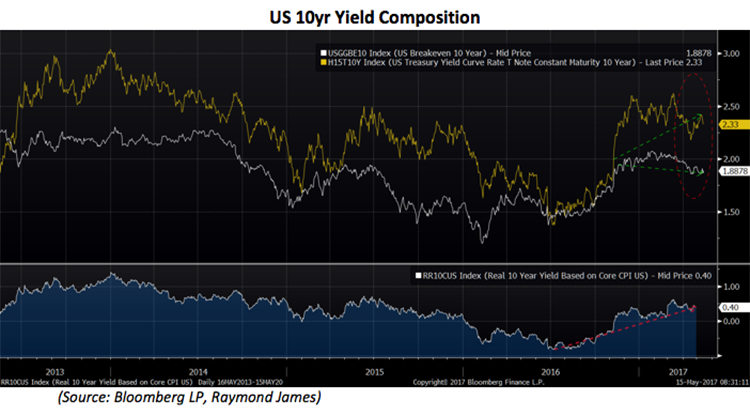

Friday’s weaker than anticipated inflation data reminded markets that core prices remain stubbornly low despite the ongoing strength of the US consumer and generally positive broad economic data. Slow and steady appears to be the base case scenario for the US economy, which given the context of slow global growth looks pretty good in comparison. Interestingly, in recent months the real yield in the US has been increasing slightly, up from a low of negative 0.8% back in mid-2016, but what’s the cause? Since February of last year the inflation component of the 10yr Treasury has declined, showing that expectations for rising inflation are waning (top pane, white line). Meanwhile, the stated/nominal yield remains range bound in the 2.25-2.50% area (yellow line below). Put those two together and you have rising real rates despite a nominal yield that hasn’t moved much. Remember, nominal yield (2.33%) less inflation (1.88%) equals the real yield (roughly 0.40%), which is on the rise despite the seemingly calm state of the bond markets. At the end of the day, there continues to be strong, ongoing demand for high-quality, income producing assets like US Treasuries and investment grade bonds. This demand is global and is a result of a number of factors including aging populations in the developed world and a global savings glut that shows no signs of slowing down. This trend is decades in the making and emphasizes the clear willingness of many investors to seek out the safety of fixed income securities in their investment portfolios.

Copyright © Raymond James