by Blaine Rollins, CFA, 361 Capital

No one said that the flight path to higher returns would be easy. With the increase in uncorrelated asset returns, there are many different sets of positive returns out in the market right now. You just need to set the right flight path to snatch some of those better return streams. International stocks and Growth equities continue to provide the best airspace for returns as the U.S. cyclical recovery continues to slip. It appears with the latest news out of Washington D.C. that the legislative agenda for 2017 will slip into 2018. So with the potential to invest in International growth that is on the upswing, while U.S. growth is moderating, why wouldn’t investors allocate more assets overseas or into multi-nationals which will benefit more from a depreciating U.S. dollar? To me this looks like the easy approach, but if you want to make things more difficult and fly your plane upside down, then go ahead. There are plenty of ways to reach your destination right now.

It was a good week in Emerging Market stocks and bonds…

Maybe the Jeff Gundlach push helped, but we all know how cheap EM is versus Developed. The Nasdaq continued to roar led by Semis and the FAANG stocks. Small caps pulled in on Trump worries.

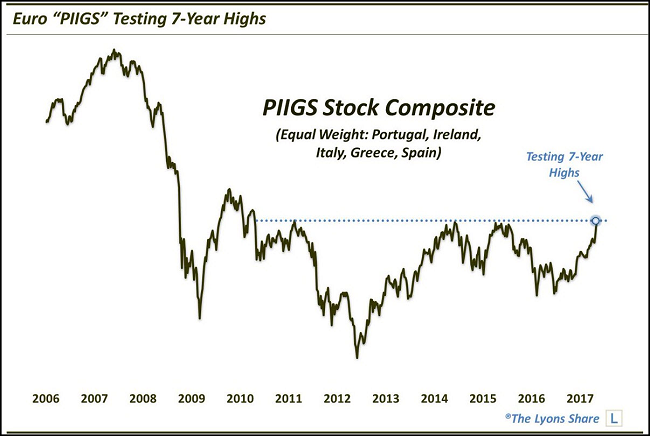

Remember the PIIGS? Well, they are back and they are very hungry to get in your portfolio…

@JLyonsFundMgmt: ChOTD-5/12/17 Euro “PIIGS” Testing 7-Year Highs $PGAL $EWI $EIRL $GREK $EWP

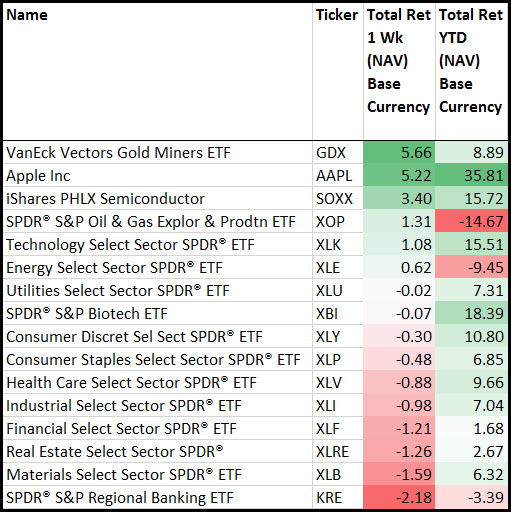

Among sectors, Semis jumped on several better-than-expected earnings reports. Energy bounced. Financials took the week off.

Looking at Friday’s 52-week lows in the Russell 1000 should tell you a lot about this market…

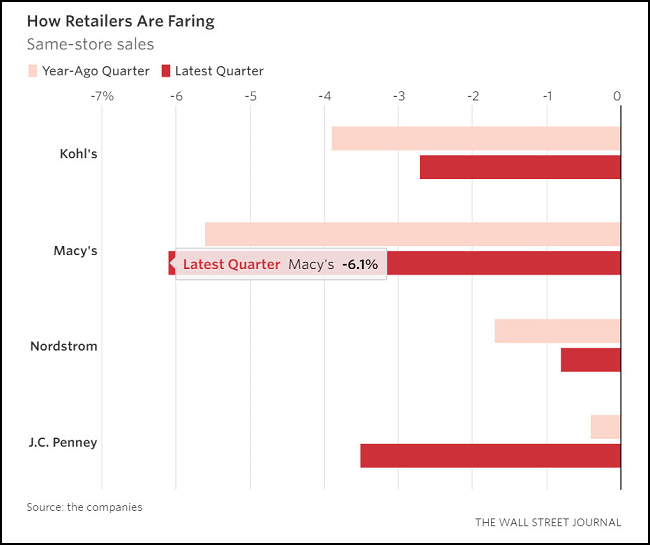

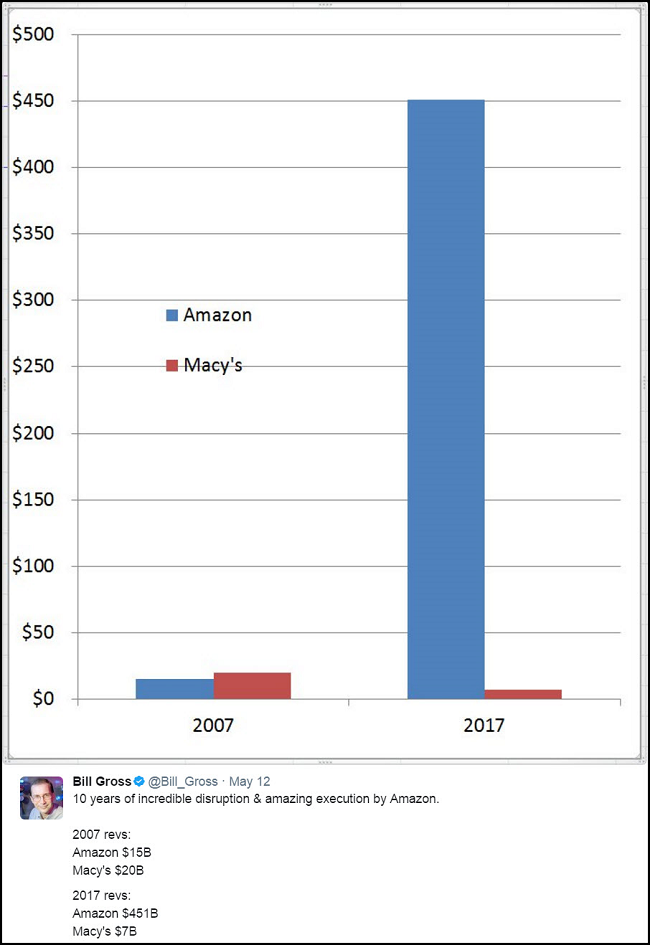

Clearly a massive secular rotation out of retail stocks as their top line comps are evaporating. Troubles with car rental prices and television advertising are also secular demand problems.

Try not to own stocks where the CFO needs to make the below statement on their conference call.

“Don’t count us out, we’re not dead,” Karen Hoguet, Macy’s chief financial officer, said in an interview.

(WSJ)

This is another quote that I do not want to hear from one of my owned companies…

“We don’t need more customers. We have all the customers we could possibly want.” (Sears CEO, Eddie Lampert)

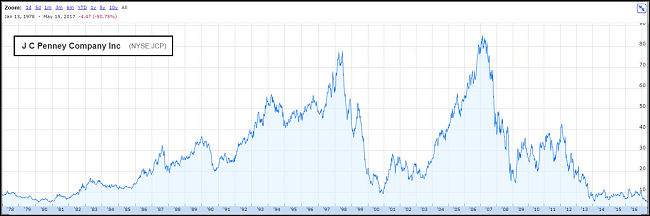

J.C. Penney’s stock chart is the only statement that you need to know there are problems…

@carlquintanilla: JCPenney falls below $4.90 to an all-time low, dating back to its IPO in 1978. $JCP @CNBC

And now retail problems are infecting those that own the real estate under the failing stores…

Real estate investment trusts that own and operate retail properties, like shopping malls, were among the worst-performing industry groups on the S&P 500 index this week. The broad benchmark ended the week down 0.35 per cent, while the retail Reit group was off 4.1 per cent. The fall this week deepens the year-to-date decline for retail Reits to 12.3 per cent, versus 1.5 per cent for the whole Reits sector.

Here is a round-up of how individual retail Reits performed this week:

● Macerich, which operates malls in the western US, fell 5.6 per cent

● Kimco Realty, which focuses on open-air shopping centres, was down 5.1 per cent

● Simon Properties, the largest player in the group, slipped 4.3 per cent

● GGP, the second-biggest group by market value, slipped 1.9 per cent

Meanwhile, Amazon is far from dead…

Who knows? Maybe the kids are alright?

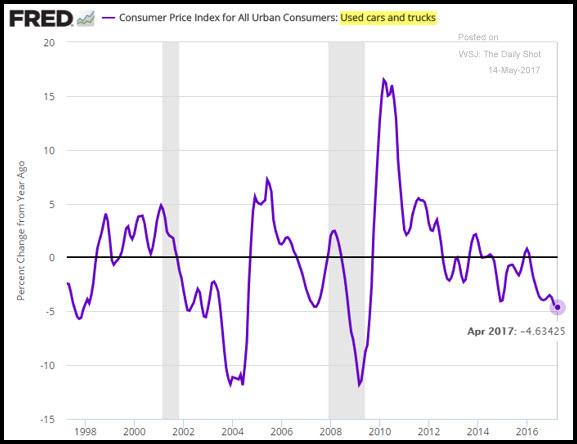

Why should they want to buy a depreciating asset where the base price is now falling 5% a year. Cars are stupid!

(WSJ/Daily Shot)

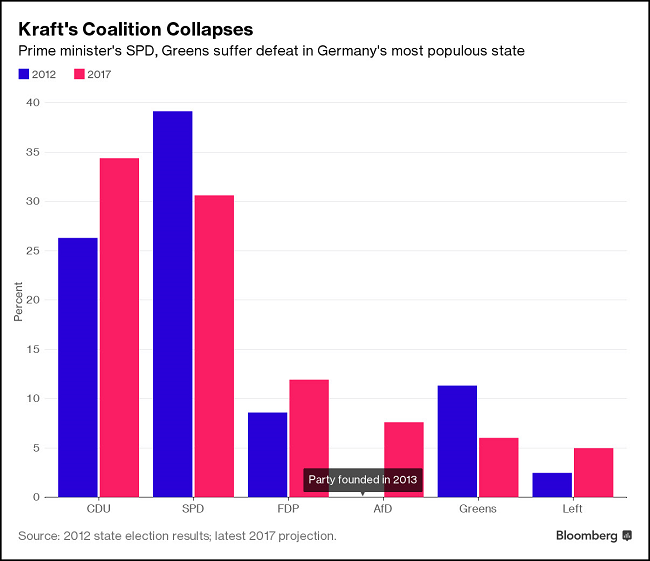

The French elections are off the table. Theresa May is about to take all the cards in Britain. And over the weekend, Angela won big time. Risk is coming off in Europe.

Chancellor Angela Merkel’s party decisively won an election in Germany’s most populous state, handing her Social Democratic opponents a humiliating defeat and further boosting her momentum as she seeks a fourth term in September.

The Christian Democratic Union’s victory in North Rhine-Westphalia, home to more than a fifth of German voters, is a resounding confirmation for Merkel, 62, and boosts her standing before a series of international summits starting this month, including meetings with U.S. President Donald Trump. She’s due to host French President Emmanuel Macron in Berlin on Monday for their first meeting after his inauguration.

“Everybody said Merkel is tired and finished,” said Annegret Kramp-Karrenbauer, a CDU member who won re-election as Saarland state premier in March. “We proved that precisely the opposite is true.”

No doubt helping Angela Merkel to gain in the key state elections was the strength in the German economy…

Germany’s economy picked up speed at the start of the year, expanding 0.6 per cent in the quarter and outstripping its major rivals in a key election year for chancellor Angela Merkel. The first quarter performance in Europe’s largest economy came in line with an average forecast compiled by Bloomberg, and climbed from the 0.4 per cent posted at the end of 2016. It was the best quarterly growth rate in a year.

Germany’s economy has been enjoying a sweet spot of late, marked by rising growth, expanding trade, and falling unemployment. The quarterly growth pick up contrasts with a slowdown in France in Q1 and means Germany expanded at twice the pace of the UK and more than three times that of the US at the start of the year.

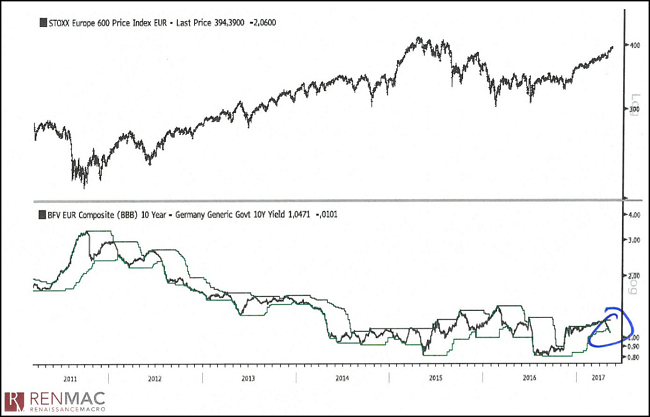

Meanwhile, European BBB credit strength is helping to increase Euro equity interest…

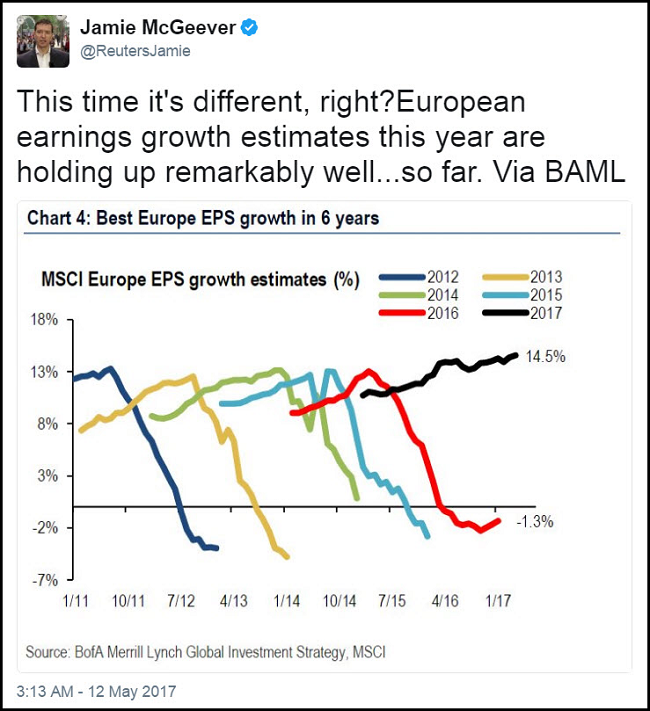

Even forward earnings estimates are now headed in the right direction after many failed years…

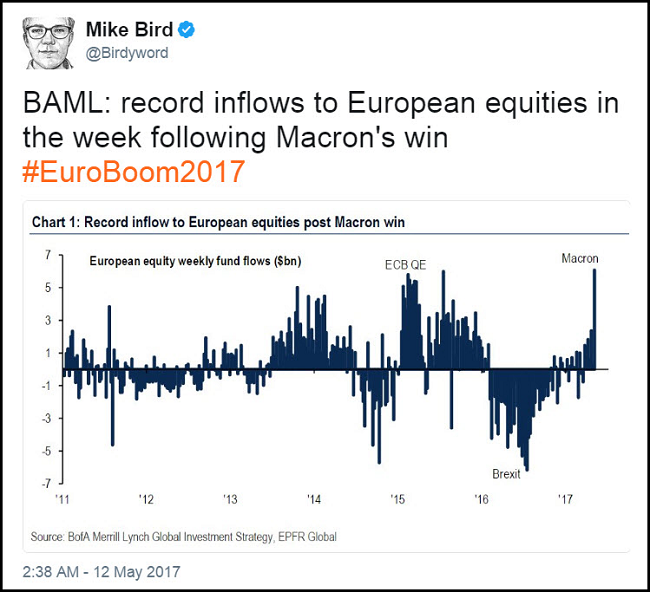

And you have seen the European fund flow data which continues to accelerate up and to the right…

Barron’s lays it all out for you in this week’s issue if you need more background work…

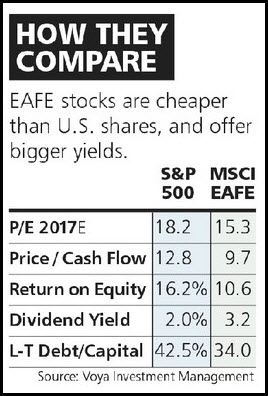

By almost any measure, European stocks are trading at a discount to U.S. shares. The Stoxx Europe 600 sports a price/earnings multiple of 16 times this year’s expected earnings, just above the EAFE’s 15 times. The S&P trades for a loftier 18 times. “Historically, the U.S. premium has been one to 1.5 multiple points, not three,” says David Donabedian, chief investment officer at Atlantic Trust.

Valuation isn’t enough of a reason for international stocks to outperform, but better earnings growth could be a catalyst. “The U.S. is much closer to peak earnings than Europe,” he says. Dividend yields also favor foreign stocks. EAFE components yield 3%, compared with 2% for the S&P.

(Barron’s)

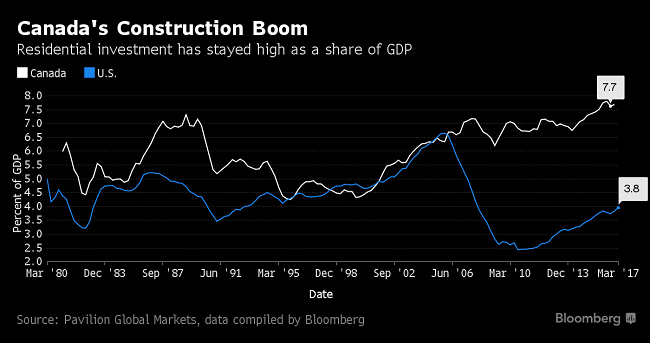

Of course, you have to be a bit careful about blindly buying the EAFE because it includes Canadian equities…

Moody’s lowered the debt rating on Canadian Banks last week as a result of the recent problems in its mortgage sector combined with its over reliance on its residential building boom.

Finally, congrats to all of this year’s college graduates. You are hitting it perfectly…

This spring’s crop of college graduates has an extra reason to celebrate: Not only are new grads entering one of the strongest job markets in recent history, but starting salaries are rising, too.

The average base pay for college grads this year ticked to the highest level in at least a decade, to $49,785, according to an analysis of more than 145,000 entry-level positions by executive-search firm Korn/Ferry International, KFY +1.38% up 3% from last year.

Adjusted for inflation, today’s salaries are 14% higher than those of students who graduated in 2007 before the start of the recession, and reflect overall strength in hiring as the national unemployment rate hovers at a 10-year low. The firm has analyzed entry-level pay from just the past decade, but a spokeswoman said that given longer-term salary trends, this year’s grads will likely be the highest earning class in recent history.

(WSJ)

Copyright © 361 Capital