Five Reasons Not To Sell in May

by Burt White Chief Investment Officer, LPL Financial Ryan Detrick, CMT. Senior Market Strategist, LPL Financial

Key Takeaways

• “Sell in May and go away” has become cliché, but the data are tough to ignore.

• Market strength heading into this seasonally weak period and broad participation in the global bull market help reduce the chances of a major sell-off.

• Additionally, low odds of a recession, improving earnings, and historically strong gains after new highs further support buying any potential weakness.

“Sell in May and go away” is probably the most widely cited cliché in stock market history. May is upon us, which sparks a barrage of Wall Street commentaries, media stories, and investor questions every year about the popular stock market adage. This week, we tackle this widely cited seasonal pattern, but focus on some reasons it might not work this year.

WORST SIX MONTHS OF THE YEAR

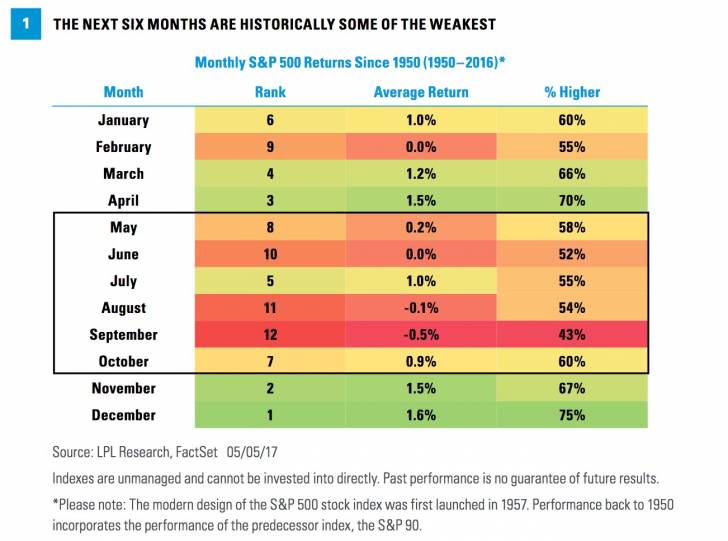

The old stock market adage “sell in May and go away” is based on the seasonal stock market pattern in which the six months from May through October are historically weak for stocks, with many believing you are better off simply avoiding the market altogether and moving to cash during the historically troublesome summer months. Stocks have gained 1.4% on average during these worst six months (since 1950*), compared with 7.0% during the November to April period. Here are all the monthly returns for the S&P 500 Index [Figure 1]. The summer months can be rather tricky and other than a July bounce, June, July, and August have been the three weakest months of the year on average.

Chart 1 This brings the obvious question: If long-term history suggests these next six months are indeed the worst six-month period of the year, then why hold? While we do respect “Sell in May,” and going away for the summer months sounds like a good idea, looking at the current data in context does not actually suggest selling.

STRENGTH HEADING INTO MAY HELPS

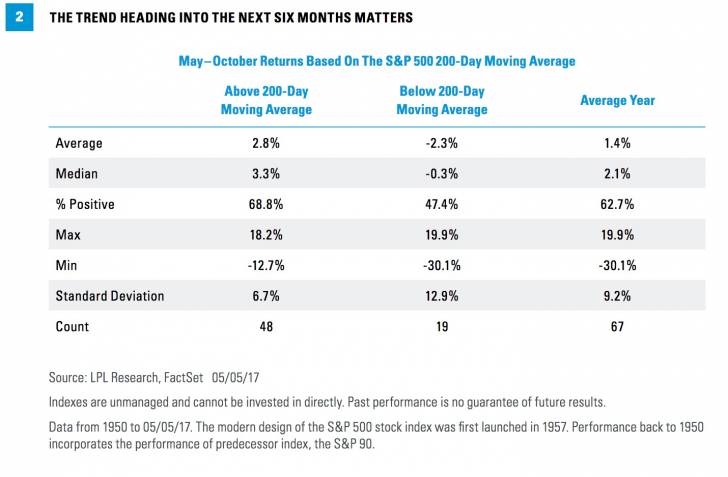

One way to assess the longer-term direction of a market trend is to use the price compared with its longer-term moving average. One popular moving average to use is the 200-day moving average, which as the name suggests is the average of the previous 200 closes. We looked back since 1950 and found that the S&P 500 was above its 200-day moving average 48 times as it headed into the worst six months of the year. Sure enough, the average gain was 2.8%, double the average of 1.4% for all years. Also, those six months were higher 68.8% of the time, versus 62.7% for all years. Further analysis

THE TREND HEADING INTO THE NEXT SIX MONTHS MATTERS

showed that the 19 times the S&P 500 started under its 200-day moving average, the index fell by an average of 2.3% over the following six months and was only higher 47.4% of the time [Figure 2]. In other words, the S&P 500’s firm uptrend in 2017 may bode well for the next six months.

THE BULL MARKET IS GLOBAL

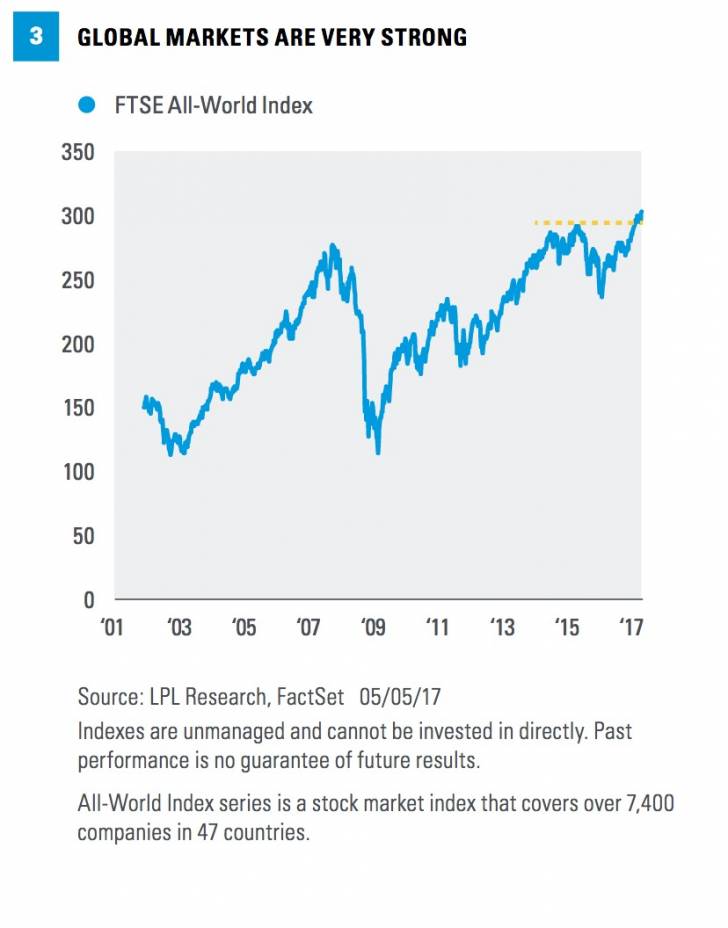

Another reason not to “sell in May” is the strength of global markets. The S&P 500 closed at new all-time highs on Friday (May 5, 2017), but what makes the current backdrop so bullish is how strong developed and emerging markets are as well. Equity markets in Argentina, Australia, Austria, Germany, Portugal, India, Mexico, Netherlands, and South Korea are at or close to all-time highs. While not at all-time highs, markets in Hong Kong, France, Greece, Portugal, Italy, Japan, and Spain are at or near 52-week highs. The global breadth of technical strength may help lessen the potential for a big “sell in May” event.

The FTSE All-World Index, which includes nearly 50 different countries and covers 98% of the world’s investable market capitalization, is an easy way to show how global markets are doing. It broke out to new highs earlier this year and made another new all-time high last week. All in all, it further confirms this bull market is global, not just a U.S. event [Figure 3].

BUSINESS CYCLE AND EARNINGS ARE STRONG

Two more reasons we might not need to “Sell in May” are that the business cycle and earnings are both healthy and expanding. We believe the current economic expansion has the potential to continue for at least the next 12 to 18 months based on our analysis of the leading indicators. Most bear markets occur near recessions, and the U.S. economy is simply not showing signs of excesses that historically have built up and led to the end of prior business cycles. In the absence of recession, any stock market declines tend to be more modest. We expect more volatility in the second half of the year, but the generally favorable economic backdrop should encourage the dips to be bought.

Earnings have been perhaps the biggest driver of this year’s stock market gains, with the possible exception of policy optimism (the two are related, so perhaps both can stake claim). Although hard to estimate, policy could add several percentage points to 2018 earnings after what we anticipate will be mid-to-high single digit earnings gains for S&P 500 companies in 2017. We expect earnings to be supported by a slight pickup in economic growth, a stable U.S. dollar, and rebounding energy sector profits.

Corporate America is doing even better than that pace in the first quarter. A very strong 75% of companies have beaten consensus estimates, producing a growth rate of near 15% with more than 400 S&P 500 companies having reported. Most companies have offered upbeat outlooks, reiterating or increasing guidance, which has led estimates to be resilient. We expect the strong near-term earnings outlook to help support stocks over the next three to six months as it has in recent weeks.

BUYING AT ALL-TIME HIGHS CAN BE A GOOD THING

The S&P 500 closed at a new all-time high on Friday. This could, perhaps counter-intuitively, be another reason not to “Sell in May.” Analysis of the S&P 500 Index indicates that from the date of any given all-time high, the index has historically hit another all-time high within one month 92% of the time.

Extending this time frame to three months increases those odds to over 97%, and extending to one year the odds approach 99%. Based on those odds, you have a very good chance of seeing another all-time high pretty soon after hitting one.

CONCLUSION

Although these numbers are reassuring, they only tell a small part of the story. Hitting another all-time high after a short period of time is great, but if those gains evaporate before a sale occurs, they really don’t matter. Are those gains sustained so they can be captured by investors over a longer-term investment horizon? The answer, historically, has been yes. If you bought at an all-time high, the S&P 500 was on average 0.5% higher after one month. After three months the average gain was 1.8%, and after one year, the average gain was 7.9%. Six-month and one-year performance has been slightly better than the average over the entire time horizon we studied, back to 1928. Longer time horizons tend to favor investing when markets have not been at all-time highs, though the numbers still show strong performance is possible even when investing at all-time highs. It is human nature to be nervous at such times, but the numbers support investment consideration.

“Sell in May” is one of the most popular investment clichés, but it also has a good deal of historical data to back it up. But remember, no investment rule of thumb works all the time. With global equity strength heading into this weak seasonal period, improving earnings, a business cycle showing little sign of recession, and history saying new highs have usually been followed by more new highs—the odds that we see a major “Sell in May” event this year is minimized in our view. This isn’t to say volatility won’t pick up later this year, we think it will; but we would consider using any weakness as an opportunity to increase equity exposure. •

Thanks to Jeffrey Buchbinder and David Tonaszuck for their contributions this week.

*****

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal, and potential liquidity of the investment in a falling market.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

All investing involves risk including loss of principal.

INDEX DESCRIPTIONS

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. FTSE All-World Index series is a stock market index that covers over 7,400 companies in 47 countries starting in 1986/

It is calculated and published by the FTSE Group, a wholly owned subsidiary of the London Stock Exchange which originated as a joint venture between the Financial Times and the London Stock Exchange.

Copyright © LPL Financial