Why do I own bonds?

by Douglas Drabik, Fixed Income, Raymond James

To fixed income gurus, the question, “Why do I own bonds” may feel much like fielding the question, “Why do I breathe”. The quick answer is, “I need to in order to survive.” OK, breathing is a critical exercise in providing physically existence but owning bonds can be likened to providing wealth sustenance. Often asset allocation is treated as if it were a contest or show of dominance by pitting one asset class against the other. It’s not a contest but a welcome accord. The truth is that a healthy portfolio depends on various asset classes to optimize a hearty life. Various assets such as MLPs, equities, real estate or alternative investments tend to carry higher risk levels but also carry higher potentials for growth. If these asset classes perform well, another portion of the portfolio, bonds, may provide the best means to safeguard that accumulated wealth.

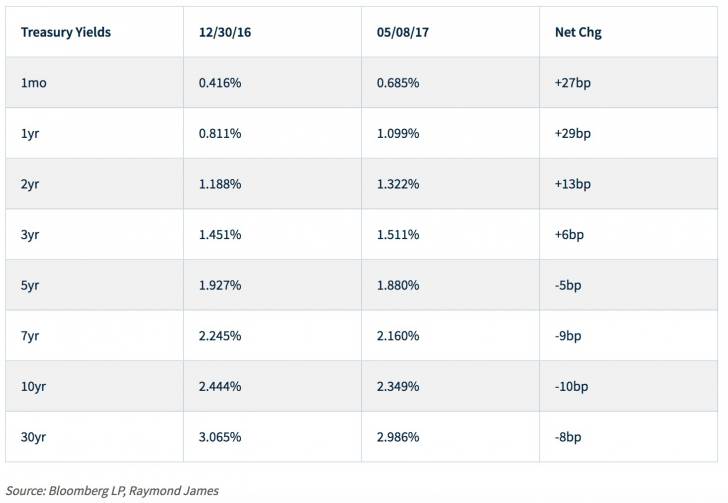

We’ve heard this before but what if rates stay low? How do I justify putting anything into bonds? First of all, rates are and have stayed low. A point of importance is that the ‘low’ rates we are labelling refers to nominal interest rates (i.e. the actual yield bonds are paying). By recent historic norms, real interest rates (yields earned after inflation), reflect a different picture. Although interest rates have declined, so has inflation. Under the current environment nominal and real interest rate variance is narrower than the appearance of solely focusing on nominal rates. So as we make the point about investing in a lower rate environment, investors should be mindful that the ‘higher rates’ earned in the past were somewhat offset by the higher inflation eroding the return.

To make the point, an extreme period would be on March 31, 1980. The 10-year Treasury rate was 12.64%. Most investors would be quite excited to see this rate today, especially on a high credit-quality bond; however, although the nominal rate was 12.64%, it was coupled with 14.8% inflation. The real rate of return was actually -2.16%. For 2 decades between 1980-2000, the 10-year averaged 8.62% but inflation averaged 4.3% bringing real rates closer to a 4.3% average.

Interest rates have been on a general decline for over 35.6 years but with the critical distinction between nominal and real rates addressed, the importance of investing in bonds even when nominal rates are low remains a key component of investing success. There is a protection gained from bonds when interest rates decline. It is called appreciation. Nice but not vital to the characteristics a well-diversified portfolio of higher quality individual bonds serve within most of our clients’ portfolios. The conservative nature built into bonds is threefold: 1) bonds provide a defined cash flow, 2) bonds provide a predictable income stream and 3) bonds decree a stated date for the return of face value. These three characteristics are what create the conservative nature of bonds.

Investors may fall into the trap that low durations are intrinsically “conservative”; however, bonds interact with the other components (asset classes) to provide their safeguard benefits. Bonds with higher duration are more likely to be non-correlated to equities, thereby more likely to hold up during periods of time when equities or other growth assets are getting battered by the market. This becomes even more imperative when the asset allocation mix of a portfolio is especially over-weighted with one type of asset class. When interest rates rise, this point is emphasized by the idea that as long as an investor holds onto their bonds, none of these bond qualities (cash flow, income or maturity) are altered regardless of changes in interest rates.

Interest rate risks are always present regardless of where current interest rates reside; however, there may be a higher risk associated with leaving growth assets unprotected than by potential opportunity risks lost when or if interest rates rise. A balance of asset classes providing the benefits of appropriate bond characteristics within the fixed income portion may prove to be one of the better investment opportunities available to optimize portfolio return while protecting amassed wealth. This is why one owns bonds!

Copyright © Raymond James