by Gregory Kolb, CFA, CIO, Perkins Investment Management

Gamblers wagered a record $138.5 million on the Super Bowl at Nevada casinos, according to Bloomberg. The prop bet menu was predictably amusing, including coin toss winner (tails), Lady Gaga's hair color (blond) and whether "Houston, we have a problem" would be said during the broadcast (it wasn't). Even more exciting would have been to parlay, or combine, many individual wagers on the game into a single bet. While the probability of winning a parlay is relatively low, the potential for a high payout is tempting and, for those so inclined, adds extra excitement to the game regardless of the outcome. Of course, if any of the wagers in the parlay lose, the entire parlay loses. The intrigue of a parlay bet lies in its payout structure.

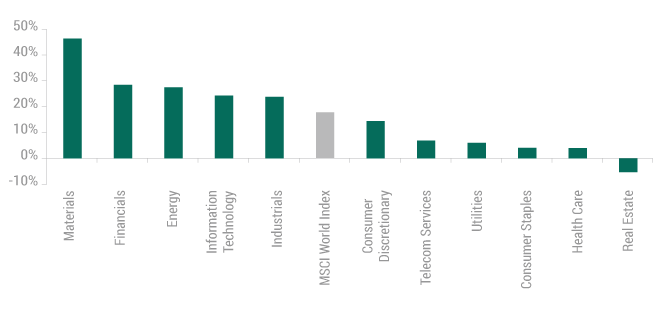

What is the nature of the payout structure in the stock market today? Increasingly it appears that many positive developments are being assumed for the (near) future. If there is major tax reform, and if there is deregulation across many industries, and if there is new infrastructure spending, and if China can sustain its high growth, and if Europe can negotiate a smooth Brexit ... the list goes on. Then what? Consensus estimates are increasingly bullish, with S&P 500 earnings per share expected to grow 20% in 2017 to $130 — which would be a new record high — after two years of stagnation. Optimism regarding future developments can also be seen in the dramatic gains within cyclical sectors of the market. In the past year, MSCI World materials (+46%), financials (+28%) and energy (+28%) surged ahead of more stable sectors including health care (+4%), consumer staples (+4%) and utilities (+6%). Investors have aggressively shifted their fund flows from the stable to the cyclical, according to Bloomberg Barclays. Expectations for economic and profit growth moved higher during 2016, and then were super-charged after the U.S. presidential election, based on a variety of policy hopes. This more bullish outlook may or may not prove correct. What is increasingly clear, in our view, is that the dominant narrative in the stock market is comprised of ever more positive assumptions, akin to a long-shot parlay bet.

THE ASCENDANT CYCLICALS

MSCI World Index 1 Year Sector Returns (as of 1/31/17)

Source: Wilshire Analytics. Real estate sector reflects return since becoming new headline sector. 8/31/16

Let's be honest, the attraction of a convoluted parlay is not the low probability of winning; rather it is the high payout for winning! And it can be fun to dream a little now and then. But your stock portfolio is a serious matter. In addition to considering the likelihood of a positive outcome, one must contemplate the upside potential, or payout, should events unfold favorably. The S&P 500 Index has tripled since the lows of March 2009 and now trades for 17x 2017 estimated earnings, while in Europe the STOXX 600 Index trades for 15x earnings. These valuation levels are high in comparison to the past 10 to 15 years, and may constrain future returns. Stock dividend yields are modest — as of 1/31/17, the MSCI World Index yields 2.44% — which also suggests unexciting upside potential. Interest rates have been low for years, and while this is supportive of stock prices by way of a lower discount rate, this circumstance is likely already well considered by markets and thus priced into stocks. All of this is to say that if current optimism over earnings and economies proves correct, even then the payout to stock investors may not be very attractive. A low probability, low payout bet does not a bargain make.

It can be fun to dream a little now and then. But your stock portfolio is a serious matter.

The investment staff at Perkins is approaching today's market environment with considerable caution. Yes, we are considering President Trump's tweets and other developments in Washington. Paying attention to the political/central bank nexus worldwide is a requirement today. At the same time, identifying noncorrelated opportunities (such as newly delevered balance sheets courtesy of wide-open capital markets), pockets of pessimism (like UK real estate due to Brexit fears), and secular growth situations (for example, the shift to digital advertising) are all areas of focus. We are maintaining discipline in the consideration of downside scenarios, particularly for the newly resurgent cyclical stocks. In many cases, the recession risk which laid these stocks so low just one year ago remains all too real. Diversification remains crucial, and is a practical response to considerable uncertainty.

As for payout structure, a high probability of an equity-like return (mid/high single-digit, over time) is OK in the current environment. We are seeing much worse on offer across the global stock market in our bottom-up research every day. We have a mantra at Perkins: We will consider downside risk before upside potential. Recouping significant losses in an investment portfolio is very hard; better to defend your capital instead. Repeat the mantra often.

Gregory Kolb, CFA

Chief Investment Officer,

Portfolio Manager

Copyright © Perkins Investment Management