by Ryan Detrick, LPL Financial

Like a nightmare from a bad ‘80s horror movie, the Greek debt crisis has re-awaked to claim another victim. Or maybe just to give us a few more sleepless nights.

Many thought that the crisis was over, but it was not. Greece and its creditors, primarily the European Central Bank (ECB) and the International Monetary Fund (IMF), had worked out a payment plan. Included in that plan were certain conditions, such as severe austerity measures that would result in Greece having a budget surplus equal to 3.5% of its gross domestic product (GDP). These targets are being achieved, but at a high cost to the Greek economy.

Greece still needs to borrow more money to complete its restructuring, and the two creditors do not agree on the next steps. The IMF has suggested that Greece’s creditors write down a portion of the debt owed. It believes that since Greek debt currently is approximately 175% of its GDP, the government couldn’t pay it off when the last bailout occurred, can’t pay if off today, and will not be able to pay it off tomorrow. Take the principle reduction (the so-called haircut) and let Greece have a more traditional economy.

However, European governments (and therefore the ECB) look at it differently. They are prevented, by the terms of the Treaty of Lisbon (that created the European Union [EU] and from which the U.K. is withdrawing) from allowing a member state to default on its debt. By law, this would require Greece to leave the EU and the Eurozone, which many people believe would be problematic for the Greek economy and the wider region.

Importantly, Greek entities (both government and private sector) have borrowed money in euros. If Greece were to leave the Eurozone and revert to the drachma, it would difficult, and perhaps impossible, for some of those entities to earn enough euros to repay their debts. Defaults across the region would likely increase, further weakening the Greek economy.

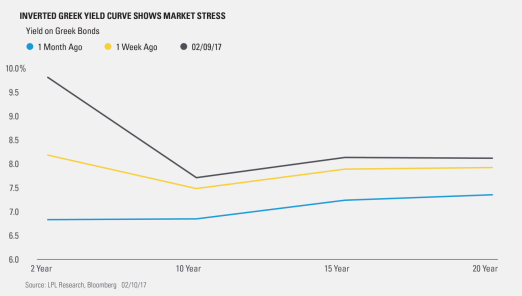

We are seeing this tension between the political and the economic issues play out in the market for Greek bonds. Yields on the Greek two-year bond moved above the yield on the ten-year over the past week.* This yield curve inversion indicates that investors are less certain that Greece’s problems will be resolved in the short term (two years), but have greater confidence in a longer-term fix, as represented by the lower yields on the 10-year bonds.

IMPORTANT DISCLOSURES

*As of 2/10/17.

Past performance is no guarantee of future results.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

The economic forecasts set forth in the presentation may not develop as predicted.

International and emerging markets investing involves special risks, such as currency fluctuation and political instability, and may not be suitable for all investors.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all of private and public consumption, government outlays, investments, and exports less imports that occur within a defined territory.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor Member FINRA/SIPC

Tracking #1-581131 (Exp. 2/18)

Copyright © LPL Financial