by Blaine Rollins, 361 Capital

Market psychology was tested last week. Early in the week, the nightly news flow out of Washington D.C. was so concerning, that it felt as if the markets could have easily opened limit down the next morning. Early stock market supporters of President Trump were becoming concerned and hedging their bets to the press and likely in their portfolios. With so much political capital being used to launch the Executive Order on Immigration, many wondered if there would be much left in the tank to go after the big economic items (like Taxes, Obamacare and Infrastructure).

But almost as if the White House knew that it was trailing by 25 points at halftime, things slowly started to get better as the week moved forward. The second derivative of mistakes being made became less negative and the market took notice. Comments from Sec. Mattis, Sec. Tillerson, Amb. Haley and Jared Kushner definitely helped. The announcement of Judge Gorsuch for SCOTUS and the rollbacks of Financial regulations were also viewed as wins. Outside of politics, a week of solid earnings reports (thanks Apple) and a Goldilocks job report helped the markets finish healthier than they began. So if you are long, there is hope that the White House is settling into its new digs and staffing up for the long road ahead. I heard from too many worried investors last week. Plenty of hands seem to be hovering over the ‘Sell” button. Let’s see if this week can continue the improving sentiment trend.

The press was ruthless last week. But the S&P 500 finished up…

(@AlexJamesFitz)

(@nickbilton)

Probably many locker room speeches were given last week. Maybe this one on Monday night turned it all around?

At a senior staff meeting last Monday, according to one adviser in attendance, the president delivered an unmistakable decree: “Reince [Priebus] is in charge. He’s the chief of staff. Everything has to go through him.”

That directive included setting clearer boundaries between the various departments and assertively tamping down on reports of staff infighting, which aides said personally angered the president.

Over the rest of the week, Priebus sought to assert control over the policy process and interagency communications, slowed the assembly line of executive orders to avoid errors and tried to organize the daily rhythms in the White House.

Even Gary Cohn (White House economic advisor) admitted that they are running full speed…

“We’ve got a lot of balls up in the air. We’ve come out of the blocks fast. We’re trying to get as much done as we can. We’re throwing a lot of ideas around. And look, we’re going to get to the right place.”

“It is a different culture than running a financial services company. Every day I learn more. Every day I get smarter. But every day, I feel like we as a team in the White House are getting better and better at what we’re doing.”

(CNBC)

Goldman Sachs was one of many who decided to down shift their financial expectations for this new Government…

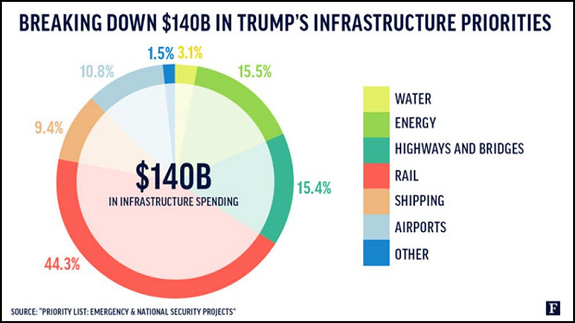

If the White House does get the ball rolling, here is a good map of their infrastructure projects…

A 50-project list outlining President Donald Trump’s infrastructure priorities surfaced last week. The projects on the list, titled “Priority List: Emergency and National Security Projects,” would cost about $140 billion and employ the equivalent of 24,000 workers for 10 years.

(Forbes)

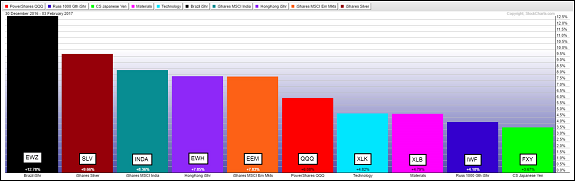

Onto the markets. If you are having a good 2017, you are likely invested in a few of these asset classes…

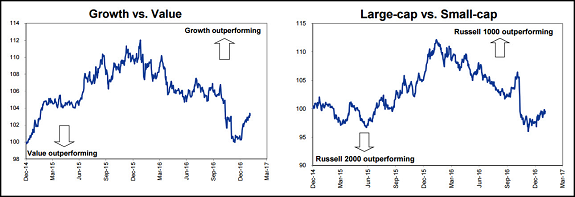

With the pullback in the Trump trade, Value and Small Cap stocks have underperformed YTD while Growth and Large Caps have led…

But the one-year trend still favors Value and Small Caps. Up to the White House to execute. A stronger U.S. dollar also won’t hurt for Small Caps.

(Goldman Sachs)

One reason that Growth has outperformed has been the Semiconductor stocks which are in beast mode…

One of the more interesting moves last week was in the Healthcare space…

It did not hurt the industry that at a meeting with the White House last week, it was said there would be fewer comments about price controls going forward. And a more drug trial friendly commissioner at the FDA would be a big plus for the drug and biotech stocks.

On the flip side, Energy stocks continue to be significant underperformers in 2017…

A warm winter and a rise in U.S. drilling cannot be positives.

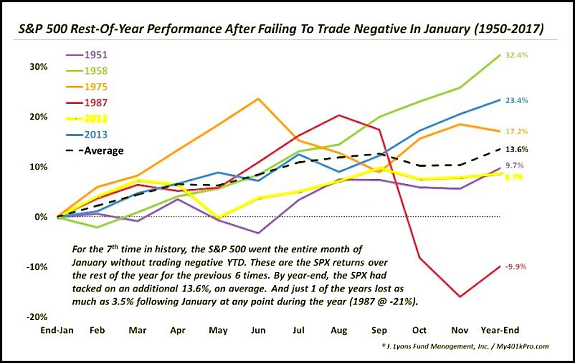

As so goes January goes the rest of the year?

January did not post a YTD loss for the S&P 500. In the past this has helped to indicate a healthy environment. Will 2017 repeat?

(jlfmi)

Looking at economic data, the ISM Manufacturing numbers last week continued up and to the right…

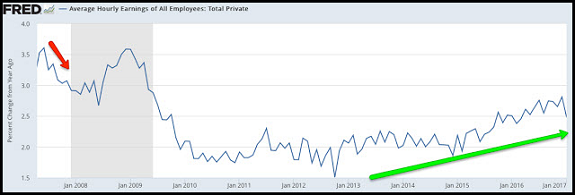

The jobs numbers Friday showed good non-farm payroll growth with an easing in average hourly earnings. Pass the porridge…

Average hourly earnings growth was 2.8% yoy in December, the highest growth rate in 7-1/2 years. That dropped to 2.5% in January. This is a positive trend, showing demand for more workers. Sustained acceleration in wages would be a big positive for consumption and investment that would further fuel employment.

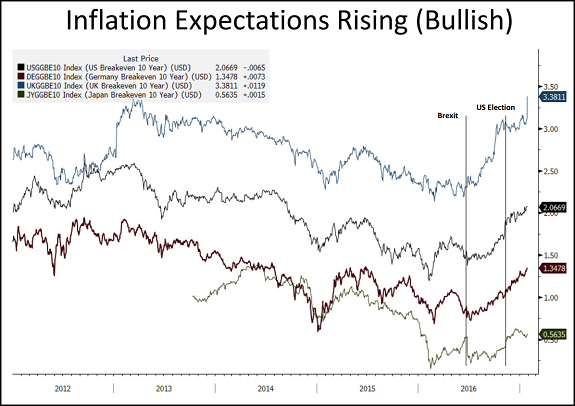

But inflation is becoming more evident in other series of numbers. Like in the ISM Service data…

And as RenMac shows, the markets are continuing to price in higher inflation into the markets…

(RenaissanceMacro)

And Morgan Stanley expects U.S. Capex to leg higher…

“It appears that capex plans have turned a corner and, if sustained, could put in the best year of performance since 2007,” concludes Zentner. “Recent strength in core capital goods orders — up 0.8 percent in December following an upwardly revised 1.5 percent gain in November — points to a broader improvement starting to take hold, and given the lead-time in capex plans we would expect this gain to be extended.”

Lots of earnings last week. The Amazon release showed why you want them to invest every dime they can back into the business…

(Goldman Sachs)

Our U.S. Crane count chart was of much interest last week. Now let’s look at a Global Skyscraper chart…

China has erected more skyscrapers in the past five years than the world built over the entire 20th century – 272 versus 265. In 2016 alone, China completed a skyscraper roughly every fifth day, for an annual total of 84, a figure greater than all the buildings wielded together in North America over the past quarter‐century.2 (Note: a skyscraper is defined as being higher than 200 meters, or 656 feet).

The total for 2016 marks a record high for China, with completions last year up 23.5% from the prior year. It was the ninth year in a row that China led the world erecting steel birds. Incredibly, 31 cities in China had at least one 200‐meter‐plus building completion in 2016, with Shenzhen, the southern manufacturing hub in Guangdong province, finishing 11 buildings. That is more than any single country (except China, of course) and more than the United States and Australia combined.

(U.S. Trust)

This is one crazy chart. How or will these two lines meet again?

(@epomboy)

Silicon Valley is to tech companies what Boulder is to food companies…

“When we were getting started, Kristy was calling all over the place to figure out where to get ingredients and the packaging we’d need,” said Mr. Lewis, referring to his wife, also a company co-founder. “Over time, she was calling people in Boulder three, four, five times a week for advice, and we just realized that our support network was here.”

Boulder is perhaps best known for craft beer and bicycles — there’s almost one for every person living here — and for being home to Mork and Mindy. But among foodies, it is also known as the place where new companies are challenging the old guard in the food business.

Up-and-coming food companies like Purely Elizabeth, Made in Nature and Good Karma Foods have relocated to Boulder to take advantage of the city’s deep bench of food executives, a food retail environment that prizes innovation and experimentation, and a growing pool of money for investments in food companies, among other things.

And the infrastructure such companies need — brokers, distributors, contract manufacturers — is arriving as well. The second-largest natural foods distributor, KeHE, opened an office here in 2013, and the Rodale Institute, a nonprofit research group devoted to organic farming, is opening a satellite office here.

Finally one for you parent coaches…

Print out this chart for your sports binder. Pull it out at halftime to remind your team to never give up, or to take a big lead for granted.

(@SportCenter)

Copyright © 361 Capital