by Frank Holmes, CIO, CEO, U.S. Global Investors

Saturday marked the Lunar New Year, the most important date in the Chinese calendar. It’s also the start of the longest holiday at two weeks, during which the largest mass migration of humans occurs every year as families reunite and go on vacations, both domestic and overseas.

2017 is the year of the 10th Chinese zodiac, the fire rooster, one of whose lucky colors is gold. Year-to-date, gold—the metal, not the color—is up 3.5 percent, which is below the 5.7 percent it had gained so far around this time last year. Unfortunately, gold prices won’t find support from Chinese traders this week, as markets will be closed in observance of the new year. If you remember, the yellow metal had one of its worst one-day slumps of 2016 back in October during China’s Golden Week, when markets were similarly closed.

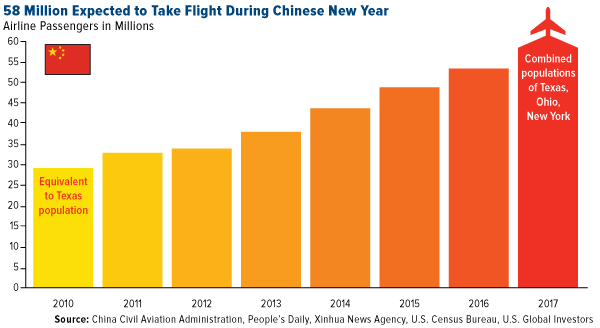

But there are other opportunities to get excited about. More than 3 billion trips are expected to take place domestically this year—58 million by air alone. That’s up from 55 million last year and is equivalent to the combined populations of Texas, Ohio and New York. China Southern Airlines, the largest carrier in Asia, added as many as 3,600 flights to accommodate the demand.

As disposable incomes rise in the world’s second-largest economy, travelers are more inclined to take their new year celebrations outside the country. This year, 6 million Chinese tourists are expected to travel abroad and spend more than $14 billion in 147 destinations, the U.S. included. As I’ve mentioned before, China is home to some of the biggest overseas spenders, with 128 million people spending a whopping $292 billion in 2015 alone.

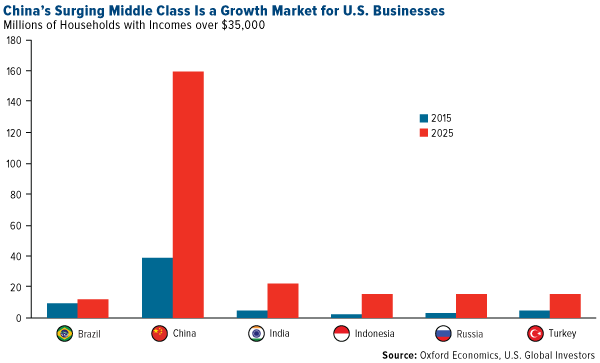

Betting on China’s Surging Middle Class

A theme I’ve written and spoken about frequently is the emergence of new investment opportunities as more and more Chinese citizens join the middle class and build disposable incomes. The size of the Asian giant’s middle class has already exceeded that of America’s. Looking ahead 10 years, the number of Chinese households with incomes over $35,000 is now expected to surge 300 percent, from 40 million today to 160 million by 2025. That projection can be found in a January report from Oxford Economics, which points out that these new middle-class Chinese consumers “will demand more of the services and higher-end products that American companies export.”

“As China’s middle class expands, we expect demand for American-made goods and services to rise as well,” the economic advisory firm writes.

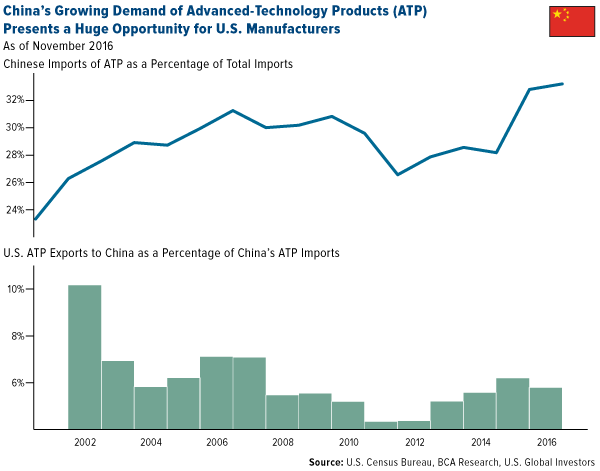

Among those goods are advanced-technology products (ATPs), made in American industries such as robotics, aerospace, electronics and pharmaceuticals. Chinese demand for such goods has indeed risen, from less than 24 percent of total imports in 2002 to close to 34 percent in 2016. However, the U.S. has been losing market share in exporting ATPs to China, according to a report this week from BCA.

Free Trade Has Benefited American Businesses and Consumers

BCA argues that President Donald Trump will need to work more cooperatively with the Chinese to regain market share for American ATPs if he’s truly committed to creating quality manufacturing jobs here in the U.S. At the moment, it’s unclear whether he’s serious about actually imposing sanctions on Chinese goods or whether he’s using the threat simply as a negotiating tactic.

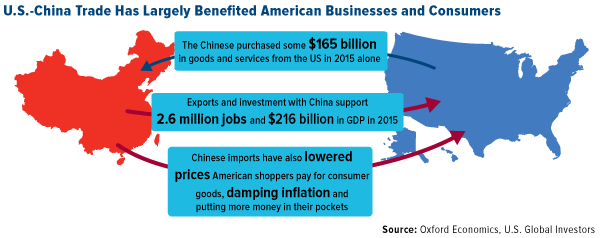

I agree with BCA’s analysis. Trump’s isolationist and protectionist leanings certainly raise the specter of a trade war with China, which would likely end up being worse for U.S. businesses and consumers in the long run. According to Oxford Economics, our trade relationship with China supports about 2.6 million jobs in the U.S. and has helped put money in Americans’ wallets by keeping consumer prices lower than they otherwise would have been. A typical American family making $56,500 in 2015 saved about $850 that year because of trade with China, Oxford estimates.

“Brewing trade tensions between the world’s two largest economies are undoubtedly negative for both the global economy and financial markets,” BCA writes, recommending that investors “should certainly hedge against such a scenario… with long positions on the dollar, gold, and the VIX,” or the Chicago Board Options Exchange (CBOE) Volatility index.

BCA makes a compelling case for gold. I’ve always recommended a 10 percent weighting—5 percent in bullion (coins, wafers and 18-22 carat jewelry), the other 5 percent in quality mining stocks and mutual funds.

China Champions Free Trade

Now that Trump is rethinking America’s involvement in free-trade agreements such as NAFTA, having already withdrawn the U.S. from the controversial Trans-Pacific Partnership (TPP), President Xi Jinping seems interested in positioning China as the global leader in free trade.

|

Earlier this month, Xi made the first-ever visit by a Chinese president to the World Economic Forum’s annual meeting in Davos, Switzerland, where he urged the world to “say no to protectionism.”

“Pursuing protectionism is like locking oneself in a dark room. While wind and rain may be kept outside, so are light and air,” he colorfully said. “No one will emerge as a winner in a trade war.”

It’s definitely a sharp departure from the norm of the past several decades that China should emerge as the world’s top defender of global trade at a time when the U.S. is set to turn inward, but this is the reality we live in now. I’m not the only one who feels this way. Speaking to Congressional Republicans in Philadelphia last week, U.K. Prime Minister Theresa May said that, while both countries are now on a more isolationist trajectory, the U.S. and U.K. must resist the “eclipse of the West.”

“We—our two countries together—have a joint responsibility to lead,” she said, “because when others step up as we step back, it is bad for America, for Britain and the world.”

As if to reaffirm its commitment to being a global leader in trade and economic development, China just agreed to cooperate with the Philippines on 30 regional infrastructure projects valued at $3.7 billion, according to Global Trade Magazine. This comes despite the two countries sharing a traditionally strained relationship over territorial rights.

What’s more, the China-led Asian Infrastructure Investment Bank (AIIB)—founded in 2015 to serve as an alternative to Western creditors such as the World Bank and International Monetary Fund (IMF)—will be joined by 25 new member-nations this year alone, including Ireland, Canada, Ethiopia and Sudan. The bank is leaving the door open for U.S. membership, but that appears unlikely under a Trump administration.

In its monthly investment report, HSBC recommends an overweight position in Chinese equities, citing improved economic activity, policy stimulus and strong credit. As for a U.S.-China trade war, the investment bank believes it to be unlikely. However, “rising trade protectionism or U.S.-China trade frictions may accelerate the development of high-valued industries in China,” it writes.

Touring the World’s Largest Building

On a final note, I was in Vancouver last weekend attending and speaking at the annual Vancouver Resource Investment Conference alongside old friends and colleagues such as Frank Giustra, Thom Calandra and many others.

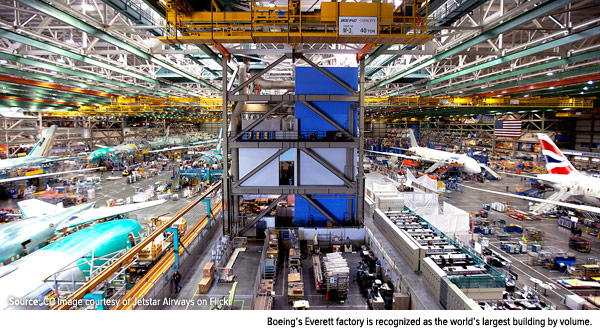

While up there, my friend Marin Katusa of Katusa Research organized a tour of Boeing’s monolithic Everett factory near Seattle, where the plane-maker builds its 747, 767, 777 and 787 Dreamliner jets.

At 13.3 million cubic meters, Boeing’s factory is recognized as the world’s largest building by volume. Words fail me in trying to describe how small and insignificant you feel in the presence of the site, which covers a massive 98.3 acres. The doors alone are the size of football fields. Among the world locations that could comfortably fit inside are the Pentagon, the Pyramids and all of Disneyland.

The thing is so monstrous, it has its own weather system.

It’s helpful to think of the factory as a small enclosed city, complete with its own hospital, daycare center, fire department and more. Security is very tight, and a strict “no photos” policy is enforced, for obvious reasons.

That’s why I recommend you go on the factory tour yourself the next time you’re in the Seattle area. Or make a special trip of it. Take a friend. It’s an impressive, awesome reminder of what American ingenuity and innovation is capable of, and I’m grateful to Marin for the opportunity to visit it.

On behalf of everyone at U.S. Global Investors, I want to wish you a Happy Chinese New Year! May the Year of the Rooster bring you lasting happiness, strong health and good fortune!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Chicago Board Options Exchange (CBOE) Volatility Index (VIX) shows the market's expectation of 30-day volatility.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of 12/30/2016: China Southern Airlines Co. Ltd., The Boeing Co.

This post was originally published at Frank Talk.

Copyright © U.S. Global Investors