Want Protection Against Rising Rates? Think Beyond Loans

by Fixed Income AllianceBernstein

Investors tend to think of floating-rate bank loans as an antidote to rising interest rates. It ain’t necessarily so. The problem: those loan coupons only float if LIBOR exceeds a certain threshold. But after a short initial waiting period, issuers can refinance their loans at will.

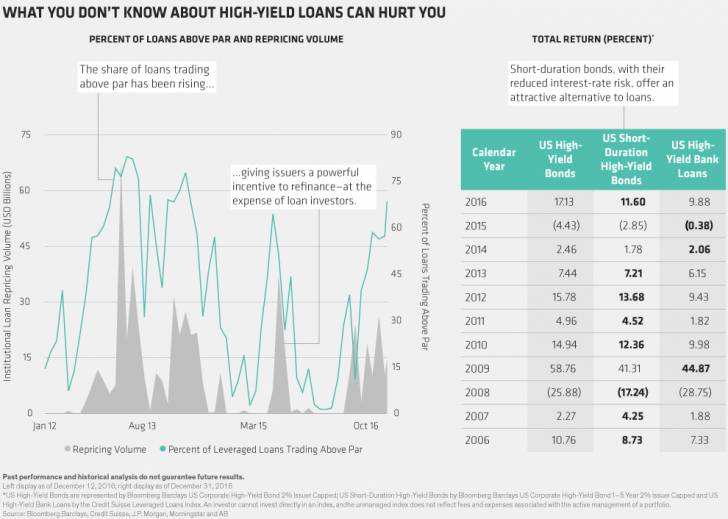

That’s what’s been happening lately. With nearly 70% of loans trading above par in December—the result of strong investor demand—issuers don’t have to wait for the coupons to rise. They can simply take out new loans at better rates, leaving investors with lower-yielding assets than they started with. This is partly why high-yield bonds have consistently outperformed loans.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Copyright © AllianceBernstein