by Jeremy Ryan, Wells Fargo Asset Management

I’m a big fan of the Beloit College Mindset List. Every year, the authors publish a list of things that define—or don’t define—the reality of the incoming class of college freshman.

In this year’s list, for example, we learn that the Class of 2020 has never lived in a world without eBay, wonders why people use email when there are perfectly good texting services available right on their phones, and disagrees with their parents about which Star Wars movie was the first one. The list offers a nostalgic way to check and challenge the assumptions we make about other generations.

Perhaps no other generation has had so many assumptions heaped on top of it as Millennials, particularly regarding financial matters. To that end, here’s an investment version of the mindset list for Millennials, as well as what it means for new investors and the financial professionals who help them.

Millennials’ mindset shaped by recession

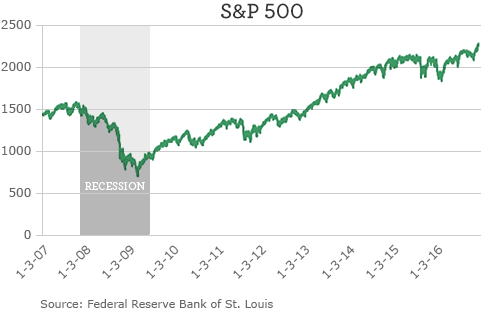

- The economy has always been in recession or recovering from recession. This generation has known nothing but one of the worst recessions in decades, followed by a slow and tepid recovery. There have been no surging moments of optimism about the economy. Instead, there’s usually been the sense that another shoe is about to drop. Some commentators have said that Millennials have a Depression-era mindset: cash and savings are top of mind, and long-term investments in stocks and bonds are perhaps luxuries that don’t fit in with an at times overly cautious approach to money management.

- Incomes have never grown. Wages have always been stagnant. When Millennials plan for the future, they can’t take into account a series of natural wage increases in a single job. Instead, they’ve gotten used to acquiring more and more qualifications to build out resumes and to ride each new qualification to a new rung of income, often in a new job in a new city. Compare this with the Boomers’ generation, which saw its greatest average hourly wage growth when Boomers were in their 20s.

- There has never been real inflation. Inflation and investing go hand in hand. Investors in previous generations grew up not only with moderate inflation but with inflation scares. In the background was always the concern that their incomes wouldn’t keep up with surging prices. By contrast, Millennials haven’t had to worry about inflation for the majority of their working lives, beyond swings in gasoline prices. That means the sting of reduced buying power has never been a motivating factor to invest.

- Events overseas have always dramatically affected U.S. markets. Japanese earthquakes. European debt struggles. China’s manufacturing output slows or grows. Ukraine. Greece again. Millennial investors have had to cope with a more interconnected and frequently chaotic world than previous generations. Why should the world’s biggest stock market tumble because a small European country can’t pay its debts? This is a very good question asked even by seasoned investors. Now imagine the only investing landscape you’ve ever known is one in which the tiniest of pebbles can cause massive ripples, and you have no idea who’s holding the pebbles. It’d be enough to make you extremely cautious about investing.

- It has always been normal to wait until your 30s for major life events (marriage, houses, kids). Extended educations. School loans. Underemployment in the aftermath of the recession. Jobs located in the priciest cities to buy houses. Add these up and you’re left with Millennials in their 30s starting to take on the bigger life events that previous generations tackled in their 20s.

Millennials should respect their financial mindset but also expect it to change

So, if you’re a Millennial or an advisor seeking to help Millennials with their investing needs, it helps to keep this mindset in view when talking about investing.

- Inflation might be making a comeback. A few years of above-average inflation can often be enough to get people to seriously question whether their savings are keeping pace with prices. If inflation hits 3% or 4% a year and your income is only rising about 2%, you’re effectively getting a pay cut with every passing year. Imagine a 30-year-old who put $100 into a non-interest-bearing account in 1980. They’d have hit the retirement age of 65 by now, and that $100 would still be $100. According to the Bureau of Labor Statistics, however, $100 in 1980 is the equivalent of $292 today, so the value of their money has shrunk to almost a third of its former value.

- Risk tolerance is inherently subjective. If you’re cautious, you’re not wrong. If you can’t get to sleep at night because you’re worried about the bottom falling out of stocks, then no one benefits. Stretching beyond your current appetite for risk could even hurt your long-term investing strategy. One market correction when you’re not prepared for it could send you running to the hills, never to return. Dial down the risk until you’re ready.

- But make sure you do reassess where you stand. Risk tolerance can change—and often does change—with research and experience and from deliberately taking a long-term perspective. Retirement accounts are perfect prods to this sort of mental exercise because their tax benefits come with the requirement that you can’t take out the money until you’re 59½ (on pain of taxes and penalties). Let your retirement accounts do the disciplined work of taking on that long-term perspective for you.

- Respect market volatility, but learn to appreciate market resiliency as well. What doesn’t get as much attention as the day-to-day volatility of the markets is their resiliency. Volatility makes noisy headlines; resiliency is quiet and takes a longer time frame to appreciate. But a longer time frame is exactly what investors need to consider. If your first brush with the markets came during the stark recession of 2007 to 2009, then skepticism is a natural and warranted reaction. But that initial reaction should be tempered by subsequent data, and the data indicates that the markets, once again, showed their resiliency.

- Major life events like marriage, first homes, and families might be backed up a few years, but that doesn’t mean they’re not on their way for most Millennials. Financial planning, whether on your own or with a trusted professional, will always be a good idea to make sure you’re in the best position you can be for the goals you set for yourself. Talk with someone about the future and the sort of resources that are available to help get you there.

Copyright © Wells Fargo Asset Management