by Douglas Drabik, Fixed Income, Raymond James

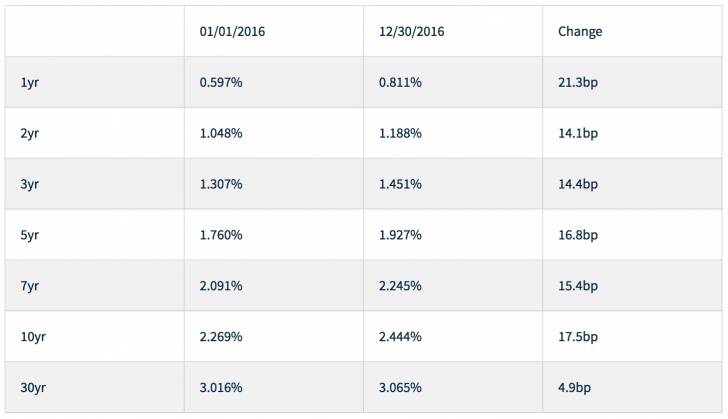

When it was all said and done and 2016 came to an end, 2017 arrived with interest rates narrowly higher. The long bond was 5bp higher at 3.06% versus 3.01% at the start of the year.

It can be surmised that rates ended the year slightly higher based exclusively on our national election. There was no significant difference in economic data, inflation, wages or any other economic identifier but the significant difference appeared in the change from a nation run by career political figures to the incoming ideal that it will now be run by business people. The take-away seems very evident: nothing will be the same. Change, whether deemed positive or negative, is on the way. The 2017 economic realm certainly stands to be transformed.

Since the election, the betting table has flipped. An emergence of Treasury future contract short-selling is partly responsible for the hasty year-end interest rate reversal. The selling of 10yr Treasury future contracts escalated. Now it appears a more conservative bet sees the selling of 5yr Treasury futures. These are bets that both economic growth and inflation will push Treasury prices down and yields up in 2017. (Source: Bloomberg LP)

OPEC seems to have a quarterly decree for cutting production and the most recent proclamation gave oil another price boost. Typically, this play is dismissed when one of the players decides it’s not worth losing market share; however, a greater force is shaping the energy world. The change here is that the U.S. is poised to be a net “exporter” of oil rather than “importer”. Much is set to play out in 2017 and the upcoming years.

The U.S. central bank, commonly referred to as the Fed, has been run by academics. It can be assumed that 2 slots to be immediately filled by Trump will go to business individuals. Chair Janet Yellen’s term will end in February, 2018. Another immediate impact will occur with the Supreme-court appointee where Trump has pledged to stick with a list of conservative nominees.

Looming over all these domestic changes is another enormously impactful change: the euro-zone and its survival or at least its composition. Germany’s vice chancellor just recently said that a euro-zone break-up is no longer inconceivable. The United Kingdom started the reality. Upcoming elections in France and the Netherlands have similar tones to the U.S. election with the “out with the old, in with the new” mantra.

It is always difficult to prognosticate but one thing seems certain entering 2017. People and nations are clamoring for change and this year can be expected to deliver.

Copyright © Raymond James