by Jeffrey Saut, Chief Investment Strategist, Raymond James

Around the turn of the century a bandit rode in from Mexico, robbed a small Texas bank, and fled back across the border. A Texas Ranger picked up his trail and nabbed him in a Mexican village. The bandit spoke no English and the ranger no Spanish, so another villager was asked to interpret.

“Ask him his name,” said the ranger.

“He says his name is Jose,” said the interpreter.

“Ask him if he admits robbing the bank.”

“Yes, he admits it.”

“Ask him where he hid the money.”

“He won’t tell me.”

Leveling his pistol at Jose’s head the ranger said, “Now ask him again where he hid the money.”

Jose quickly blurted out in Spanish, “The money is hidden in the well in the village square.”

“What did he say?” demanded the ranger.

The interpreter replied, “Jose says he is not afraid to die!”

The translation and interpretation of the news can play a crucial role on Wall Street. This is especially true when it comes to public perception; and the media plays a dominant role when it comes to shaping the public’s perception. And their modus operandi is clear. For instance, everyone has heard of the classic, “Is the glass half full or half empty?” Well, when it comes to media translation and interpretation it’s almost always half empty. Bad news sells newspapers, gets more TV and radio time . . . good news doesn’t. I mean think about it, only a few weeks ago the media said that a Trump presidency would be devastating for the stock market and the economy. Now, because stocks have rallied, pundits see a boom. As the erudite King Report notes, “Wall Street is not rational; it is rationalizing.”

Keeping the translation and interpretation theme in mind, come with us now in the Mr. Peabody “WayBack” machine (WayBack). The time was May of 2015 and the S&P 500 (SPX/2213.35) had peaked around 2135. Subsequently, the index “back and filled” between that level and roughly 1800, on increasingly wrong-footed negative media news, until July of 2016 when it broke out to the upside and tagged ~2194. We counseled that upside breakout was significant and advised increased equity exposure. Silly us, because the SPX declined back to its 2080 – 2100 support zone shortly thereafter. Undeterred, we continued to recommend the accumulation of equities, believing another new upside “leg” for this secular bull was in the offing. So let’s examine what has happened.

In the final analysis what has happened is that the D-J Industrial Average broke out to the upside in the charts from a 14-month consolidation in July of 2016. In the process it registered a Dow Theory “buy signal.” Dow Theory is the interrelationship between the D-J Industrial and the D-J Transportation Average. We are one of the last practitioners of Dow Theory after the passing of our friend Richard Russell (Dow Theory Letters) last year. Dow Theory is not always right, and it is subject to interpretation, but it is right a lot more than it is wrong. There was a Dow Theory “sell signal” on September 23, 1999, a “buy signal” in June of 2003, another “sell signal” on November 21, 2007, followed by numerous “buy signals” since the March 2009 lows. Dow Theory says that the primary trend of the equity market is “up” despite all the alleged uncertainty. Of course with most of the indices trading out to new all-time highs, it belies the old stock market “saw,” “The markets don’t like uncertainty.” In point of fact, “uncertainty” is the friend of the well prepared investor!

As for the short-term, there was this from an astute, Canada-based portfolio manager, namely Craig White:

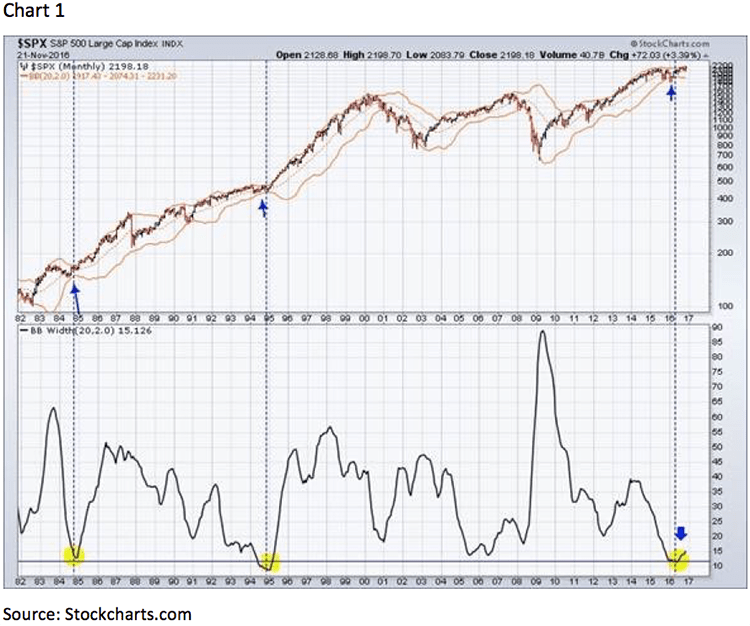

I came across the following chart in my morning readings. I believe you had talked about a Bollinger Band (BB) squeeze in recent months, noting that we were at a multi-year compressed reading. I do admit I am no expert on BB’s, but a ‘squeeze’ is a consolidation period of price, after which the price then breaks out in a particular direction if my past readings are correct. Looking at the chart (see chart 1 on page 3) highlighting the BB width, we can see that only 3 times since 1982 had we reached these recent ‘squeeze’ levels. The subsequent performance for equity markets was indeed favourable. I think it is no different this time.

Also waxing bullishly was Renaissance Macro’s Jeff deGraaf in last Wednesday’s MarketWatch article, as quoted by William Watts. To wit:

“The S&P 500 was up 3.4% in November through November 21. [deGraaf] found that when the S&P 500 is up 3.3% or more for the month through November 21, returns from that point through the end of the year average 200 basis points. When returns are less than 3.3%, the average is closer to 70 basis points.”

The call for this week: Interestingly, two of the longest secular bull markets chronicled in our notes began following Republican “revolutions.” The 1953 to 1973 bull market sprung from Eisenhower’s election (1952) and the subsequent infrastructure spending. The 1982 to 2000 secular bull market commenced with Ronald Reagan’s election (1980) and was initially driven by his administration’s tax cut and de-regulation policies. Yet Reagan’s secular bull market had a slow start, which is eerily being tracked currently. When Reagan was elected the D-J Industrials rallied from ~925 to 1017 (+9.9%). Then in early December the Dow pulled back to 900 from where the fabled Santa Rally began. That rally took the Industrials back above 1000 by year’s end only to see stocks decline into February where on February 5, 1981 President Reagan stated, “We have inherited the worst economic mess since the Great Depression.” Of course with that kind of statement stocks bottomed, carrying the Dow back to 1024, which is when Fed Chairman Paul Volcker jammed the prime interest rate to 21½%. From there stocks stumbled, registering a Dow Theory “sell signal” that would leave the Dow at 776.92 in August of 1982, which happened to be the “valuation low,” and the 1982 to 2000 secular bull market began. This is not an unimportant point, for the Dow made its “nominal” price low of 577.60 on December 6, 1974 (the lowest it would go in terms of price), but its “valuation low” (the cheapest it would get) came eight years later (8/12/82). So fast forward, the Dow’s “nominal” price low came on March 6, 2009, but the “valuation” low didn’t occur until October 3, 2011. Now consider this, NOBODY measures the 1982 – 2000 secular bull market from its “nominal” price low (1974), but rather from its “valuation” low of August 12, 1982. If that’s the case currently, this bull market is not as old as everyone thinks. Indeed, this secular bull may not even have gray hair! Look for a short-term trading peak in this overbought market that sets the stage for the fabled Santa Claus rally.

Copyright © Raymond James