by Frank Holmes, CIO, CEO, U.S. Global Investors

Share this page with your friends:

Please note: The Frank Talk articles listed below contain historical material. The data provided was current at the time of publication. For current information regarding any of the funds mentioned in these presentations, please visit the appropriate fund performance page.

November 21, 2016

It’s never too late to change your mind.

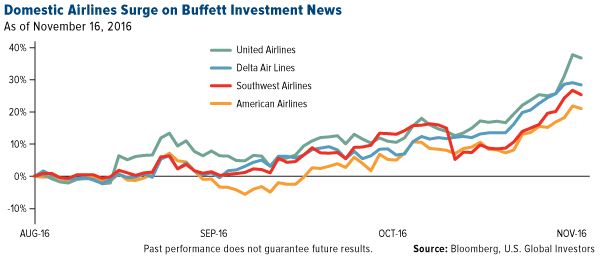

After years of deriding the airline industry, Warren Buffett confirmed last week that his holding company, Berkshire Hathaway, has invested nearly $1.3 billion in four big-name domestic carriers: American, Delta, United and Southwest.

The stake is a dramatic reversal for the 86-year-old investing wizard, who previously called the industry a capital “death trap” and once joked that investors would have been served well had Orville Wright’s plane been shot down at Kitty Hawk.

The thing is, Buffett held these opinions long before airlines began making the fundamental changes that would flip their fortunes from bankruptcy to record profitability. When Buffett first tried his hand at making money in the aviation industry in 1989, airlines were still struggling in a fiercely competitive marketplace. Many carriers called it quits, including President-elect Donald Trump’s Trump Shuttle, which ceased operations in 1992. Others spent years in bankruptcy court.

But following the massive wave of industry consolidation between 2005 and 2010, a new business environment emerged, one characterized by disciplined capacity growth, new sources of revenue, greater efficiency and a commitment to repairing balance sheets. I’ve written about these changes for the past 18 months, all of which are summarized in this brief five-minute video.

Buffett also likes airlines now for the same reason he’s long been a fan of railroads—namely, the barriers to entry are extremely high if not entirely impenetrable to new competitors. This is the “moat” Buffett refers to when talking about rail.

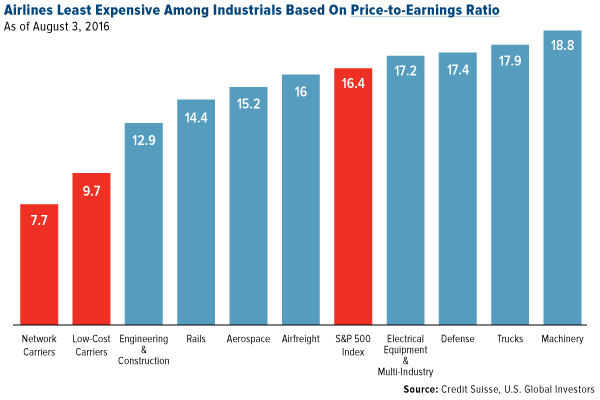

As a value investor, he prefers inexpensive stocks, and among industrials, airlines are cheapest of all, based on price-to-earnings and cash flow.

Buffett’s bullish rotation into airlines was followed by news last week that Citi also made fresh buys of Southwest, Delta, American and Allegiant shares, on the “broad theme that sector consolidation and an improved economy will reap benefits,” according to Seeking Alpha’s Clark Shultz.

Challenges still remain, of course, but domestic airlines today are profit-making, dividend-paying machines. In the first nine months of 2016, the top nine U.S. carriers—Alaska, Allegiant, American, Delta, Hawaiian, JetBlue, Southwest, Spirit and United—reported combined net income of $18.3 billion. That’s quite an improvement from the $11.2 billion they pocketed for the entire year in 2014.

Over the same nine-month period, airlines returned $11.4 billion to shareholders via stock buybacks ($10.5 billion) and dividends ($912 million), according to industry trade group Airlines for America (A4A).

Here’s Why Blue Skies Could Last

In the near-term and long-term, airlines continue to look very attractive. Air travel demand is rising as incomes grow and the size of the global middle class expands.

This Thanksgiving week, more than 27 million passengers are expected to fly on U.S. airlines, an increase of 2.5 percent over the previous year, according to A4A. Much of the demand is being driven by affordable airfare, which is at its lowest in seven years.

The picture looks just as optimistic further down the road. The International Air Transport Association (IATA) sees global passenger demand nearly doubling over the next 20 years. The group expects 7.2 billion people to fly in 2035, up dramatically from 3.8 billion last year.

The Asia-Pacific region should be the biggest demand driver, with China displacing the U.S. as the world’s largest aviation market. As I’ve written about before, the U.S. and China both agreed to extend visas for business travelers, tourists and students, which has already led to increased travel between the two nations. When I last visited the New York Stock Exchange recently, I noticed that half of the tourists appeared to be from China.

What Effect Might President Trump Have on Airlines?

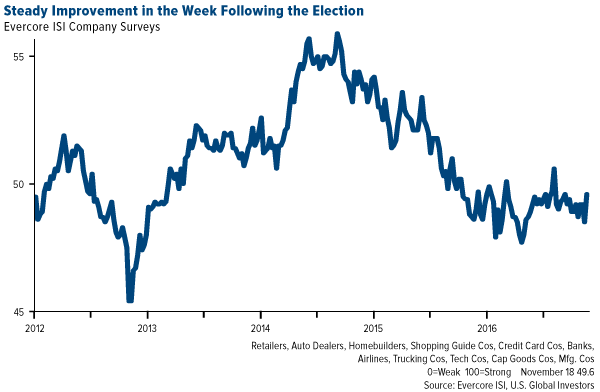

In the week following the presidential election, we saw modest gains in several sectors, including airlines. Evercore ISI’s proprietary Company Surveys, designed to monitor the economy on a weekly basis, showed a post-election bounce, rising 1.1 points to 49.6.

In many more ways than one, Donald Trump is unlike any other person ever to occupy the White House, bringing with him a unique set of skills and experiences that no other president can claim. As I mentioned earlier, he will become the first U.S. president who was formerly an airline executive. He also boasts an extensive background in tourism and hospitality, having built and managed everything from hotels to resorts to golf courses

Industry leaders, therefore, hope Trump will prove to be a powerful ally and take their side on several key issues. For starters, many are encouraged that the president-elect has proposed as much as $1 trillion in infrastructure spending on “our highways, bridges, tunnels, airports, schools, hospitals,” as he announced the day following last week’s election.

Trump has also promised to swing the pendulum away from monetary policy toward fiscal policy—cutting taxes and relaxing regulations—which has put Federal Reserve Chair Janet Yellen on the defensive. On Friday, she defended the Dodd-Frank Act, which Trump has vowed to dismantle, stating a repeal would increase the likelihood of another financial crisis.

As for the aviation industry, U.S. carriers have been pushing Congress for years to reform air traffic control so that the steering wheel is in the hands not of the Federal Aviation Administration (FAA) but a private, not-for-profit entity. Canada made a similar transition in 1996 when it turned authority of its civil air navigation service over to the privately-run Nav Canada, which today manages approximately 12 million aircraft movements a year.

The industry would also like to see open talks with several state-owned Middle Eastern carriers, whose governments provide tens of billions of dollars in “unfair” subsidies every year.

Jill Zuckman, chief spokesperson for Partnership for Open & Fair Skies, an airline lobby group, has urged Trump, a harsh critic of international trade agreements, to protect the interests of American airlines and workers.

“The Gulf carrier subsidies threaten the jobs of 300,000 U.S. aviation workers and the American aviation industry as a whole,” Zuckman alleged, “and we are optimistic that the Trump administration will stand up to the United Arab Emirates and Qatar, enforce our trade agreements and fight for American jobs.”

Other leaders see headwinds in some of Trump’s more isolationist and nativist rhetoric, particularly his tough stance on immigration from Mexico—currently the number two market for travel and tourism to the U.S.—and Arabic-speaking countries.

| Rank | Country | Number of Visitors, in Millions |

Percent Share | |

|---|---|---|---|---|

| #1 |

|

Canada

|

23.39 | 33.5% |

| #2 |

|

Mexico

|

14.34 | 20.6% |

| #3 |

|

United Kingdom

|

3.84 | 5.5% |

| #4 |

|

Japan

|

3.73 | 5.3% |

| #5 |

|

Brazil

|

2.06 | 3.0% |

| #6 |

|

Germany

|

1.92 | 2.7% |

| #7 |

|

China

|

1.81 | 2.6% |

| #8 |

|

France

|

1.50 | 2.2% |

| #9 |

|

South Korea

|

1.36 | 1.9% |

| #10 |

|

Australia

|

1.21 | 1.7% |

According to the Council on Foreign Relations, a travel ban on Muslims entering the U.S.—a controversial proposal Trump has since softened—could cost the U.S. economy as much as $71 billion a year and up to 132,000 American jobs. As The Economist pointed out in a recent article, travelers from the Middle East tend to be big spenders, shelling out 50 percent more per trip than Europeans on average.

Trump has also expressed interest in reversing current diplomatic relations with Cuba, favoring a reinstatement of old travel and trade embargos. (“The people of Cuba have struggled too long,” he tweeted in October. “Will reverse Obama’s Executive Orders and concessions towards Cuba until freedoms are restored.”) Many U.S. airlines have already begun scheduled flights to Havana, including United, American and Southwest, with others soon to follow (JetBlue, Alaska, Delta and Spirit, among others).

As for whom Trump might name as head of the Transportation Department—which oversees the FAA, Federal Highway Administration, Federal Railroad Administration and other agencies—rumors are circulating that it’s come down to either Rep. John Mica (R-Fla.), former House Transportation Committee chairman; or James Simpson, former commissioner of New Jersey’s Department of Transportation.

The airline industry has proven itself resilient time and again, emerging stronger from a decade ago. For investors, the group is relatively inexpensive and generous with its dividends and stock buybacks. Changes might very well be in the cards, but I remain bullish on airlines, just as Warren Buffett is.

CLICK HERE FOR ADDITIONAL RESEARCH ON THE AIRLINE INDUSTRY!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

Cash flow is the total amount of money being transferred into and out of a business, especially as affecting liquidity.

The price-earnings ratio (P/E Ratio) is the ratio for valuing a company that measures its current share price relative to its per-share earnings.

There is no guarantee that the issuers of any securities will declare dividends in the future or that, if declared, will remain at current levels or increase over time.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of 9/30/2016: American Airlines Group Inc., United Continental Holdings Inc., Delta Air Lines Inc., Southwest Airlines Co., Allegiant Travel Co., Alaska Air Group Inc., Hawaiian Holdings Inc., JetBlue Airways Corp., Spirit Airlines Inc.

This post was originally published at Frank Talk.

Copyright © U.S. Global Investors