by Carl Tannenbaum, Asha Bangalore, Ankit Mittal, Northern Trust

SUMMARY

- The Bond Market’s Ballot

- How Is the U.S. Election Playing in Overseas Markets?

- Proposed Policies Will Favor Some Industries And Hamper Others

Editor’s note: You can now follow our musings on ![]() Twitter @NT_CTannenbaum.

Twitter @NT_CTannenbaum.

Arriving in New Zealand after a 12-hour flight delay, I got to the hotel and went straight to sleep. After an hour or so, I was awoken by what sounded like scratching along the walls and groaning from above. The neighbors, perhaps? Not this time … an earthquake had hit New Zealand’s southern island, and the building was shifting. Just as I was settling back down, my phone began chiming with a series of alerts covering the event. No rest for the weary.

It seems like seismic events are following me around. During discussions the next day, talk quickly shifted from the geologic tremors to the political tremors shaking the United States. It may take a while to get a full accounting of the impact, but one early casualty has been U.S. interest rates, which have risen sharply. Through the lens of the bond markets, we can get an initial view of how policies proposed by the incoming administration might influence the economy’s path.

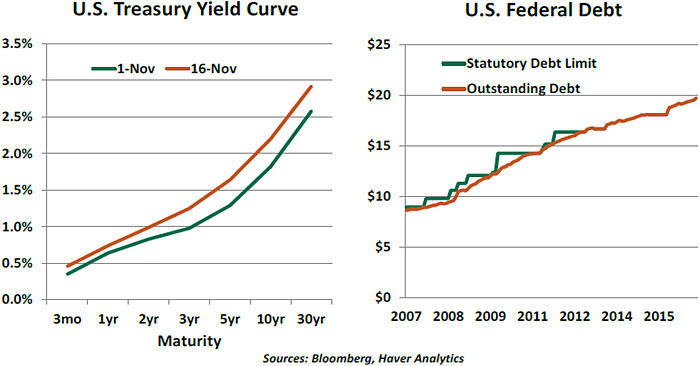

The U.S. bond market has retreated since the election. Long-term yields have risen by almost 40 basis points. It appears that the 30-year-old bull market in bonds is really over.

Interest rates are reacting to several factors. First, several of the president-elect’s campaign proposals have the potential to create upward pressure on inflation. New tariffs would raise the prices of imports and might offer shelter for higher prices on domestic products. The prospective deportation of undocumented workers could raise labor costs. The transition away from the Affordable Care Act could increase health care costs.

Second, the prospect of additional deficit spending would increase the issuance of Treasury securities. Global investors have demonstrated an insatiable appetite for these instruments over the past several years, partly because of the fiscal discipline exercised by the Congress. If markets sense that this discipline is slipping, yields might continue upward.

Donald Trump has proposed a combination of steep tax cuts and additional infrastructure spending. While most would agree that these measures would increase the rate of economic growth, most also agree that they are unlikely to be deficit-neutral. Further, adding stimulus at a time when the country is close to full employment might place additional stress on labor markets.

The Republican Party has traditionally favored fiscal rectitude, and there is a corps of people in Congress who take this very seriously. Discussions between the incoming administration and Congress to reconcile these perspectives will be delicate. Trump’s supporters will be expecting him to follow through on his promise to shake things up, but he’ll need the cooperation of Congress to move forward on his budget plans.

The Republican Party has traditionally favored fiscal rectitude, and there is a corps of people in Congress who take this very seriously. Discussions between the incoming administration and Congress to reconcile these perspectives will be delicate. Trump’s supporters will be expecting him to follow through on his promise to shake things up, but he’ll need the cooperation of Congress to move forward on his budget plans.

A test of deficit discipline will come early next year, when the U.S. debt ceiling comes back into force. (It has been suspended since the middle of 2015.) Will House Republicans take the same hard line on this topic that they took when Democrats held the White House? Or will they acquiesce to fiscal expansion?

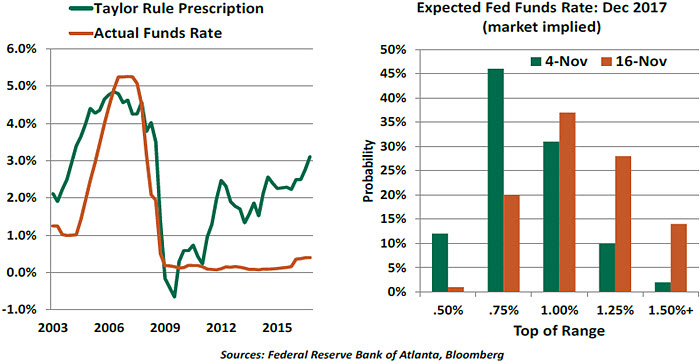

Finally, Trump and his key economic advisors have been critical of the Federal Reserve’s lower for longer policy, which they see as a brand of financial repression. Congress has been singing a similar tune, and threatened to press the issue by auditing monetary strategy against a simple Taylor Rule, which suggests that rates should be increased.

To be sure, using a formula to set monetary policy has a number of potential weaknesses. The Taylor rule requires a series of assumptions about potential economic growth, the neutral rate of interest, and the lead time between monetary changes and their impact on inflation. All of these are very fluid concepts in the current day. But the perception remains, in many corners, that official interest rates are too low. The market’s anticipation about the likely course of Fed policy has changed dramatically since the election, as illustrated in the panel above.

We’ve not been shy about suggesting that central banks are at the edge of their effectiveness. It is unclear that low rates are promoting incremental leverage, and there is spreading concern that they are promoting reaches for yield that could create asset price excesses and financial instability. But government interference in the operation of central banks is something that makes investors uncomfortable.

If the Fed is pressured to remove policy accommodation on a more rapid schedule that it might prefer, the knock-on effects could be significant. A number of emerging markets still have dollar-denominated debt, which could be more difficult to service. (Some of these same countries might also be in jeopardy if U.S. trade policy turns more restrictive.) Every increase in the rates on Treasury securities adds to the annual carrying costs of the U.S. Federal debt. And rising U.S. mortgage rates could prove very challenging for the housing sector.

If the Fed is pressured to remove policy accommodation on a more rapid schedule that it might prefer, the knock-on effects could be significant. A number of emerging markets still have dollar-denominated debt, which could be more difficult to service. (Some of these same countries might also be in jeopardy if U.S. trade policy turns more restrictive.) Every increase in the rates on Treasury securities adds to the annual carrying costs of the U.S. Federal debt. And rising U.S. mortgage rates could prove very challenging for the housing sector.

There are two open positions on the Fed’s Board of Governors. Nominations to the Federal Reserve Board will essentially require 60 votes in the Senate to overcome procedural impediments, so it seems unlikely that two hawks could be seated. But tension between the incoming administration and the central bank is likely to be a theme of 2017.

During my visit to Australia and New Zealand, a number of my partners and clients offered asylum. Happily, they meant an immigration visa, not psychiatric support (although I could probably use some of the latter). I politely declined; the next few months are going to make for interesting watching. Better to do so at close range.

Emerging Consequences

Every new president walks into the White House under the warm glow of renewed hope and expectations, pre-election polarization notwithstanding. Inside the United States, there is some optimism that pro-growth policies will produce additional economic momentum. But the Trump program appears to be a mixed bag for emerging market economies.

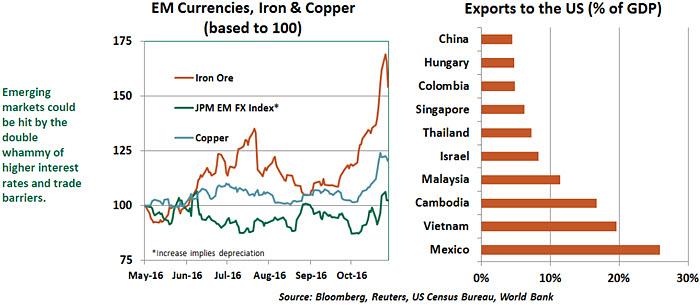

The promise of higher infrastructure spending would be good for exporters of commodities such as copper and iron ore — Trump’s acceptance speech was enough to send copper and iron ore to 17- and 24-month highs, respectively. At a broader level, a U.S.-led recovery in global growth should benefit everyone.

At the same time, the possibility of punitive trade barriers, a stronger U.S. dollar and the tighter monetary policy regime that would follow an activist fiscal policy will not only be a negative for many emerging markets, but might plant the seed for the next emerging market crisis. The outflows from emerging markets over the last week and a half — a mini rerun of 2013’s ”taper tantrum” — seem to suggest that the market expects these risks to tilt toward the negative.

While Mexico and China have attracted most of the attention in the trade arena, countries in Latin America and Asia are vulnerable as well, given the large volumes they export to the United States. The sudden drying up of liquidity in emerging Asia underlines that risk. At this point we have no clarity on how (or whether) the Trump administration plans to change U.S. trading relationships, but the odds are that they will become more restrictive. At best, we might see current arrangements being preserved, even as the Trans-Pacific Partnership (TPP) and Trans-Atlantic Trade and Investment Partnership (TTIP) stall. A more extreme scenario could involve the U.S. government tearing up the North American Free Trade Agreement (NAFTA) and imposing high tariffs on Chinese imports. In the latter scenario, we would expect the recent weakness in daily U.S. dollar to renminbi exchange rate fixings to accelerate, which would have ripple effects in the region.

Furthermore, many emerging markets still have large external funding needs and are likely to get the wrong end of the stick if U.S. interest rates rise too rapidly and the carry trade unwind worsens. On the other hand, markets such as India, Russia and countries in Eastern Europe would be relatively shielded due to a number of factors, including limited exposure to U.S. trade.

All of these convictions will be tested and adjusted in the days and months to come — and are shifting even as this piece goes to the press — as we get a clearer picture of the Trump administration. A badly calibrated fiscal-monetary mix can easily turn this global reflation narrative into global stagflation, with all the downside of trade protection and higher U.S. interest rates, minus the upside from growth.

With apologies to George Orwell, all fiscal deficits are equal, but some fiscal deficits are more reflationary than others. If fiscal policy is heavier on tax cuts and lighter on infrastructure spending, the growth dividend would likely be muted. Add negative spillback from rest of the world to the mix, and the outcome of the new administration’s economic policy could be less rosy than what is being priced in at the moment. Slower U.S. growth would also be a negative for emerging markets.

It is early, and much is still unknown. But it appears that prospects for the world’s emerging markets are darker today than they were two weeks ago. And that, in turn, could darken the doorstep of the United States.

Favored Few

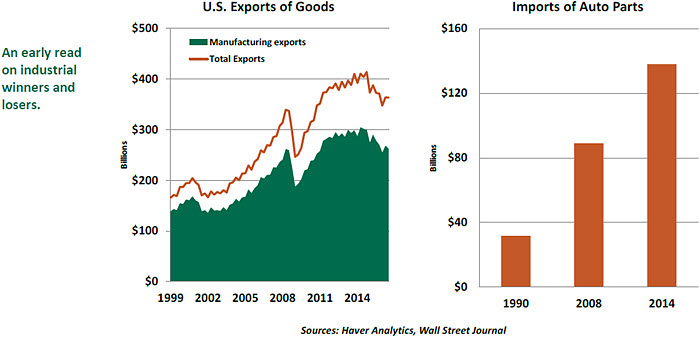

U.S. businesses are faced with a new economic and regulatory landscape following last week’s elections. Some will benefit and others will be hurt as new economic policies unfold.

Banking and health care stocks have gained since November 9, in anticipation of looser regulation. Steel, mining, cement and engineering companies, along with heavy equipment makers, energy-related firms, tool makers and a host of related industries should prosper if the United States expands infrastructure spending.

On the other side of the spectrum, the auto industry faces challenges from trade restrictions that could cause supply disruptions and higher prices for cars. Imported auto parts have risen significantly in recent years. Shipping firms and railroads engaged in the transportation of goods overseas are likely to suffer as a result of reduced traffic due to tariffs.

The outlook for some sectors in mixed. The coal industry is on the favored list, but it faces stiff competition from natural gas. Support for new pipelines for the energy industry will offset not-so-friendly policies toward wind and solar energy firms. The food and agricultural industry will welcome lighter regulation, but the net benefit may be smaller due to trade barriers.

Promoting growth of the factory sector is one of the new administration’s stated goals. Expansionary fiscal plans and a less accommodative monetary policy are a perfect mix for a stronger dollar, which will lower all exports, including factory goods. Retaliation from U.S. trading partners could also affect export industries.

Although details are unclear, the changes the new administration has proposed could potentially change the fortunes of a number of key industries. Their relative fortunes will have an important influence on the overall success of the new economic program.

Copyright © Northern Trust