by Brooke Thackray, Alphamountain Investments

Does polling work anymore? Definitely not as well as it did in yesteryear. Brexit Redux.

Asymmetrical risk strikes again. The stock market priced in a Clinton win and even if she won, the stock market would probably not have moved up very much. On the flip side, there was a lot more downside risk if Trump won. Granted the odds were not 50/50, but the stock market did not reflect the possibility of a Trump win.

What should we expect now. As I am writing this piece, the S&P 500 are limit down and the stock market is expected to open much lower.

How long will the negative trend last? No one knows for sure, but typically the market stabilizes two or three days after the initial unexpected shock. Brexit took two days and then the stock market rallied strongly.

Do not assume that the stock market will follow the same “bounce” path as it did in the Brexit scenario. Brexit was totally different. In the case of Brexit, investors realized very quickly that it was possible that no concrete action, seceding from EU, would take place for two years. To the average investor two years seems like an infinity and they quickly jumped back into the stock market. A Trump presidency does not provide the same opportunity. Investors will be wondering what Trump will do. This will take some time to figure out, especially since the inauguration does not happen until January.

The stock market will probably drop and then stabilize, not rally- at least not right away.

It will be interesting to see if the media tries to redeem itself for its very bias coverage of the election run-up. After a day or two, they will probably ease up on Trump and investment reporters will probably put forward the message that a Trump presidency will not be so bad. They will put forward the message that the Republicans will control him and he will have to change his plans. In the end, a Trump presidency is not the end of the world.

If investors start to believe that Trump will not be able to carry out a lot of extreme policies, the stock market will start to settle down. And very shortly, the investment media will start to focus on sectors of the stock market that will benefit from a Trump presidency, such as:

♦ defense

♦ utilities (coal)

♦ energy

♦ infrastructure stocks

♦ healthcare (no Hillary Clinton to attack sector)

♦ ....and of course, concrete stocks....concrete is needed to build the wall Inflation talk is expected to pick up...especially now that Trump has been elected President and spending will commence soon

There has been a lot of talk recently about the chances of inflation picking up. At the beginning of the year inflation expectations started to rise and then subsided. Recently, inflation expectations have been picking up once again as investors have been expecting either Trump or Clinton to spend a lot of money on infrastructure to try and help stimulate the economy, which would ultimately cause inflation.

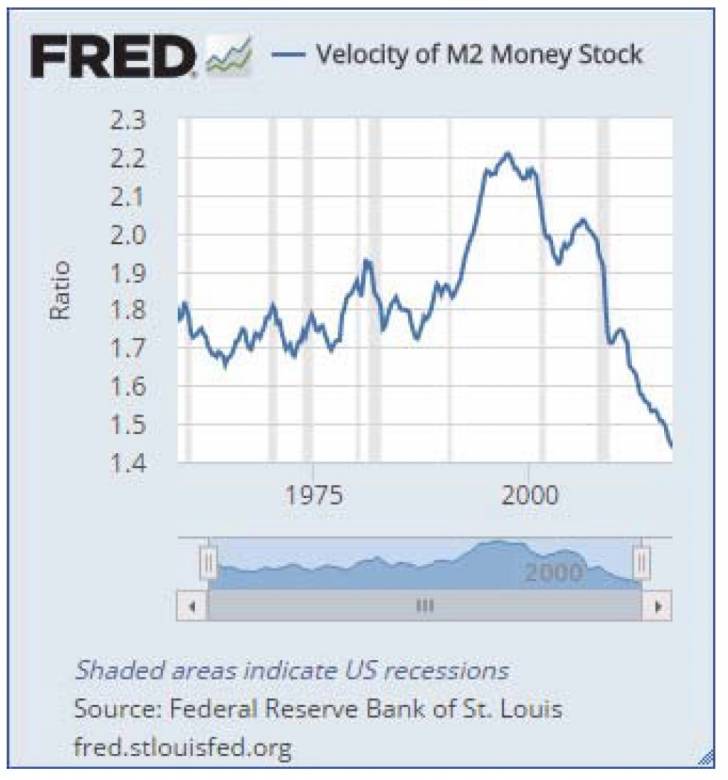

There are a number of reasons why inflation expectations may increase in the future, including rising wages (already starting to happen), large increases in oil prices (probably not going to happen), increasing commodity prices (need to see more economic growth before a sustained trend, increasing velocity of money, or turnover (hasn’t happened so far... see FRED graph Velocity of M2 Money Stock).

There is currently not a sustained risk factor for higher infl ation. The Federal Reserve has been printing money for years. Japan has been printing money for decades. Both countries have not been able to get their inflation rates to where they want.

Sidebar: One day inflation will probably start to uptick dramatically. When? The answer is largely dependent on when interest rates start to increase. Part of the reason that the velocity of money is so low is that interest rates are low forcing investors into liquid money rather than interest baring securities. If interest rates start to increase, this will actually help increase the inflation rate by increasing the velocity of money, which will increase the money supply, which will increase inflation. Umh! I know that a lot of you are running back to your economics textbooks and looking up the relationship between interest rates and inflation, knowing that higher interest rates are used to mitigate inflation. Generally I agree, but in this world of zero-bound interest rate policies it really is an upside down world. This is just another example of how artificially low interest rates can have negative consequences. For more information on “What Does Money Velocity Tell Us about Low Infl ation in the U.S.?”, please see Federal Reserve article

(https://www.stlouisfed.org/on-the-economy/2014/september/ what-does-money-velocity-tell-us-about-lowinfl ation-in-the-us).

So why get concerned about inflation, if the possible causation factors are not displaying imminent signals that inflation is about to get out of hand? Although actual economic numbers make a difference, expectations are also very important.

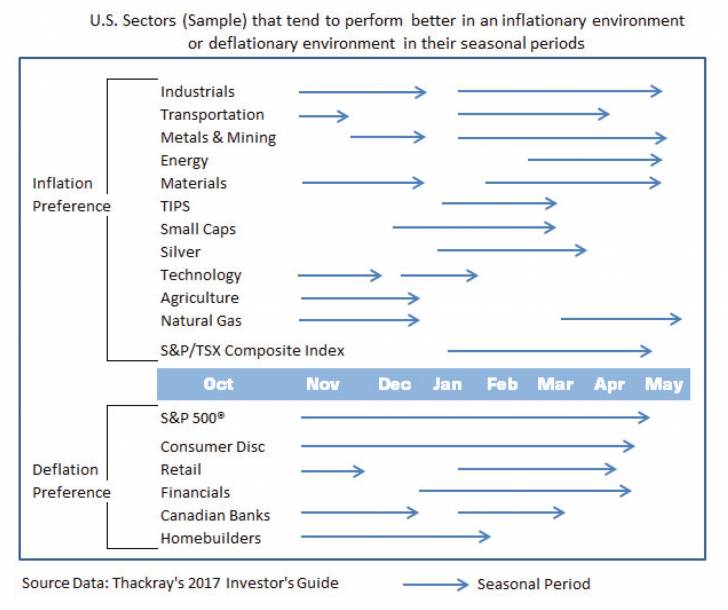

If the fears of rising inflation rates rise once again it would be expected that sectors that have outperformed in the past during a similar situation would have a higher probability of performing well.

Seasonal investing first. The first premise for seasonal investing is that seasonal investing is the first and primary screen, or selection mechanism in deciding what sector or investment to make. Technical indicators can also be used to help, if and when an investment should be made.

If a sector is underperforming, why invest in the sector? Lastly, fundamental factors can help with the allocation of acceptable seasonal sectors. Technicals are more important than fundamentals, as the markets expectation to the fundamentals is presented in the price action of an investment.

In a way, fundamentals set up the base case for allocation and then technicals determine the action within the seasonal period. Seasonal trends are always the most important factor in making a decision.

On a seasonal basis, positive economic and inflation expectations tend to be highest in Q1 of the year. Last year, after being beaten up in Q4, the commodity and cyclical sectors outperformed in Q1, partly because they represented good value and partly because investors bought into the reflation trade. It is possible that we could see the same phenomenon this year, with the commodity and cyclical sectors being the top performers once again. The fact that it happened last year, does not mean it will happen again this year, but if the conditions are similar the probability of the same outcome increases.

I have included a diagram that illustrates some of the seasonal periods for sectors that tend to perform well over the next few months, and categorized them in two categories, the first one being sectors that are expected to outperform in a higher inflation environment and the second category being sectors that are expected to outperform in a lower inflation environment. All of the sectors in the diagram are seasonally valid and expected to outperform the broad market, but if expectations for inflation increases, then sectors that tend to perform better in this environment are preferred. Although, inflation expectations are part of a fundamental allocation decision, it should be technicals that help determine if certain sectors should be overweighted or underweighted.

My classification of sectors on the inflation/deflation list, reflects the general consensus of others whom have written on this subject. Nevertheless, there will be some differences compared to other lists.

Read/Download the complete Brooke Thackray Update below:

Thackray Newsletter 2016 11 November by dpbasic on Scribd

Copyright © Alphamountain Investments