by Benjamin Streed, CFA, Fixed Income, Raymond James

Bond markets rallied last week, thanks largely to renewed concern over the US presidential election. There is clearly some built up angst in financial markets across the globe and each and every little tidbit of information surrounding Clinton and Trump has had an outsized effect on markets. Broadly speaking, markets appear to see a Trump presidency as riskier than Clinton as any pro-Trump (anti-Clinton) news tends to quickly add selling pressure to risk assets such as equities while fueling demand for “safe haven” assets like US Treasuries helping to keep yields down.

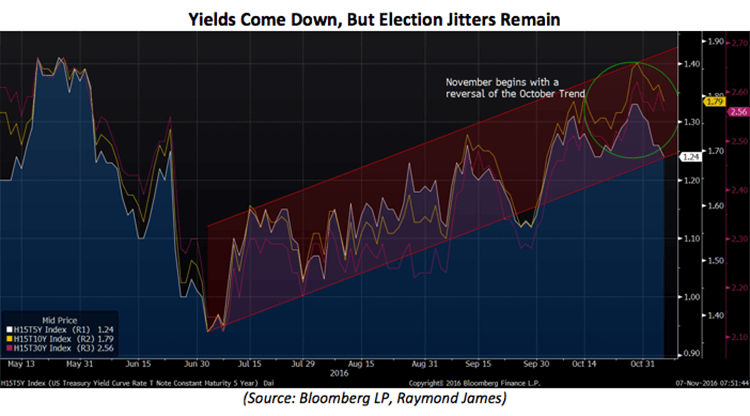

Over the course of the last week yields in the US fell as yet another FBI investigation fueled another round of concern that Trump could in fact pull off an upset Tuesday evening. However, by Monday morning the fear seems to have reversed and markets are again in “risk on” mode after the FBI concluded no charges will be brought (so no change), with yields up across the board and equities appearing ready for a substantial rally.

Polls continue to suggest the election is too close to call, leaving many to wonder if this could possibly be the US version of a Brexit surprise. At this juncture the election is likely to continue to dominate the ebb and flow of financial markets leaving fundamental economic data including inflation, wages and job growth on the backburner.

Regardless of who wins, once we get through the US election the market is likely to put a renewed emphasis on economic data and the ever-important actions of central bankers. As you may have noticed, the Fed refrained from any action during its November meeting which played out exactly as most expected. There was only a slight chance of any hike last week with consensus being for a December hike on the 14th which will also include a press conference style Q&A with Fed Chair Yellen. As of Monday, Bloomberg futures data show a 76% chance of a hike, nearly identical to where the markets were pricing the initial hike some twelve months ago.

A quick update on the credit markets: The month of October was a difficult one for bond markets as Treasury yields marched higher on positive economic data in addition to the Fed’s recent comment that inflation continues to rise close to their 2.00% goal. As noted in the chart above, yields have moved lower in the first few days of November as election uncertainty adds to the demand for safe assets. Despite the move lower in Treasury yields, credit markets showed some temporary weakness as spreads moved higher, with the vast majority of the move coming from the high yield (HY) space (below Baa3/BBB-).

As a reminder, spread is the additional yield required above a comparable Treasury rate and is viewed as compensation for risk. Higher quality bonds have a smaller spread (less risk) than lower quality (more risk) bonds. Investment grade bonds, as has become somewhat customary, were mostly spared from the general “risk off” trade in the markets.

For comparison, according to Citi Yieldbook index data HY spreads widened by ~42 basis points (bp) during last week’s “risk off” trade, while their investment grade counterparts only saw a move of only 5bp. For investors, this is a strong reminder that spreads matter, but it’s also important to consider the relative risk of any incremental yield. For more insight on index returns and spread data, you can find our Weekly Index Monitor here.

Copyright © Raymond James