by Ben Carlson, A Wealth of Common Sense

The S&P 500 last closed at an all-time high in mid-August. We’re only 3-4% away from that number and stocks haven’t done much lately, but many investors become very nervous when they hear about all-time highs in the market. After all, the S&P 500 got cut in half following all-time highs in early-2000 and late-2007. Therefore, the thinking goes that any time stocks reach new highs that disaster can’t be too far away.

History tells a different story.

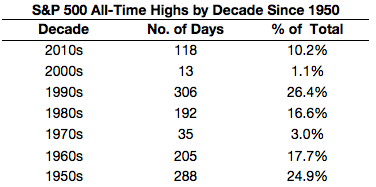

If we look at daily pricing data going back to 1950, what you see is a ton of new all-time highs in stocks. Here are the numbers broken out by decade:

Some decades have been better than others, but you can see that all-time highs happen fairly frequently. Nearly 7% of all market trading days have seen new all-time highs since 1950.There are definitely decades where new highs tend to cluster together more than others. There were also some lengthy droughts following bear markets where a new high wasn’t seen for some time. There was a seven and a half year period from 1973 to 1980 and another seven plus year period from 2000 to 2007 that the S&P 500 went without seeing new highs. So it’s not like these things work on a set schedule.

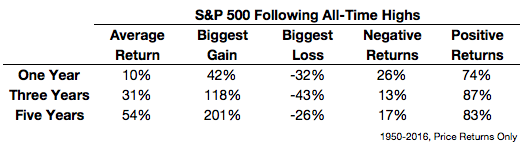

It’s also helpful to see how stocks have performed, on average, following historical all-time highs in this period:

The average returns following an all-time high one, three and five years out into the future have been similar to the average gains over this entire period. And stock market returns have been positive the majority of the time when you look ahead over all three time frames. Basically, all-time highs are a natural part of a stock market that has mostly gone up over time. Most of the time markets continue to rise from all-time highs.

Here’s also another way to think about this — since nearly 7% of all days since 1950 have been an all-time high that means that more than 93% of the time the stock market is in a drawdown state from a previous peak. So 9 times out of 10 you are going to be beating yourself up for not selling at the previous high. This is what makes the markets so interesting and excruciating all at the same time. Most of the time you’re in a state of regret.

Having said all of that, every correction, crash or bear market can eventually be traced back to an all-time high level, so they seem dangerous. Unfortunately, before the next bear market occurs, stocks have to peak. Who knows, maybe they already have. But just because there’s an all-time high does not mean that you are guaranteed to call a new market top. It’s never that easy.

You’ll only ever know about the top in hindsight.

Further Reading:

Investing a Lump Sum at All-Time Highs

So You Want to Be a Top-Caller?

Copyright © A Wealth of Common Sense