by Mike Harris, Price Action Lab

Although it appears that the market has started to correct, there is some evidence that investors may be selling overbought low volatility and high yield stocks to raise cash before a market rally.

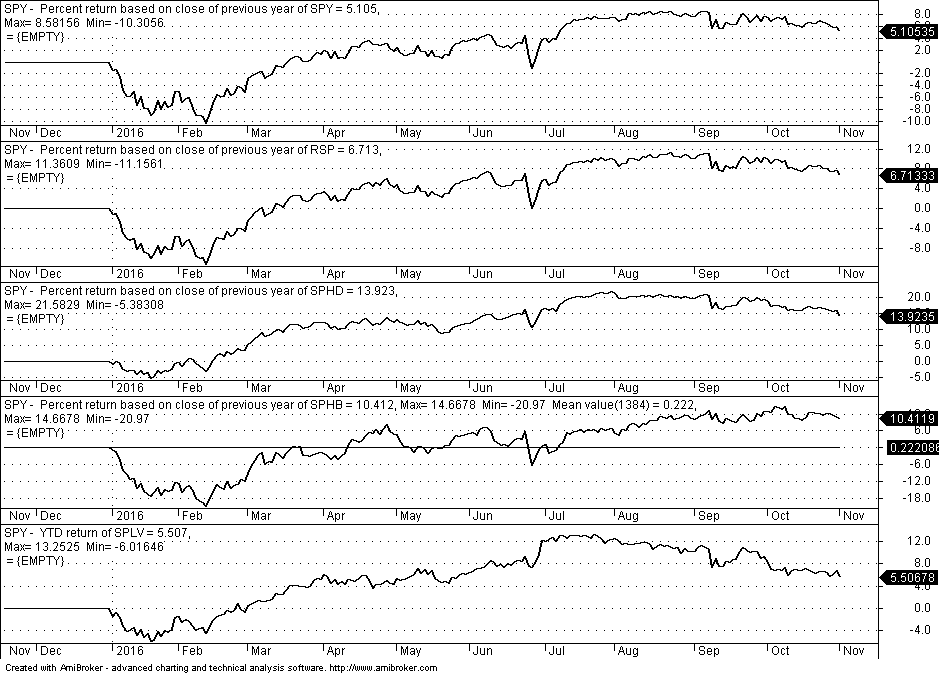

The ratio of low volatility S&P 500 (SPLV) to high beta S&P 500 (SPHB) is still on a downtrend, as shown in the chart below:

Higher risk stocks are holding onto their gains while low risk stocks are losing ground.

The high dividend – low volatility S&P 500 (SPHD) year-to-date return has dropped from a high of 21.6% by the end of July to about 14%, as shown in the third pane of the chart below:

At the same time, year-to-date return of the high beta S&P 500 (SPHB) rocketed from a low of -21% in February to a high 14.5% and has corrected only by about 4% from that top, as it may be seen from the fourth pane of the above chart. The low volatility S&P 500 (SPLV) has dropped from a maximum of 13.25% to 5.5%.

Therefore, there is some evidence that pressures are more pronounced in overpriced low volatility and high dividend stocks. It may be the case that investors are preparing for a rally after the election. But this is only speculation supported by limited evidence and conditions may change at any time so no one should base any investment decisions on an article like this one that only expresses personal opinions.

If you have any questions or comments, happy to connect on Twitter: @mikeharrisNY

Copyright © Price Action Lab