Inside the Numbers: United Parcel Service Inc (UPS)

by Bob Simpson, Synchronicity Performance Consultants

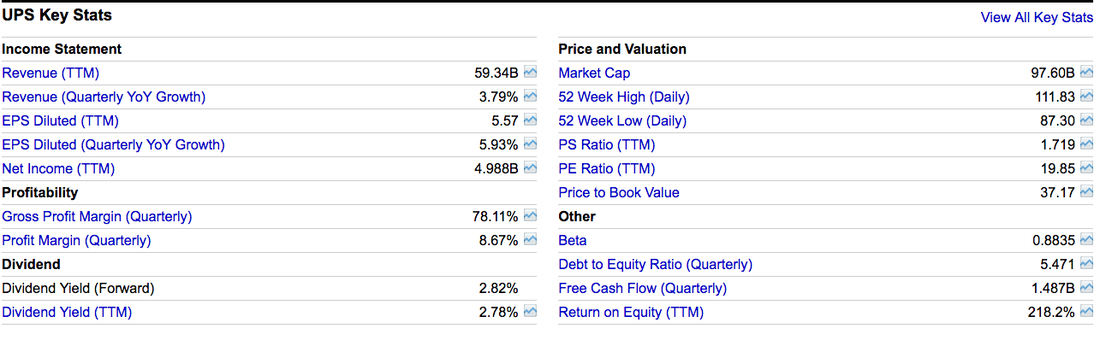

United Parcel Service Inc. (UPS) is a package delivery organization less-than-truckload industry & provider of supply chain management solutions. It operates in three segments; U.S. Domestic Package, International Package and Supply Chain & Freight.

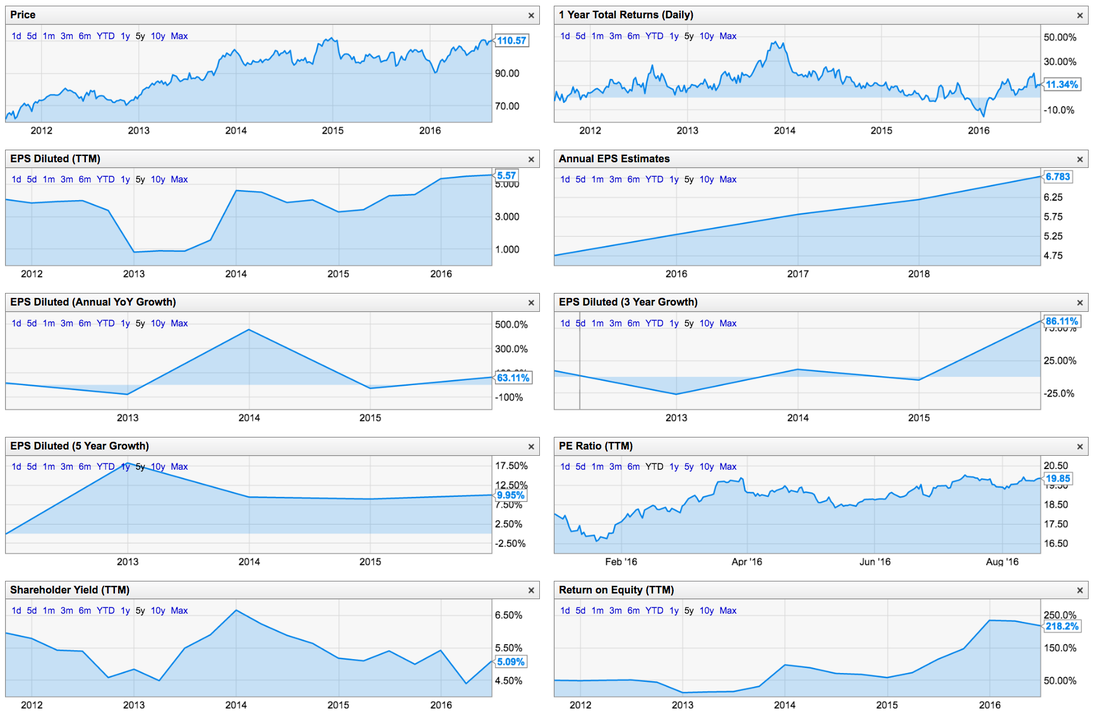

UPS has been consolidating in a trading range between roughly $95 and $112.45 since 2014 and is currently approaching all-time highs.

Let’s look inside the numbers:

Interesting Information

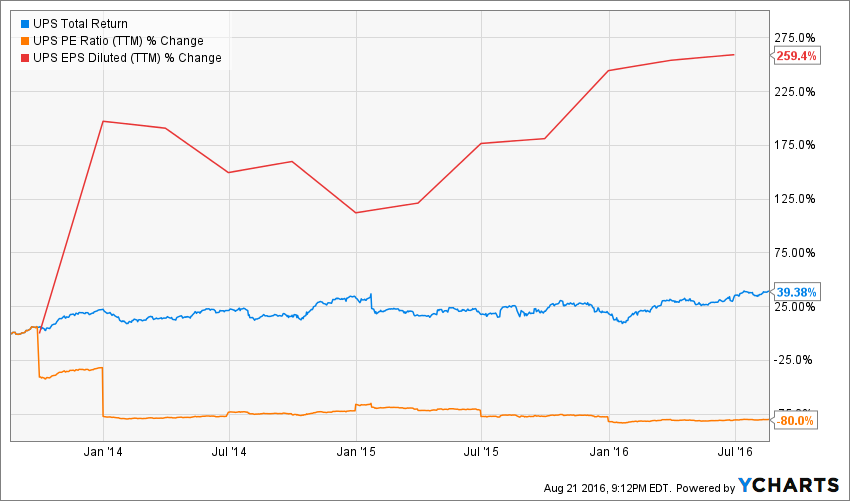

UPS' price earnings multiple has declined by 17.1% over the past year, which has resulted in much lower stock performance, compared to earnings growth. Over the past three years, the PE multiple has declined 80.0% while earnings have grown 259.4%. As a result, the total return price (including dividends) has grown by only 39.38% over the past three-years.

If EPS estimates are achieved and current PE ratio is maintained, UPS could trade in the $135 range by 2019. The current dividend yield is 2.78% and if earnings grow by 21.7% by 2019, the dividend will increase by approximately that percentage.

In The News

5 Ways UPS is Adjusting To The Economy

Watch Fedex and UPS as Brick-And Mortar Cracks Grow

Note: This is not a recommendation, just an analysis for educational purposes only. It is intended to highlight the capabilities of YCharts and teach subscribers and potential subscribers how to do research using this valuable tool.