Foreign Inflation-Linked Bonds Led Markets Higher Last Week

by James Picerno, The Capital Spectator

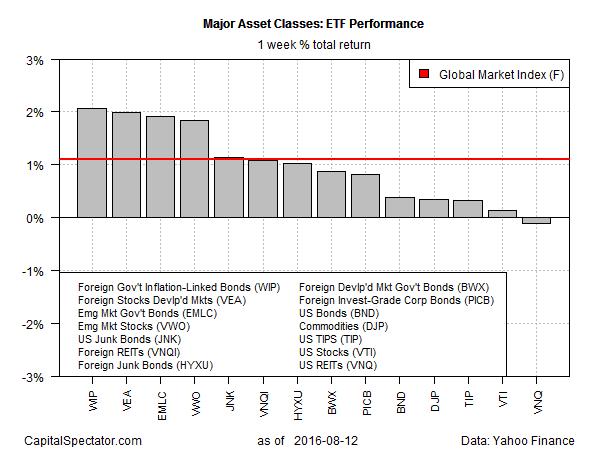

The relatively obscure corner of foreign inflation-linked government bonds edged out the rest of the field last week with 2.1% total return, based on a set of proxy ETFs for the major asset classes. The performance was just enough to fractionally pull ahead of foreign stocks in developed markets, the number-two performer for the five trading days through Aug. 12.

The 2.1% increase last week for SPDR Citi International Government Inflation-Protected Bond (WIP) marks the fund’s third straight weekly gain. Is the crowd’s interest in WIP in recent weeks a clue that inflation is headed higher in the global economy? Perhaps, although if the motivation is yield chasing, WIP is sure to disappoint. The ETF’s trailing 12-month yield is a razor-thin 0.08%, according to Morningstar.com.

The upside bias last week lifted an ETF-based version of the Global Markets Index (GMI.F), an investable, unmanaged benchmark that holds all the major asset classes in market-value weights. GMI.F climbed a solid 1.1% for the five trading days through Friday.

Meantime, US REITs continued to give back a piece of the strong performance that has prevailed for months. The Vanguard REIT (VNQ), last week’s only loser among the major asset classes, slumped for the second week in a row, posting a fractional 0.1% decline.

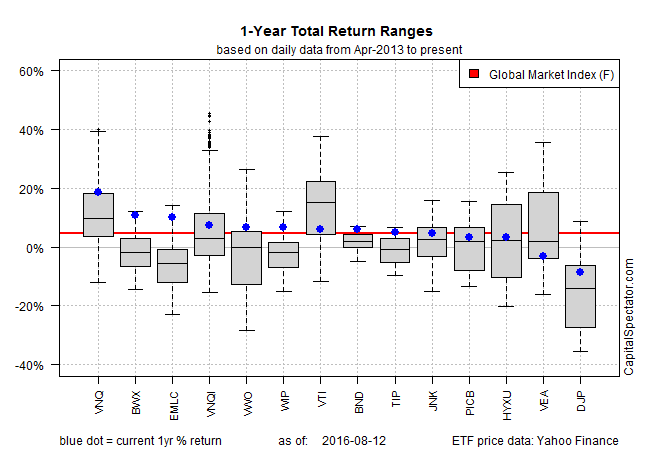

REITs, however, continue to hold the top spot for trailing one-year results, courtesy of the strong run this year for US securitized real estate. VNQ is up a strong 18.9% for the 12 months through last Friday. The increase translates into a hefty performance premium over the remaining pieces of the major asset classes.

Although commodities broadly defined posted a mild bounce last week, there’s still a hefty amount of red ink in this corner for the trailing one-year period. The iPath Bloomberg Commodity Index is off nearly 9% over the past 12 months through Aug. 12.

GMI.F, by comparison, remains firmly in the black these day for the trailing one-year performance. The benchmark is currently ahead by 4.4% for the past year.