by Don Vialoux, Timingthemarket.ca

Economic News This Week

Canadian April Retail Sales to be released at 8:30 AM EDT on Wednesday are expected to increase 1.1% versus a drop of 1.0% in March. Excluding Auto Sales, April Retail Sales are expected to increase 0.8% versus a drop of 0.3% in March.

May Existing Home Sales to be released at 10:00 AM EDT on Wednesday are expected to drop to 5.45 million units from 5.50 million units in April.

Weekly Initial Jobless Claims to be released at 8:30 AM EDT on Thursday are expected to slip to 273,000 from 277,000 last week.

May New Home Sales to be released at 10:00 AM EDT on Thursday are expected to ease to 560,000 units from 619,000 units in April

May Durable Goods Orders to be released at 8:30 AM EDT on Friday are expected to drop 0.6% versus a gain of 3.4% in April. Excluding Transportation Orders, May Durable Goods Orders are expected to increase 0.1% versus a gain of 0.4% in April

Final June Michigan Sentiment to be released at 10:00 AM EDT on Friday is expected to slip to 94.0 from the first estimate at 94.3.

Earnings News This Week

Tuesday: Adobe, Carnival, FedEx, KB Homes, Lennar

Wednesday: Bed Bath & Beyond, Red Hat

The Bottom Line

Focus this week is on “Brexit” on Thursday and Janet Yellen’s Humphrey Hawkins testimonies in mid-week. Meanwhile, trends for short and medium term momentum technical indicators for most world equity markets and economic sensitive sectors have turned down and the average optimal period of seasonal strength for most world equity markets has just past. It’s time to take a cautious stance on equity markets until mid-October. Exceptions exist (e.g. precious metals and precious metal stocks when volatility spikes, a scenario that has not arrived yet).

Observations

Economic focus this week is on Federal Reserve Chairman’s Humphry Hawkins testimony to congressional committees on Wednesday and Thursday. Other economic reports are expected to imply a slight slowdown in economic activity.

Earnings reports are sparse this week. Focus is FedEx to be released on Tuesday. Most U.S. companies have entered into a regulatory quiet period prior to the release of second quarter reports. However, 81 S&P 500 companies already have released negative second quarter guidance and only 32 companies have released positive guidance. Consensus for S&P 500 companies is for a 5.0% year-over-year decline in earnings and a 0.8% decline in sales.

Earnings and revenue prospects for S&P 500 companies beyond the second quarter are more positive. However, estimates continue to slip lower. According to FactSet, earnings on a year-over-year basis are expected to increase 1.3% in the third quarter and 7.6% in the fourth quarter. Revenues are expected to increase 2.2% in the third quarter and 5.0% in the fourth quarter.

Intermediate term technical indicators continue to trend lower. Short term momentum indicators for most equity indices and sectors also are trending down and are oversold, but have yet to show signs of bottoming.

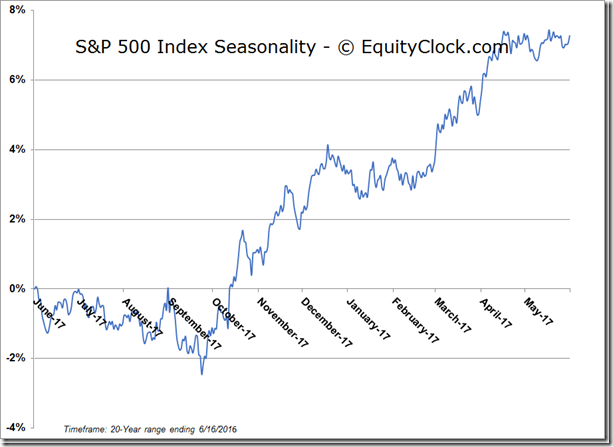

A study based on data since 1966 by EquityClock on performance of the S&P 500 Index from June 17th to end of the month shows an average decline per period of 0.50% with negative returns realized 56.0% of the time.

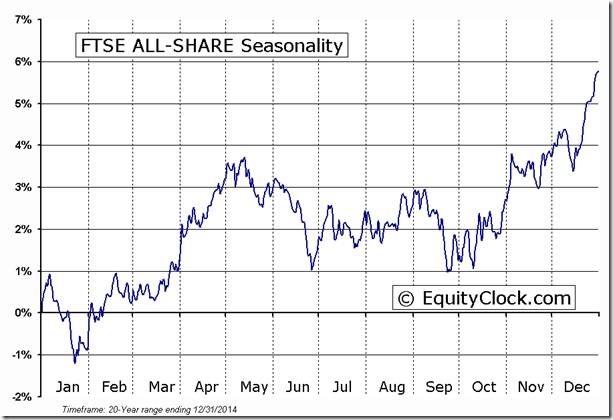

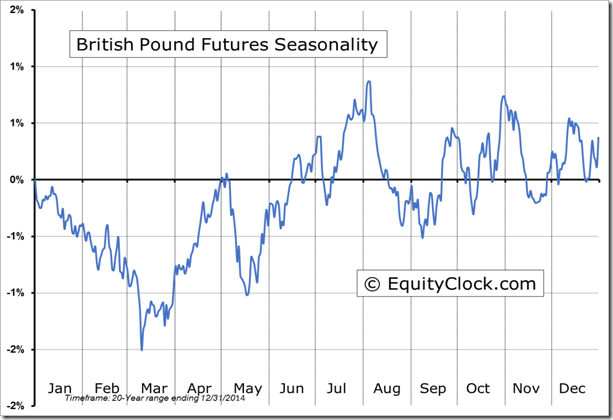

Brexit has become a significant issue for equity markets. Latest polls for the June 23rd event show a close race. This is a binary event of equity markets, particularly European equity markets. A vote to remove the United Kingdom from the European Economic Community will increase stock market uncertainty. Conversely, a vote to stay in the Community will reduce stock market uncertainty. Short term momentum indicators for the British Pound and the London FT turned positive on Friday, implying that traders are expecting a “stay” vote.

Technical action by individual S&P 500 stocks turned significantly bearish late last week: 86 S&P 500 stocks broke support and 3 stocks broke resistance.

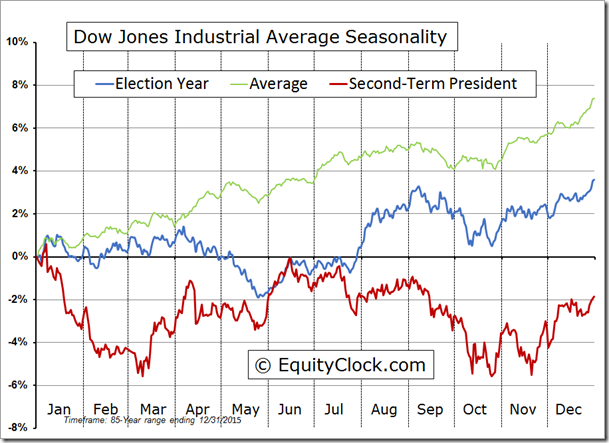

The Dow Jones Industrial Average during a Presidential election year after a second term President has a history of reaching a seasonal peak in mid-June.

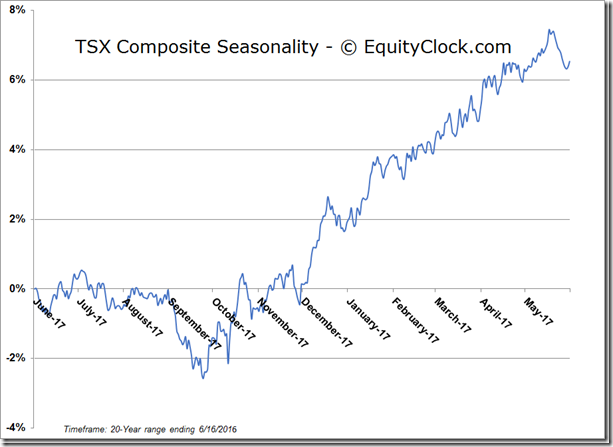

Both the S&P 500 Index and the TSX Composite Index recently passed their average optimal period of seasonal strength during the past 20 years. Historically, the period between now until mid-October has included a time when volatility spikes and North American equity markets enter a corrective phase. A brief period of strength between now and mid-July is possible (particularly if Brexit becomes a non-event). If strength into mid-July does occur (not predicted given current economic and earnings news anticipated during the next month), one last opportunity to take trading and seasonal profits prior to a significant correction.

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for June 17th 2016

Green: Increase from previous day

Red: Decrease from previous day

Calculating Technical Scores

Technical scores are calculated as follows:

Intermediate Uptrend based on at least 20 trading days: Score 2

Higher highs and higher lows

Intermediate Neutral trend: Score 0

Not up or down

Intermediate Downtrend: Score -2

Lower highs and lower lows

Outperformance relative to the S&P 500 Index: Score: 2

Neutral Performance relative to the S&P 500 Index: 0

Underperformance relative to the S&P 500 Index: Score –2

Above 20 day moving average: Score 1

At 20 day moving average: Score: 0

Below 20 day moving average: –1

Up trending momentum indicators (Daily Stochastics, RSI and MACD): 1

Mixed momentum indicators: 0

Down trending momentum indicators: –1

Technical scores range from -6 to +6. Technical buy signals based on the above guidelines start when a security advances to at least 0.0, but preferably 2.0 or higher. Technical sell/short signals start when a security descends to 0, but preferably -2.0 or lower.

Long positions require maintaining a technical score of -2.0 or higher. Conversely, a short position requires maintaining a technical score of +2.0 or lower.

The S&P 500 Index lost 24.84 points (1.19%) last week. Intermediate trend remains up. The Index dropped below its 20 day moving average last week. Short term momentum indicators continue to trend down.

Percent of S&P 500 stocks trading above their 50 day moving average (also known as the S&P 500 Momentum Barometer) dropped last week to 53.00% from 62.80%. Percent remains intermediate overbought and trending down.

Percent of S&P 500 stocks trading above their 200 day moving average slipped last week to 69.40% from 71.00%. Percent remains intermediate overbought and trending down.

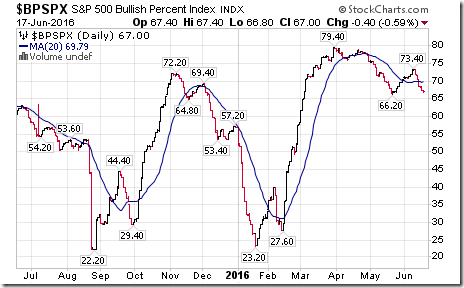

Bullish Percent Index for S&P 500 stocks slipped last week to 67.00% from 71.80% and dropped below its 20 day moving average. The Index remains intermediate overbought and trending down.

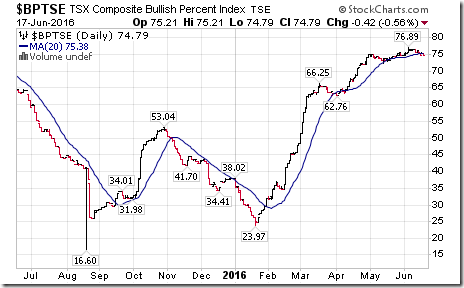

Bullish Percent Index for TSX Composite stocks slipped last week to 74.79% from 75.63% and dropped below its 20 day moving average. The Index remains intermediate overbought and showing early signs of rolling over.

The TSX Composite Index dropped 135.77 points (0.97%) last week. Intermediate trend remains up (Score: 2). Strength relative to the S&P 500 Index turned negative last week (Score -2). The Index remained below its 20 day moving average (Score: -1). Short term momentum indicators continue to trend down (Score: -1). Technical score slipped last week to -2 from 0.

Percent of TSX stocks trading above their 50 day moving average (Also known as the TSX Composite Momentum Barometer) dropped last week to 58.01% from 73.71%. Percent remains intermediate overbought and trending down.

Percent of TSX stocks trading above their 200 day moving average slipped last week to 72.29% from 73.71%. Percent remains intermediate overbought and trending down.

The Dow Jones Industrial Average dropped 190.31 points (1.07%) last week. Intermediate trend remains neutral. Strength relative to the S&P 500 Index remained neutral last week. The Average dropped below its 20 day moving average last week. Short term momentum indicators continue to trend down. Technical score slipped last week to -2 from 0.

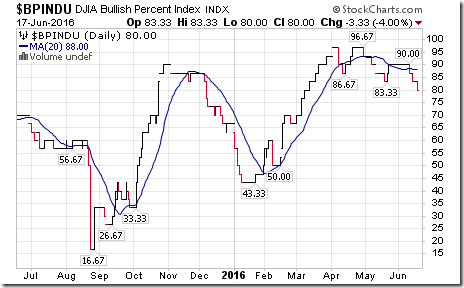

Bullish Percent Index for Dow Jones Industrial Average stocks fell last week to 80.00% from 86.67% and remained below its 20 day moving average. The Index remains intermediate overbought and trending down.

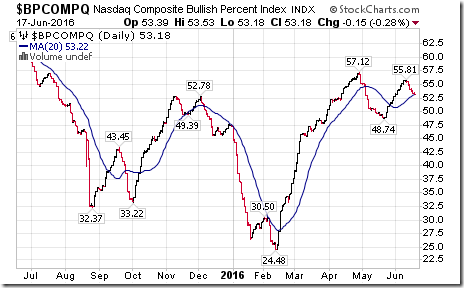

Bullish Percent Index for NASDAQ Composite stocks dropped last week to 53.18% from 55.51% and dropped below its 20 day moving average. The Index remains intermediate overbought and trending down.

NASDAQ Composite Index fell 94.21 points (1.92%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index changed last week to negative from neutral. The Index dropped below its 20 day moving average last week. Short term momentum indicators continue to trend down. Technical score dropped last week to -2 from 2.

The Russell 2000 Index lost 19.23 points (1.65%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index remains positive. The Index dropped below its 20 day moving average last week. Short term momentum indicators continue to trend down. Technical score dropped last week to 2 from 4.

The Dow Jones Transportation Average dropped 175.01 points (2.25%) last week. Intermediate trend changed to down from neutral on a move below 7,469.97. Strength relative to the S&P 500 Index returned to negative from neutral. The Average moved below its 20 day moving average. Short term momentum indicators continue to trend down. Technical score dropped last week to -6 from -2.

The Australia All Ordinaries Composite Index dropped 143.30 points (2.66%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index remains negative. The Index remained below its 20 day moving average. Short term momentum indicators continue to trend down. Technical score remained last week at -2.

The Nikkei Average plunged 1,001.70 points (6.03%) last week. Intermediate trend changed last week to down from up on breaks below two support levels: 15.975.47 and 15,471.80. Strength relative to the S&P 500 Index changed to negative from neutral. The Average remained below its 20 day moving average. Short term momentum indicators are trending down. Technical score dropped last week to -6 from 0.

Europe iShares dropped 0.26 (0.67%) last week. Intermediate trend changed last week to down from up on a move below $38.68. Strength relative to the S&P 500 Index remains negative. The trend for short term momentum indicators changed on Friday to up from down. Technical score slipped last week to -4 from -2.

The Shanghai Composite Index dropped 42.06 points (1.44%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index remains neutral. The Index moved above its 20 day moving average last week. Trend for its momentum indicators turned mixed on Friday. Technical score slipped last week to 3 from 4.

Emerging markets iShares slipped 0.26 (0.78%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index changed to neutral from positive last week. Units fell below their 20 day moving average last week. Short term momentum indicators continued to trend down. Technical score dropped last week to 0 from 4.

Currencies

The U.S. Dollar Index dropped 0.35 (0.37%) last week. Intermediate trend remains down. The Index remained below its 20 day moving average. Short term momentum indicators are mixed.

The Euro added 0.21 (0.19%) last week. Intermediate trend remains up. The Euro remained above its 20 day moving average. Short term momentum indicators are mixed.

The Canadian Dollar dropped US 0.78 cents (1.00%) last week. Intermediate trend remains up. The Canuck Buck remained above its 20 day moving average. Short term momentum indicators are trending down.

The Japanese Yen jumped 2.46 (2.63%) last week. Intermediate uptrend was extended on a move above 94.50. The Yen remains above its 20 day moving average. Short term momentum indicators are trending up.

Commodities

Daily Seasonal/Technical Commodities Trends for June 17th 2016

Green: Increase from previous day

Red: Decrease from previous day

The CRB Index slipped 0.51 points (0.26%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index remains positive. The Index remains above its 20 day moving average. Short term momentum indicators are trending down. Technical score remained last week at 4.

Gasoline dropped $0.04 per gallon (2.56%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index remained negative. Gas remained below its 20 day moving average. Short term momentum indicators are trending down. Technical score remained at -2.

Crude oil slipped $0.51 per barrel (1.04%) last week. Intermediate trend remained up. Strength relative to the S&P 500 Index changed to neutral from positive. Crude remains below its 20 day moving average. Short term momentum indicators are trending down. Technical score slipped last week to 0 from 2.

Natural Gas added another $0.06 per MBtu (2.34%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index remains positive. “Natty” remains above its 20 day moving average. Short term momentum indicators are trending up. Technical score remained last week at 6.

The S&P Energy Index slipped 0.33 (0.07%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index changed to neutral from positive. The Index moved back above its 20 day moving average on Friday. Short term momentum indicators are trending down. Technical score slipped last week to 2 from 4.

The Philadelphia Oil Services Index dropped 2.29 points (1.33%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index slipped to neutral from positive. The Index remained above its 20 day moving average. Short term momentum indicators are trending down. Technical score slipped last week to 2 from 4.

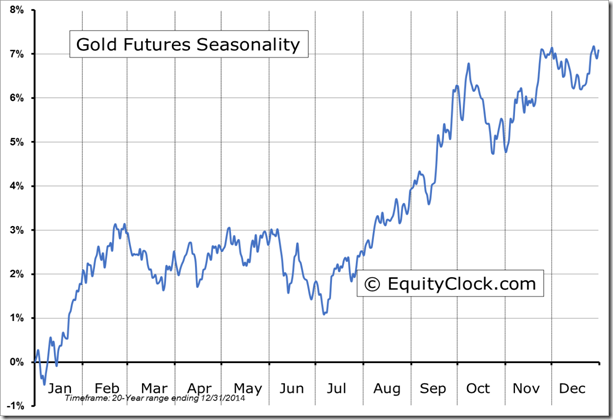

Gold added $18.90 per ounce (1.48%) last week. Intermediate uptrend was confirmed on a move above $1,306.00. Strength relative to the S&P 500 Index changed positive from neutral. Gold remained above its 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to 6 from 2

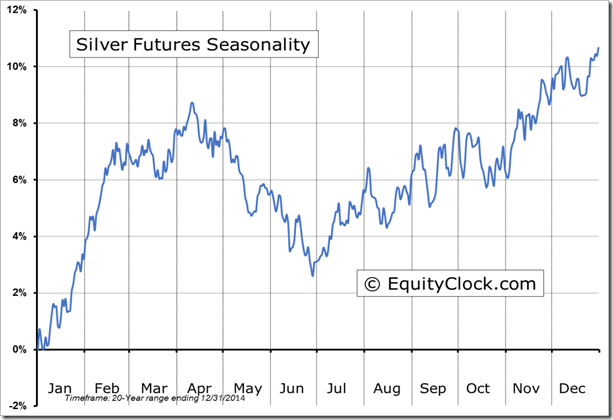

Silver added $0.08 per ounce (0.46%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index remained positive. Silver remains above its 20 day moving average. Short term momentum indicators are trending up. Technical score remained last week at 6.

The Gold Bug Index dropped $3.80 (1.65%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index changed to positive from neutral. The Index remained above its 20 day moving average. Short term momentum indicators turned lower. Technical score remained last week at 4.

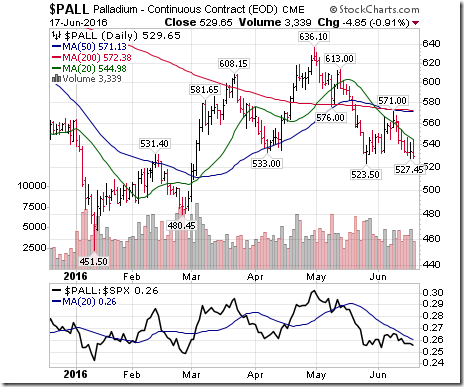

Platinum dropped $28.10 per ounce (2.83%) last week. Intermediate trend remains neutral. Strength relative to the S&P 500 Index: negative. Trades below its 20 day MA.

Palladium dropped $16.30 per ounce (2.99%) last week. Intermediate trend remains neutral. Strength relative to the S&P 500 Index remains negative. PALL remained below its 20 day moving average. Short term momentum indicators are trending down. Score: -4

Copper added 2.1 cents per lb. (1.03%) last week. Intermediate trend remained down. Strength relative to the S&P 500 Index improved last week to neutral from negative. Copper remained below its 20 day moving average. Short term momentum changed to up from down. Technical score improved to -2 from -6.

The S&P Metals and Mining Index gained 26.74 points (4.97%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index remained positive. The Index remained above its 20 day moving average. Short term momentum indicators turned upward. Technical score improved last week to 6 from 4.

Lumber dropped 8.10 (2.65%) last week. Intermediate trend remains up. Relative strength remained negative. Trades below its 20 day MA. Momentum trending down.

The Grain ETN added another $0.19 (0.52%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index remains positive. Units remained above their 20 day moving average. Short term momentum indicators are trending up. Technical score remains at 6.

The Agriculture ETF dropped $0.51 (1.04%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index changed to neutral from positive. Units moved below its 20 day moving average. Short term momentum indicators are trending down. Technical score changed last week to 0 from 4

Interest Rates

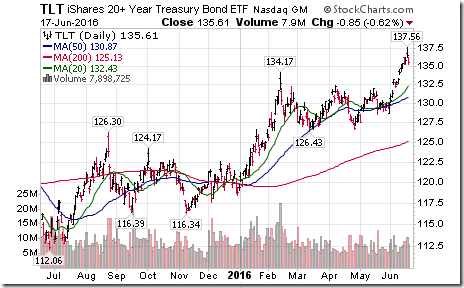

Yield on 10 year Treasuries dropped another 2.1 basis points (1.28%) last week to an all-time low. Yield remains in an intermediate downtrend. Yield remains below its 20 day moving average. Short term momentum indicators are trending down, but are oversold and showing early signs of bottoming.

Conversely, price of the long term Treasury ETF gained $0.83 (0.62%) last week. Intermediate trend remains up. Price remains above its 20 day moving average.

Volatility

The VIX Index jumped 2.13 (12.51%) last week. Intermediate trend changed to up from neutral.

Sectors

Daily Seasonal/Technical Sector Trends for March June 17th 2016

Green: Increase from previous day

Red: Decrease from previous day

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts. Following are examples:

StockTwits Released on Friday

Gold and silver chart significant reversals from horizontal resistance as fear trades are liquidated.

Technical action by S&P 500 stocks to 10:00: Quiet. Breakout: $VNO. Breakdown: $TSCO.

Editor’s Note: After 10:00 AM EDT, one more stock broke support: Google on a downgrade.

Mark Leibovit’s Weekly Radio Show

WALL STREET RAW RADIO WITH MARK LEIBOVIT AND GUESTS HENRY WEINGARTEN AND SINCLAIR NOOE – JUNE 18, 2016

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca

![clip_image002[5] clip_image002[5]](https://advisoranalyst.com/wp-content/uploads/2019/08/4b162dc04e49b2c2d2f11180411df278.png)

![clip_image002[7] clip_image002[7]](https://advisoranalyst.com/wp-content/uploads/2019/08/2bf4060bed7dac18fb00fe944b53645a.png)

![clip_image002[9] clip_image002[9]](https://advisoranalyst.com/wp-content/uploads/2019/08/40b98388ebe57dd61f58bdc85988af27.png)