Stay Positive: How to Go Global and Avoid Negative Yields

by Fixed Income AllianceBernstein

When it comes to globalizing their bond portfolios, some investors find themselves channeling the early Christian philosopher St. Augustine: they want to do it—just not yet.

It isn’t that they don’t recognize the benefits of going global. So what’s holding them up? Two words: negative yields.

Through May 31, more than a quarter of the bonds in the Citibank World Government Bond Index had negative yields—the result of negative interest-rate policies that central banks hope will boost inflation and spur growth. About half the bonds issued by eurozone countries and 64% of Japanese Government Bonds were yielding less than zero.

US Treasury yields are low by historical standards, too. But the Federal Reserve has started to raise benchmark interest rates, and that’s kept yields in positive territory across the curve. For this reason, many US-based investors have decided now’s not the time to venture beyond national borders.

Currency Hedging: The Antidote to Negative Yields

That may seem like a reasonable decision. But the costs of forsaking a global approach can be high. As we’ve detailed in previous posts, a truly global strategy does a better job of providing the stability, income and diversification against riskier equities that investors expect from a core bond portfolio.

Fortunately, there are ways around the negative-yield problem. For example, a manager who is running a truly global portfolio can avoid overconcentration in parts of the market where yields are low or negative, and move swiftly to seize opportunities in areas that offer higher potential returns. A passive approach that tracks an index can’t pick and choose bonds, by definition, so avoiding negative-yielding securities isn’t possible.

For core portfolios, there’s an even more elegant solution: hedge the currency exposure. We’ve noted before that a currency-hedged global portfolio lowers risk while delivering returns comparable to those of a nonhedged portfolio.

So how does hedging help neutralize negative rates? Simple: hedging out the currency exposure of a bond involves selling the cash rate of the currency you’re hedging from and buying the rate of the currency you’re hedging to. So depending on the relative short-term interest rates, hedging can either raise or lower a bond’s yield.

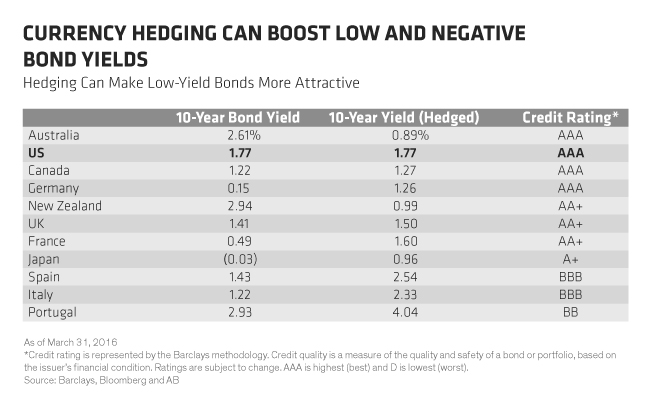

Short-term US interest rates, while low by historical standards, are higher than those in most other developed countries. For such countries, simply hedging a non-US bond to US dollars can raise yields considerably. As the following Display illustrates, the yield on a 10-year German Bund jumps from 0.15% to 1.26%. A 10-year Japanese Government Bond goes from –0.03% to 0.96%.

Of course, exchange rates fluctuate often, so having an active manager who monitors the market and adjusts the hedges accordingly is critical.

The Global Imperative

In our view, core bond portfolios with a strong home bias simply aren’t going to cut it in the years ahead. That’s a tough pill for some investors to swallow. After all, for decades, a US-only allocation worked wonders. The US bond market was by far the world’s largest and most diverse. And between 1981 and 2015, a steady decline in 10-year US Treasury yields produced average annualized returns of 8%.

In the future, a US-only core portfolio probably won’t deliver those types of returns—or protect investors the way it once did. For instance, the US Treasury portion of the Barclays US Aggregate Bond Index has nearly doubled since 2007, making a US-only portfolio more vulnerable to rising interest rates. And with yields so low, volatility is likely to have a bigger effect on returns.

The global fixed-income universe, meanwhile, has experienced a big-bang–style expansion: some two-thirds of the more than 17,000 components of the Barclays Global Aggregate Bond Index are non-US securities. Active managers who fish in a pond that big can diversify interest-rate and economic risk and reduce volatility.

For those who want their bonds to reduce risk while providing stability and income, going global is the way forward. So don’t let fear of negative yields throw you off course. With a truly global approach, you don’t have to accept them.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Director—Global Fixed Income and Canada Fixed Income

Scott DiMaggio is Senior Vice President and Director of both Global Fixed Income and Canada Fixed Income at AB. In this capacity, he leads both the Global Fixed Income and Canada Fixed Income portfolio-management teams, and is ultimately responsible for all investment activities in both the Global and Canada Multi-Sector Fixed Income Strategies. DiMaggio is also a member of the Multi-Sector Research Review team and the Rates and Currencies Research Review team. Prior to joining the Fixed Income team, he performed quantitative investment analysis, including asset-liability, asset-allocation, return attribution and risk analysis. Before joining the firm in 1999, DiMaggio was a risk management market analyst at Santander Investment Securities. He also held positions as a senior consultant at Ernst & Young and Andersen Consulting. DiMaggio holds a BS in business administration from the State University of New York, Albany, and an MS in finance from Baruch College. He is a member of the Global Association of Risk Professionals and a CFA charterholder. Location: New York

Senior Managing Director—Global Fixed Income Business Development

Alison M. Martier is a Senior Managing Director for Global Fixed Income Business Development and a Partner at AB. She previously served as senior portfolio manager and director of the Fixed Income senior portfolio manager team. Martier was director of the firm’s US Multi-Sector service from 2002 to 2007. She joined the firm in 1993 from Equitable Capital, where she began as a trader in 1979 and was named portfolio manager in 1983. She is the co-author of “LDI: Reducing Downside Risk with Global Bonds,” published in The Journal of Investing. Martier holds a BA in economics from Northwestern University and an MBA from New York University’s Stern School of Business, and is a CFA charterholder. Location: New York

Related Posts

Copyright © AllianceBernstein