Analyzing Credit Strategies from a Risk and Return Perspective

by Andy Sparks, Head of Fixed Income Research, MSCI

Understanding the performance of credit portfolios is essential in explaining a strategy’s merits to clients and prospects. At the same time, analysts need to comprehend the portfolio's exposure to different sources of risk, identify unintended bets and clearly communicate risk forecasts. Integrating these processes to achieve a coherent, side-by-side attribution of both risk and return creates a powerful analytical tool.

In a case study using BarraOne, we focus on a hypothetical corporate bond portfolio that uses a credit value strategy. The strategy aims to capitalize on credit risk exposure by selecting the bond with the largest spread from each duration-by-rating group in the benchmark. We assume that a bond with a high spread compared to similar bonds in its group will see its spread decrease and will mean revert towards the group average. Thus, the strategy aims to pick up alpha from spread return as spreads tighten on selected bonds (and their prices increase).

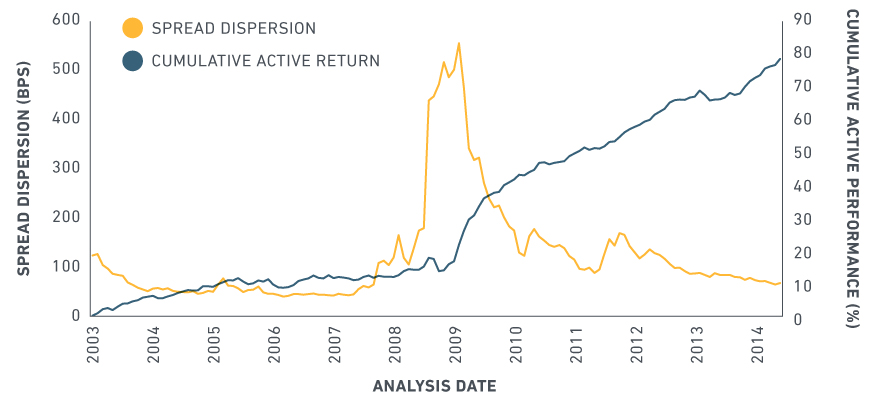

In our analysis, we showed that the credit value strategy would have outperformed greatly from January 2003 to March 2014 and that performance improved significantly when the spread dispersion was greatest (see exhibit).

Spread Dispersion and Cumulative Active Return for the Credit Value Strategy

However, we cannot say that the active return derived from exposure to credit risk was a direct result of the strategy without conducting a performance attribution analysis. A detailed analysis for calendar year 2014 (where exposure to spread risk and issue-specific selection risk was strongly rewarded) revealed that the strategy would have provided alpha with active spread return contributing almost 300 of the 373 basis points of active return.

Being able to view both risk and performance on a single platform, such as BarraOne, provides a powerful complement to the investment decision process — for measuring risk, adjusting allocations and attributing portfolio performance.

Read the paper, “Analyzing Credit Alpha in an Integrated Risk and Performance Analysis” by Nick Sharp, Zsolt Simon, András Bohák.

The author thanks Nick Sharp, PhD, Executive Director, Analytics, for his contribution to this post.

Copyright © MSCI