How to Earn Attractive Returns in Strong and Weak Equity Markets

by ETF Research, iSectors

Unfortunately, investors that strongly emphasized 3 and 5 year performance numbers to choose investments at the beginning of 2015 have been disappointed with their results over the past 12 months. Our view is that one has to look at returns in strong and weak equity markets. From March 2009 to May 2015, stocks rose strongly with only one correction in 2011. Although we have not declined 20% from last year’s high, this recent correction has been deeper and longer than usual. We now have recent market data to test asset classes’ returns in different market environments.

iSectors® has been a proponent of dividend-tilted portfolios in our asset allocation strategies. Dividends were the original “smart beta” factor with over 30 years of academic and practitioner research supporting it. Also, there have been dividend mutual funds available for decades. We were leery of the newer smart beta funds due to the concern that they were issued based on backtested data and had not experienced multiple bear markets or corrections.

We now are beginning to see that some of the smart beta strategies, that were strong previous to 2015, have underperformed over the past twelve months.

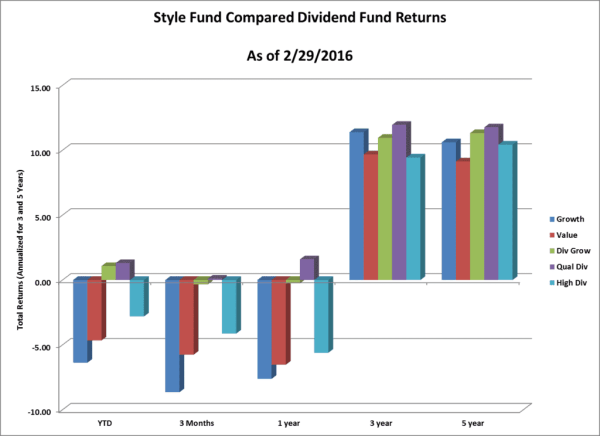

Fortunately, dividend funds continue to maintain their status as premier investment vehicles. The chart below presents the returns for typical, very large growth and value ETFs. Next to them, returns for an ETF that owns companies with a history of growing dividends, one that has a company quality screen, and a fund that emphasized stocks with the highest dividend yields.

I was amazed how well dividend funds with screens had acted in the recent correction. Looking over the past three months, both growth and value funds have declined by more than 5%. The dividend grower and quality dividend funds are flat. Although the high dividend fund is the worst performing of the three dividend funds presented, it still outperformed both the growth and value funds. The one year numbers tell a similar story. It was exciting to see that the quality dividend fund is up over 1.50% over the past year!

Most market observers would have expected dividend funds to outperform in market declines. But it is interesting to see that they acted well in the periods of positive returns. Although not shown on the chart, over the past three years, both the dividend grower and quality dividend funds outperformed a 50% growth fund/50% value fund portfolio. All three dividend funds, even the high yielding one, beat the same 50% growth/50% value portfolio over the past five years! Also, it should be noted that the dividend funds will have less volatility than a 50% growth/50% value portfolio.

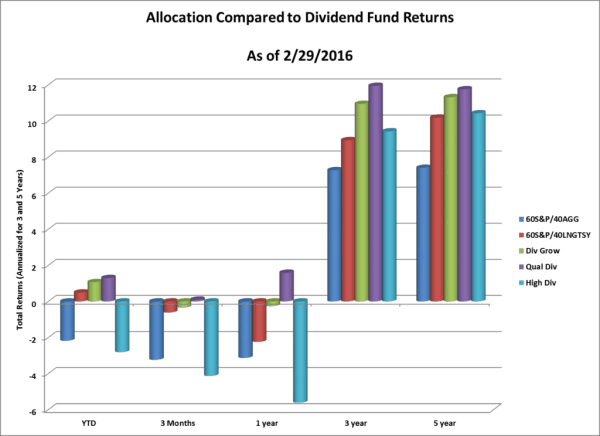

Even more exciting is the comparison of the dividend funds with typical 60% stocks/40% bond portfolios. In the chart below, the three dividend funds are compared to two ETF allocation portfolios. One is allocated 60% to an S&P 500 stock index fund and 40% to a Barclays Aggregate bond index fund. The other has the same 60% equity fund but the 40% bond allocation is to a long-term Treasury bond fund. The second allocation is the best case scenario for bonds since long-term interest rates have declined during this period.

What I did not expect is that the dividend funds would outperform both allocations in positive and negative stock markets. Since dividend funds are composed of close to 100% equities, all three funds outperform both ETF allocations in the rising three and five-year stock markets. But even over the past three and twelve month periods when the S&P 500 has declined six to seven percent, the screened dividend funds are ahead of the ETF allocations with 40% bonds!

Financial Advisor Investment Implications: On one level, dividend funds with screens have recently performed well in all market scenarios. Next, at a minimum, these dividend funds should replace value funds in client portfolios. Unfortunately, value funds include “value traps”, which are stocks that are cheap but there is no catalyst to turn around company fortunes. Companies that are growing their dividends or have a quality balance sheet are able to grow earnings and attract investor interest. Finally, client portfolios should have a “dividend tilt” to them. At this point in time, dividend yields are competitive to investment grade bond yields and yet, have the ability to increase dividend payments and stock prices over time. We still believe that client portfolios should be broadly diversified into a wide range of equity, fixed income and alternative funds, but dividend funds should be the core of these portfolios.

iSectors Implementation: All of the iSectors strategic portfolios have equity allocations with tilts of 75% in dividend ETFs:

- iSectors Domestic Equity Allocation – composed of 75% US dividend ETFs/25% US growth ETFs.

- iSectors Global Equity Allocation – composed of 70% US/30% international with 75% in dividend funds.

- iSectors Global Growth Allocation – composed of 75% Global Equity allocation and 25% in global fixed income.

- iSectors Global Balanced Allocation – composed of 50% Global Equity allocation and 50% in global fixed income.

- iSectors Global Conservative Allocation – composed of 25% Global Equity allocation and 75% in global fixed income.

- iSectors Endowment Allocation – composed of 30% Global Equity allocation and 70% in liquid alternatives and global fixed income.

Copyright © iSectors