Tuning Out the White Noise in High Yield

by Gershon Distenfeld, Director, High Yield, AllianceBernstein

The sound and fury surrounding high yield these days can make it hard for investors to hear themselves think. It’s time to turn down the volume. Here are four things to keep in mind:

1) This isn’t 2008 all over again. The recent sell-off looks a lot more like what the market endured in 2002. Back then, the bursting of the dot-com bubble exposed excessive borrowing at many telecom companies, which had become a large share of the overall market. That led to higher defaults in that sector and a sell-off across the high-yield market. Sounds familiar, right? This time, the trouble is mostly in energy, metals and mining—sectors hurt by falling commodity prices.

So what should investors expect? Defaults will probably rise—especially among commodity-dependent companies. But issuers in other sectors will likely benefit from lower oil prices. That suggests plenty of upside in the years ahead. Remember, investors who bought non-telecom sectors of the market in the years after the 2002 sell-off did quite well.

2) Many high-yield bonds are attractively priced. Over the last several months, global investors have punished high yield indiscriminately, and that presents an opportunity for the value minded. The yield-to-worst of the Barclays US High Yield Index sits above 9%. It dipped below 5% in mid-2014. Yields are even higher now on some individual non-energy sector bonds.

History has shown that starting yield is usually a reliable indicator of what you can expect to earn over the next five years. This is because the majority of issuers that don’t default typically call their bonds before they mature—and pay an average premium to bondholders of 2%-3% for the privilege. That offsets losses suffered on bonds that do default, leaving investors to earn something close to their starting yield.

3) Investors still have to pick their bonds carefully. Blindly buying the index with a passive exchange-traded fund, for example, is highly risky. That’s because it exposes you to CCC-rated junk bonds from highly levered companies that are most likely to default—many in embattled commodity-sensitive sectors. During the European debt crisis of 2011, and after the 2013 “taper tantrum,” investors who blindly bought risk ended up doing well.

That’s not the case this time. We’re at a later stage in the credit cycle, and investors who loaded up on CCCs over the last 12–18 months, hoping to boost returns, are nursing sizable losses today. CCCs were down more than 12% in 2015, compared to 1% for BB-rated bonds and 4.7% for B-rated ones. We expect them to fall more in the months ahead.

It’s important to be selective among higher-quality securities, too—especially in the US high-yield market, which is in the later stages of the credit cycle. This is why an active global and multi-sector approach is critical.

4) Adding high yield to an equity portfolio can provide equity-like returns with less risk. The key to understanding this one boils down to how one thinks about high yield. Most investors consider it part of their fixed-income allocation. And because high yield is riskier than other types of bonds, investors tend to be wary of holding too much of it.

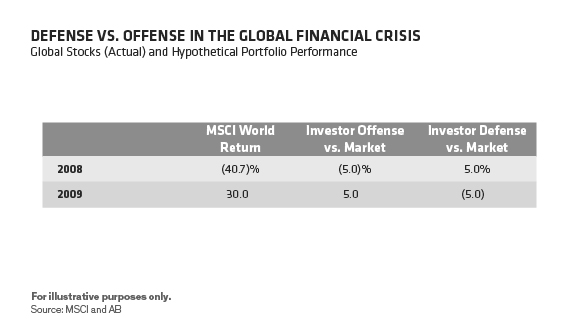

But in reality, high yield acts a lot more like stocks than it does other bonds—with one important difference: it’s less volatile. When times are good, high yield doesn’t go up as much as stocks. But it declines less in down markets (and recovers more quickly). That’s why we think it makes sense to think of high yield as a complement to one’s equity exposure rather than part of a bond allocation. Tactically rotating some equity exposure into high yield can provide valuable downside protection while maintaining equity-like returns.

Making investment decisions in volatile markets isn’t easy. Cutting through the noise can help. High yield is a resilient asset class, and there are opportunities out there for selective investors.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Director—High Yield

Gershon M. Distenfeld is Senior Vice President and Director of High Yield, responsible for all of AllianceBernstein’s US High Yield, European High Yield, Low Volatility High Yield, Flexible Credit and Leveraged Loans strategies. He also serves on the Global Credit, Canadian and Absolute Return fixed-income portfolio-management teams, and is a senior member of the Credit Research Review Committee. Additionally, Distenfeld co-manages the High Income Fund and two of the firm’s Luxembourg-domiciled funds designed for non-US investors, the Global High Yield and American Income Portfolios. He has authored a number of published papers and initiated many blog posts, including “High Yield Won’t Bubble Over,” one of the firm’s most-read blogs. Distenfeld joined the firm in 1998 as a fixed-income business analyst. He served as a high-yield trader from 1999 to 2002 and as a high-yield portfolio manager from 2002 until 2006, when he was named to his current role. Distenfeld began his career as an operations analyst supporting Emerging Markets Debt at Lehman Brothers. He holds a BS in finance from the Sy Syms School of Business at Yeshiva University and is a CFA charterholder. Location: New York

Related Posts

Copyright © AllianceBernstein