Investing Tips from a Football Coach

by Equity Research, AllianceBernstein

Legendary coach Bear Bryant once said, “Offense sells tickets, but defense wins championships.” It was a winning formula for Bryant’s college football team. It also holds the secret to success for the game of investing.

Bryant is best known as the longtime head coach of the University of Alabama football team. During his 25-year tenure, he and his team racked up six national championships and 13 conference championships.

Bryant was talking about what it takes to build a great football franchise. Fancy running plays and touchdowns thrill fans and fill stadiums, but it’s the disciplined and less glamorous efforts to prevent the opponent from scoring that win games.

The same can be said of investing. A spectacular stock pick or a prescient call ahead of a dramatic price movement will grab investors’ attention. But it’s the less glamorous efforts to not lose money that will build wealth over the long haul.

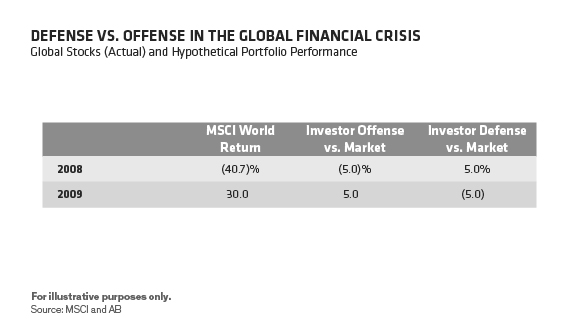

We’ll use recent experience to prove our point. Global stocks plunged by more than 40% in 2008 and then rebounded by 30% in 2009. Let’s say that “Investor Offense” underperformed the market by 5% in the 2008 crash and outperformed the market by 5% in the 2009 recovery, and that “Investor Defense” did the opposite (Display).

Because both Investor Offense and Investor Defense each beat and trailed the market by 5% in one of the two years, it may seem that they should have performed roughly in line with one another and with the benchmark over the full period. But that’s not how the math works.

As shown in the display below, Investor Defense ended 2009 in much better shape than Investor Offense and the market. In fact, Investor Defense beat Investor Offense by a whopping $7, or 10%.

To use financial jargon, this outcome illustrates the effects of risk drag, or the depressing influence of too much volatility on performance. Put more simply, because Investor Defense’s portfolio lost less money in the market slump, it didn’t have to work as hard as Investor Offense’s to regain lost ground. So, even though the defensive portfolio lagged the market in the 2009 recovery, it was still ahead of the game in the end—and also positioned to compound off that higher base thereafter.

The takeaway: the pattern of return is essential to an investor’s ultimate wealth. We believe that a good defense matters more than a good offense in investing. Bear Bryant’s insights into championship football strategy apply to the investing world, too.

These insights may be even more relevant in the times ahead, given where we are in the economic cycle. For most of the past few years, markets have been fairly calm. But as macro uncertainties have risen, volatility has spiked and looks likely to remain high for some time. Against this backdrop, it will be increasingly important to pay attention to the pattern of returns—and to how and when investment strategies are likely to beat the market. In any event, investors will want to make sure to flank their portfolios with a strong defensive lineup to help them go the distance in meeting their long-term goals —or, might we say, to investing victory.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

Portfolio Manager—Strategic Core Equities

Sammy Suzuki is Portfolio Manager of Strategic Core Equities, and has managed the Emerging Markets Strategic Core portfolio since its inception in July 2012. He joined AB in 1994 as a research associate covering the capital equipment industry, and then became an analyst covering the technology industry. From 1998 to 2004 Suzuki served as senior research analyst for the global automotive industry. He then became director of research for Canadian Value Equities and served as leader of the global commodities team. From 2010 to 2012 Suzuki was director of Fundamental Value Research, managing a team of over 50 fundamental analysts globally. In addition, from 2008 to 2015 he was director of research for Emerging Markets Value Equities. Before joining the firm, he was a consultant at Bain & Company. Suzuki holds a BS in materials science and engineering and a BS in finance from the University of Pennsylvania. He is a CFA charterholder. Location: New York

Portfolio Manager—Strategic Core Equities

Kent Hargis is Portfolio Manager of Strategic Core Equities. He has been managing the Global, International and US portfolios since their inception in September 2011. Hargis was named Head of Quantitative Research for Equities in 2009, with responsibility for overseeing the research and application of risk and return models across the firm’s equity portfolios, and is currently Co-Head of Quantitative Research. He joined the firm in October 2003 as a senior quantitative strategist. Prior to that, Hargis was chief portfolio strategist for global emerging markets at Goldman Sachs. From 1995 through 1998, he was assistant professor of international finance in the graduate program at the University of South Carolina, where he published extensively on various international investment topics. Hargis holds a PhD in economics from the University of Illinois, where his research focused on international finance, econometrics, and emerging financial markets. Location: New York

Portfolio Manager—Equities

Christopher W. Marx is Portfolio Manager of Equities. He joined the firm in 1997 as a research analyst, covering a variety of industries both domestically and internationally, including chemicals, food, supermarkets, beverages and tobacco. Marx joined the portfolio management team in 2004. Prior to joining the firm, he spent six years as a consultant for Deloitte & Touche and the Boston Consulting Group. Marx holds a BA in economics from Harvard University and an MBA from the Stanford Graduate School of Business. Location: New York

Related Posts

Copyright © AllianceBernstein